Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

Everyone knows derivative stock/index trading is done on cash, however, many people do not know that if they hold stocks in their Demat account they can use them to trade derivatives (futures and options selling). Yes, you can save money by having your stocks act as collateral margin and also increase your ROI (Return on Investments). Read to know how.

Do you know future and option shorting can be done free of cost? By free of cost, I do not mean that you do not need cash to trade futures and option selling – you need. But you can easily use this money to buy quality stocks and keep them in your Demat account and ask for collateral margin from your broker and trade futures and options with that money without bringing extra money in your trading account.

If you want to know the names of 17 quality stocks that will become multi-baggers then open an account with this broker who does not charge anything for stock buying and selling. Click Here to register your mobile number and start the process of account opening. Once your account is opened I will send you the names of these stocks and will also give you the reasons why these are multi-baggers.

What Is Collateral Margin?

In technical terms is it should be called Margin on Collateral. The invested stock is used as a Collateral (asset) to give margin (loan) to trade to the owner of the collateral (stocks). Let me give you an example. Suppose you bought 100 shares of a company XYZ whose current value is say 100,000.00 (1 Lakh). Now it’s held in your Demat account with a broker. You are not holding it but your broker is holding it on your behalf. Legally he is not allowed to sell them. What if you get into a contract with your broker and ask for a loan (only margin loan not cash loan) to trade futures and/or options selling. If they give you a loan they will need some kind of collateral. The stocks you hold can be used as collateral and now they can give you margin (loan) to trade derivatives. This contact is legal and is done by almost all brokers in India. However, there is some risk for the broker here. What if the stock crashes 50% in the next few days?

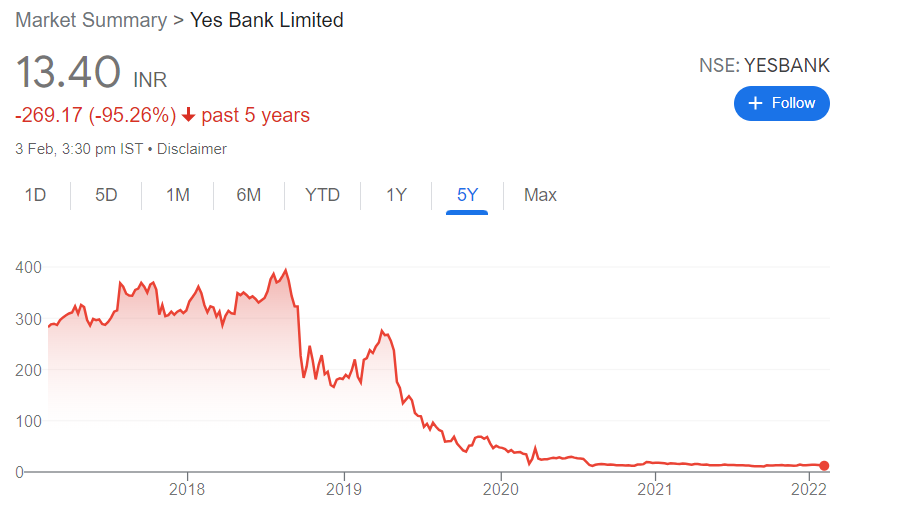

See this Yes Bank Crash. From 400+ in mid 2018 to 16.15 in 06-Mar-2020. Source Google Finance:

In percentage terms this is 96% crash. Imagine if you were a broker and given collateral in Yes Bank to thousands of your clients what would have been your position.

In such a situation what can a broker do to survive?

1. Brokers do not give 100% of the value of the stock as collateral to their clients. It depends on the historical volatility of the stock. Blue-chip shares get 80% of the actual value of the stock when a client asks for collateral margin. This can go down to 50% w.r.t the stock. For too volatile stock collateral margin is not given to reducing the risk.

