I will update the NIFTY 50 and BANK NIFTY Outlook for June 2025 here. Not all days will be posted, but those days when I feel it is important.

NIFTY-50 OUTLOOK Tuesday, June 17, 2025:

Nifty Resistance: 25041 / 25136

Nifty Support: 24778 / 24609

NIFTY-50 kept the support of 24,500. The previous week’s loss was recovered. Since the weekly expiry is on Thursday, June 19, 2025, there may be some volatility due to the geopolitical situation. More volatility will be there in commodities like Crude Oil due to the ongoing war between Iran and Israel.

The range of Nifty over the next few days could be 24,500-25000 levels.

Nifty Call & Put OI Highest Open Interest for the Weekly Expiry on Thursday, 19-Jun-25:

NIFTY Highest Call OI (Open Interest): It has moved lower to 25,000

NIFTY Highest Put OI (Open Interest): 24,500

What can you do?

This is available via my newsletters only. If you want to receive my emails, kindly subscribe for a 5-day free course on options using the form at the top of this page.

BANK NIFTY OUTLOOK Tuesday, June 17, 2025:

BANK NIFTY Resistance: 56169 / 56394

BANK NIFTY Support: 55551 / 55157

Due to the heavy buying of banking stocks, Bank Nifty opened lower but bounced from the support range of 55,400 and closed near the high point of the day.

If 56,300 is crossed, then Banknifty may cross an all-time high of 57,000 levels over the next few days.

Bank Nifty Call & Put OI Highest Open Interest for the June 2025 Monthly Expiry:

BANK NIFTY Highest Call OI (Open Interest): It has moved higher to 57,000 strikes.

BANK NIFTY Highest Put OI (Open Interest): It has moved lower to 54,000.

What can you do?

This is available via my newsletters only. If you want to receive my emails, kindly subscribe for a 5-day free course on options using the form at the top of this page.

Stock Activity on Tuesday, June 17, 2025:

Infosys Ltd. and Prestige Estates Projects Limited witnessed a long build-up. They may maintain a positive momentum for the next few days.

========================================

NIFTY-50 OUTLOOK Monday, June 23, 2025:

NSE 23-Jun-25

NIFTY-50 is looking strong. Today’s fall is mainly due to the Israel-Iran war. Within days, Nifty will cross the 25,500 levels. On the downside, the support is at a 20-day moving average of 24,850. Therefore, 24800 / 24750 will act as support.

The Relative Strength Index (RSI) of Nifty has crossed above 55 and is now at 59, signalling a bullish momentum. This may trigger further upside, potentially reaching new highs.

The Relative Strength Index (RSI) is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. It oscillates between 0 and 100, with values above 70 generally indicating overbought conditions. In overbought conditions, a stock usually falls because it has been bought more than the average for the same period; therefore, a pullback may occur.

Values below 30 indicate an oversold condition. In an oversold condition, a stock usually goes up because its price looks attractive compared to a 30-day moving average of the price of the stock.

The Highest Call Open Interest (OI) is at 25,000 strikes.

The Highest Put Open Interest (OI) is at 24,500 for the weekly expiry.

BANK NIFTY OUTLOOK Monday, JUNE 23, 2025:

The Bank Nifty index has shown a strong momentum with a sharp bounce from the demand zone around the 54,200–54,800 range. 54,500 is a STRONG SUPPORT as of now.

The Relative Strength Index (RSI) of Banknifty is currently at 57.77 and turning upward, suggesting increasing bullish momentum without being overbought. Of course, if it crosses 70, then it will reach the overbought zone and may pull back.

The Highest Call Open Interest (OI) is at 57,000.

The Highest Put Open Interest (OI) has moved lower to 57,000 for the monthly expiry.

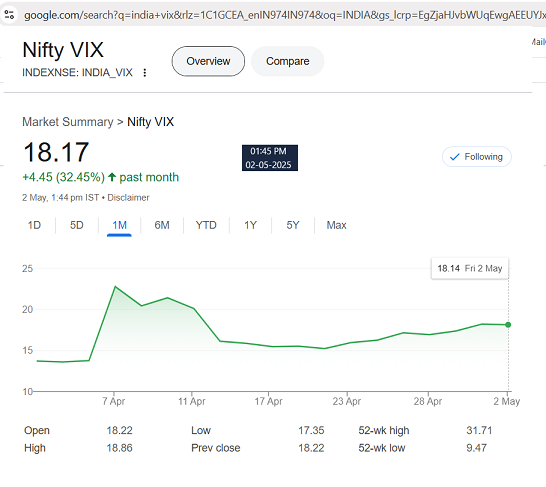

Still, 18.64 is considered high INDIA VIX.

Still, 18.64 is considered high INDIA VIX.

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users