Open ZERO Brokerage FREE Share Trading Account - Buy and Sell Stocks Without Brokerage - Set GTT (Good Till Triggered) Orders on System and Forget

This broker does not charge anything for stock buying and selling. You can set GTT (Good Till Triggered) order after buying a stock - the system will sell the stock automatically at your target price even if you are not monitoring the market. Only 25k is blocked for option selling with hedge. Get a lifetime account in Sensibull.com (virtual trading app & strategy builder) fee ₹800.00+GST per month for FREE. It takes 5 minutes to open an account online. Click Here to Open Free Account with Them Today and Join 1+ Crore Investors & Traders>>My Course Testimonials Year Wise:

Year 2015 | Year 2015 Page 2 | Year 2015 Page 3 | Year 2015 & 2016 | Year 2016 | Year 2017 | Year 2018 | Year 2019 | Instant Reaction Testimonial | Difference Between Othe Courses And Mine | Most Emotional Testimonial | Year 2020 | Year 2021 | Year 2022 | Year 2023 & 2024

Learn Intraday trading tricks, techniques and ideas for Nifty and Indian stock markets.

Retail traders journey starts from investing then to Intraday day trading. Intraday trading is very attractive especially to the younger generations. However most lost money because they either speculate their trades or take to tips providers.

What is Intraday Trading?

Intraday or day trading is buying and selling or selling and buying a financial instrument in same trading day. It attracts traders because they are eager to make money every day.

It can be a very good way to trade if you are good at it else day trading has lots of dangers involved. 95% intraday traders lose money. Almost 100% intraday traders lose money. Trading without plan, no financial management, no basic knowledge about trading – all this combined make traders lose money.

Here are some ideas to become better Intraday trader.

Get knowledge

Any business needs knowledge to succeed otherwise the business will fail. If you want to become a better trader it is very important to know what you are day trading and why? How much money you are willing to risk. You should know basic trading procedures – like difference between “MIS” and “NRML”.

For intraday day trading MIS orders are used. MIS stands for MARGIN INTRADAY SQUARE-OFF. These orders are closed before the market closes the same day.

For positional trading NRML orders are used. NRML stands for Normal Margin. These are derivatives delivery based trading. These can be squared off any day before or on the expiry day.

Intraday traders must keep a watch on the business news and related information that can affect stocks. Government policies, its economic effects and the companies it may effect. Like the recent news of Cigarette taxation to raise revenue made ITC stock fell by 15%. Those who knew this would have shorted ITC and made a lot of money in a single day.

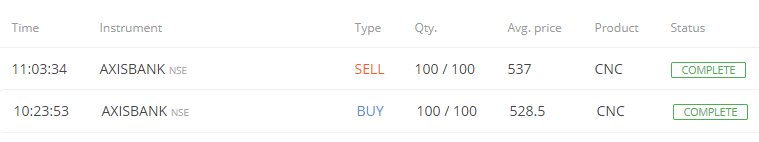

Yesterday I read a news and traded Axis Bank and made quick Rs. 850 in 40 minutes of trading. See this image:

If you read current business news before start of day trading chances of winning will be more.

You Must Know The Amount You Are Willing To Trade

Intraday trading is more risky than positional trading because there is no way to hedge an Intraday trade. Hedge is very important in positional trading as it can limit losses to a large extend in an event of a stock market crash.

There is no need also as the position is closed the same day. But you cannot have a job and still do day trading. Intraday day trading needs your 100% attention else you can never become a good day trader.

Therefore it is very important to know how much you are willing to risk every day. This may change from day to day depending on your view. If your view is very strong then you may increase the risk to give some room for the stock to move.

But risked amount should not exceed 3% of the margin blocked for the trade. Average is 1-2% per day. Profit percentage should be double of the loss percentage every day.

Never day trade with borrowed money, you will trade in panic.

Never trade with the money you need in the next six months. You must be absolutely sure you have money to manage your daily expenses for the next six months.

Keep a Separate Time to Day Trade

Even if you are a full time Intraday trader you must fix a time to trade. Intraday trading is very stressful so it is highly recommended that you fix a time to trade. Note that you cannot take break in day trading. You have to watch you trades like an owl. If a break is necessary then put a stop loss order and profit booking order both in the system, then ask your broker to cancel the not-executed order once any one is executed – either the stop loss or the profit booking order.

Some people trade Intraday who have night-shift jobs. In that case you need some rest. You cannot trade without proper sleep and with bad health. In that case make sure you set your time to trade and take rest.

For example it could be from 1 to 3.30 pm. You can take rest before that to prepare well for Intraday trade and your night-job.

Start Day Trading With A Small Amount

When you start Intraday trading it is almost likely that you will lose money. Therefore it is very important to start small. Do not start with more than 10000 rupees. Try to trade with this money for one or two months then if making profits increase the amount.

Do not increase your trading money if you are losing money. This is one of the worst habit of traders. Once they have lost money they bring more money to take a “revenge” on stock markets. Remember stock market is neither your friend nor your enemy. It is an indicator or demand and supply. If there are more buyers than sellers it moves up, if there are more sellers than buyers it goes down.

If you try to take revenge on stock markets you will never succeed. If you trade with a plan you will.

Take Only Two Trades A Day And Learn From Every Trade

As a beginner Intraday trader it is important that you do not take too many trades in a single day. Start with one or two stocks trading a day and then you must learn from every trade. Write down every trade details in a notepad and what you learned from it. Make sure whatever you learn from every trade, you never repeat that mistake again. This way within six months you will be a better trader.

Do Not Trade Penny Stocks

Penny stocks looks great to trade because of their movements. But they are not stable and could result in fatal loss in a single trade. Penny stocks are not liquid as well. It is better to avoid them and trade only in the large cap stocks.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I am an Authorized Person (AP) of a Stock Broker. I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

Find 200+ testimonials of my course:

What Traders Say About This Course

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Thank you Dilip Shaw providing suggestion on

Trading

Welcome

Sir, definitely , I also want to learn about intraday stock trading methods.

Sir thanks a lot for your advises.