Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

In this article learn what Is INDIA VIX And why it changes in the stock markets.

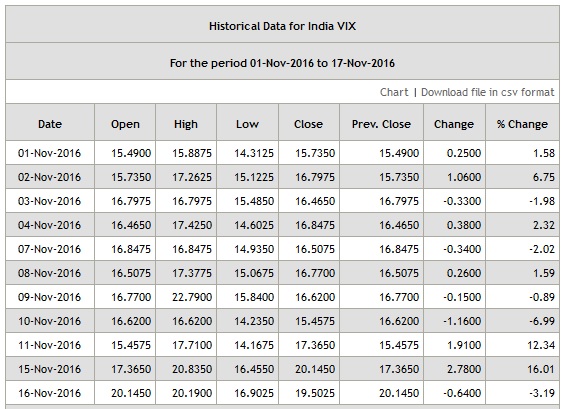

As you can see INDIA VIX Is Continuously Falling, what does it indicates?

First what is INDIA VIX?

INDIA VIX is measurement of Indian Stock Market Trading Volatility.

VIX is Volatility Index in stock markets. It is measured the way patterns in trades changes in the markets, or are expected to fluctuate in coming days. If too much trading is done or is expected due to some event, which is above normal trading days, Volatility Index increases. It usually increases before some big news is announced because it is a clear sign that too much trading may happen. Like the recent US elections.

Why does it increase before the news is announced?

The reason is obvious that too much trading will happen because traders get panicked and to save their positions start investing in speculative shares (greed following), or buy/sell too much calls and/or puts (again greed following). It does not matter to markets who wins or who loses money, but Volatility Index sees or is expecting to see abnormal trading patterns and increases accordingly.

Once the news is announced it starts to fall.

Why does it falls after the news is announced?

It is simple, traders start to close their positions. Buyers become sellers, and sellers become buyers and trading slowly starts to get back to normal. And frankly this is expected after the news is announced so VIX starts to fall.

When the VIX measurement software sees trading patterns getting back to normal it starts to fall. Of course it takes some time for the trading pattern to get back to normal as not everyone closes their positions the next day. Some do the next day itself or same day so most VIX falls the next day itself of the news announcement day.

You can go back to INDIA VIX history and see that the max fall of -6.99% was on 10-Nov-2016 when the final results of Donald Trump winning the US elections was clear by night of 9-Nov-2016.

After that there was an increase of 12.34% but it had to do with a different news – The Demonetization of Rs. 500 and Rs. 1000/- notes and its effects in Indian economy. People were confused and trading patterns changed.

This is a good question in the comments section and I think this must be included for everyone to read.

Question: Is the increase or decrease of India VIX associated with bullishness or bearishness?

Answer: No. Usually VIX and Nifty are inversely related as far as direction is concerned. If you see Nifty and India VIX history, whenever Nifty falls India VIX increases and whenever Nifty rises India VIX falls. But it has nothing dodo with Nifty as VIX is least bothered about what is happening to Nifty. As written in the article above VIX increases due to panic among trades and expectation that speculative trading will start. Sometimes you will see Nifty will rise still VIX will also rise and vice versa. So basically VIX movement has its own set of rules and Nifty has its own. Inverse relation is mostly just a coincidence.

Hope it is now clear why India VIX changes everyday. If you have any more doubts please ask in the comments section given below. If the question is good it will be included here in the article for everyone’ benefit.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Comments on this entry are closed.

Is the increase or decrease of India VIX associated with bullishness or bearishness?

No. Usually VIX and Nifty are inversely related as far as direction is concerned. If you see Nifty and India VIX history, whenever Nifty falls India VIX increases and whenever Nifty rises India VIX falls. But it has nothing dodo with Nifty as VIX is least bothered about what is happening to Nifty. As written in the article above VIX increases due to panic among trades and expectation that speculative trading will start. Sometimes you will see Nifty will rise still VIX will also rise and vice versa. So basically VIX movement has its own set of rules and Nifty has its own. Inverse relation is mostly just a coincidence.