Though it looks easy – buy and option/future and sell it at a higher price looks easy – fact is trading is one of the most difficult profession in the world. Actually it is not that difficult – your expectation makes it difficult.

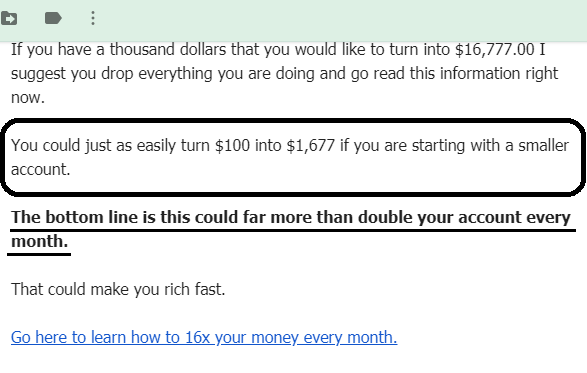

I read quite a lot of newsletters on stock markets – mostly from USA traders. But there too it looks like traders’ mind-set is same as here in India – double money every month or something like that. See this newsletter from a Forex Trading Software provider I got today morning:

After reading the above I immediately deleted the email.

Let me warn you in bold & capital letters – THERE IS NO SOFTWARE/PERSON/TIP PROVIDER/ALGO TRADING SYSTEM THAT CAN DOUBLE YOUR OR THEIR OWN MONEY IN ONE MONTH – IN FACT LET ME BE EVEN MORE STERN – THERE IS NO SOFTWARE/PERSON/TIP PROVIDER/ALGO TRADING SYSTEM THAT CAN DOUBLE YOUR OR THEIR OWN MONEY IN ONE YEAR.

Read that again and keep that in your mind forever. I also offer a course but nowhere in my site or on whatsapp or on a phone call have I said the above. You can read my Nifty course and Bank Nifty course page to know yourself what you can achieve in one year.

After doing my courses you can make anywhere from 20% on the lower side and 40% on the higher side in one year. Some testimonials in my site are mind-boggling but they are mostly because the trader took some risk slightly different from my strategy – means changing the strikes or deviating from the strike selection to buy or sell as per the guidelines given in the course. This can be done but only after doing my course and getting some experience trading them. I do not take much credit for the mind boggling results in some trades given in the testimonials. 70% of the credit goes to the trader – but it was possible because they learned to hedge from my course and took a risky trader with confidence.

What I am trying to say is that the biggest roadblock that is negatively impacting your trading results is that you are expecting too much from the stock markets. This is forcing you to take huge risk in trading on top of that you are not wiling to hedge.

These are some roadblocks that you need to remove to become a better trader:

Please note that failure to become a good trader has many causes however I will write some of the major reasons here:

1. Inability to plan well:

Right from the very beginning the planning and execution is bad. You ”think” that a stock since its moving up will go further up and buy a call, or seeing it go down buy a put, or buy both. Only to see nothing is working.

Did you ever ask yourself why did you do this trade? If the reason is because you though – then the planning is wrong. Just because you think the stock will go up or down, it will not behave that way. Stock will behave on demand and supply.

2. Inability to manage risk:

Traders do not know whether to buy one lot or two lots or more. They do not take a second to decide how much to go for. Most of them buy with all the money in their trading account. Only to see all the money becoming zero. How much to invest in a trade is a very important decision – you must take that with proper thinking.

3. Trading something not suiting your lifestyle:

Most newbie traders choose intraday trading over positional trading. It’s interesting to note that most of them have a day job still they prefer intraday trading. You cannot execute both at one time. You have a job and some work associated with it so how can you do intraday trading. Does the nature of your job allows you to trade stock markets while on the job? If the answer is no you must take positional trading only. Positional trading involves only 5-10 minutes a day which you can easily take off time from your office. Go out of the office and trade on your mobile and go back to work. Day trading is not for busy people – it’s for people who have a night job or people who have a business and can afford to take time out from it. You need to pick a style of trading and stick to it. I have known traders who try a lot of things without much success.

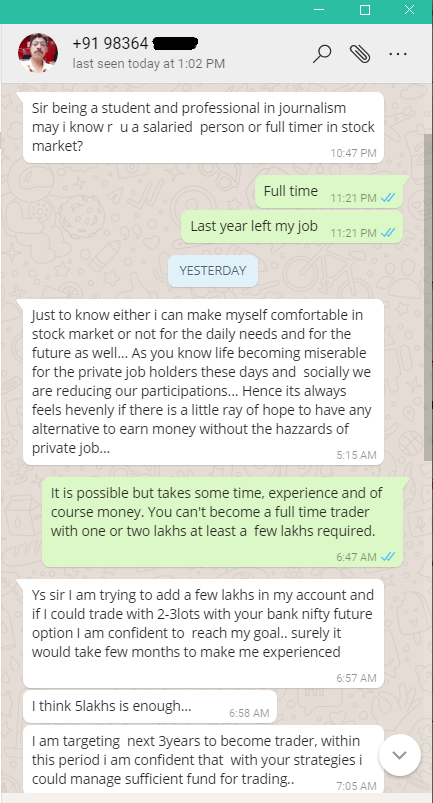

4. Less Capital:

This is also a big roadblock. How can you make money from very small amount? You cannot turn 1000 into 100,000 in a year. Just do not believe what you see in those, millions of telegram channel. They do not show the losses. Every option that you buy will not convert to gold. You need money to short options as well sometimes. For that money will be required. You cannot become a full time trader with 50,000 in your account. At least 10 lakh is required to become a full time trader.

You must start trading with at least 1 lakh capital with proper hedging and risk management.

5. Not trading with money you cannot afford to lose:

You should not trade with money you cannot afford to lose at least for next one year. Well up to 20% is fine but not more than that. Some traders trade with a big portion of their net worth to make too much money. And when they lose, they get into major financial problems.

Note that if you are trading with money you cannot afford to lose it will severely impact trading psychology and you are likely to do mistakes. A free mind can never trade. If you trade with money you need to pay your bills you will force yourself to trade. Forcing yourself to trade is a bad trading decision. You will panic every time the market goes even slightly against you because you cannot afford to lose the money. In panic you will go against the rule of the trade and press the stop loss button.

6. Taking Tips:

After losing money trading themselves traders turn to tip providers. This is the best way to lose double the money. You will trade in more lots thinking the person giving tips is awesome plus you will pay a monthly fees. You lose money in both your trading account and by paying to tip providers.

7. Not learning to trade:

Some people hate reading books or researching online. To become a good trader you must learn something every day so that after a few months you know a lot about trading, planning and risk management. This is one business where you cannot do a mistake even by mistake. One simple mistake will cost you money. So you must keep yourself updated.

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users