As you can see in the above case the broker is safe up to 80,000/- (80% of 1 lakh). But Yes Bank tanked 96%. In such a case brokers are allowed to do this:

2. On the day Yes Bank falls 17-18% of the margin given – the broker gives a margin call to their client explaining the situation. If the client does not pick up the phone or does not reply to the email or just does not transfer funds in their Demat account, the broker sells the stocks of Yes Bank to recover the margin blocked to keep the derivative trade alive. But if the margin shortfall nears 80% of the margin required to hold the derivative trade overnight – they have the right to sell all the shares left and close the derivative trade. This post explains collateral margin shortfall well.

The above point no 2 is very important if you are looking to take collateral margin to trade derivatives.

Please note that some brokers charge a fee to give and close a collateral margin plus also charge a daily interest if the collateral margin is used more than a certain percentage. In most cases, it’s 50% of the collateral margin. Since this differs from broker to broker I recommend you ask them directly or search their website for a fee on collateral margin and associate charges then proceed for a collateral margin if you still need it.

Side note: For Nifty BeES, as far as I know, most brokers in India give 100% collateral margin against Nifty BeES without charging any interest. Nifty BeES is treated as cash holding. If you lose in option sold or future trading traded in that collateral margin – some holdings of the Nifty BeES will be sold to recover the loss. However please check with your broker before buying Nifty BeES for getting collateral margin. Note that for stocks brokers give up to 80% collateral margin and charge some interest on more than 50% of that if used. However, for Nifty BeES 100% collateral margin is given without charging any interest on the full margin. Again my knowledge is limited to this broker only – please confirm with your broker before buying Nifty BeES for getting collateral margin.

What is a collateral – explained in details?

Collateral is a property or other asset (here another asset are the stocks in holding), that a borrower offers as a way for a lender (the broker) to secure the loan (margin). Suppose you lose money more than the collateral amount given to you by the broker then the broker has every right to sell your shares and recover the loss. Since collateral offers some security to the broker they allow a loan to their customers to trade derivatives. This collateral comes at a lower interest than normal personal loans.

Please note that for Group A stocks (large caps) most brokers give an 80% collateral margin. It can go down for volatile stocks. Please consult your broker for collateral margin rules. Every broker has different collateral margin rules. Since the rules are different for every stock broker I cannot write a defined rule here. The only thing I can say is that some brokers charge a fee for collateral margin money. Make sure to know all terms and conditions before asking for collateral margin.

However, most brokers do not charge any fees if you use only 50% of the collateral margin – anything above that is considered as a loan and charged a small fee. So you should read the full terms and conditions before asking for collateral margin.

One good stock (Disclaimer: This is not a recommendation to buy or sell. Please do your research before investing in this stock) is HDFC Bank. It is a fundamentally strong company unlikely to fail. This is one stock that you can keep for life. There is no entry here and target 1,2,3 in this stock like the tips providers fool us.

These kinds of stocks are called All-Weather Stocks. Whatever happens to stock markets these stocks will keep giving good returns over the long term. These kinds of stocks come under the Warren Buffett style of investing. He has once said in an interview that – “Our favourite holding period is forever.” This is what you should do with a few stocks.

You must stay invested in good stocks until you retire, ask for collateral margin on them and trade options conservatively with proper hedge so that you keep making a monthly income that comes for free apart from the dividends you get from these quality stocks.

If you want to know the names of such 17 fundamentally stocks that will become multi-baggers then open an account with this broker who does not charge anything for stock buying and selling. Click Here to register and start the process of account opening. Once your account is opened I will send you the names of these stocks and will also give you the reasons why these are multi-baggers.

Frankly, I have summed up how you should invest and trade and make good money in small steps, accumulate them by the time you retire or in 10 years in stock markets. Then either leave your job or do whatever you want. Rest is plain noise that’s going on about stock markets in media – Television and the Online world. Unfortunately, people follow the myth about the stock markets told in golden words and get trapped to lose money.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users