Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

Post date: 01-Sep-2018

In a recent circular SEBI has asked to block more money as ASM a.k.a Additional Surveillance Margin for selling options and trading futures. The an Additional Surveillance Margin (ASM) shall be levied on all gross open positions on futures contracts and on short positions in options contracts.

To which NSE issued the circular which you can find here.

This circular basically says that more margin will be blocked for selling options and trading futures. This will happen:

Should you worry?

Well the only problem is margin block will increase. Worrisome for people who trade with less capital – not so much for people who have more money to deploy. But still a worry.

But most importantly huge worry for traders who do not hedge their positions. If you are reading this and you trade without hedge – my sincere advice is learn hedging. Either do my course or someone else course or research but stop trading without hedge.

Exactly how much margin will increase will finally be known by 30-Nov-18.

What is the current margin block?

Currently, the Initial margin to trade options and futures includes SPAN and Exposure margins. It covers the risk of around 8% movement in Index and 12.5% to 30% movement on stocks in one trading day. Due to the above circular, by November 2018, margin requirement for trading Index contracts may go up to 10% (approx 70,000) and for stocks between 17.5% to 35%.

Please note that Additional Surveillance Margin (ASM) was meant to be added to the exposure margin. Note that exposure margin does not takes into account the positions that hedge each other. Which means whether you hedged your positions or not you were required to add more money as per ASM rules to sell options or trade futures. Currently traders who hedge their positions get benefit of hedged positions, so less margin is blocked.

For example if you were long in current month future and short in next month future a lot less margin would be blocked as positions were hedged. However due to the above rules the hedge benefit would not be there. 🙁

There is another news – slowly all stocks will come under full margin block rules. What I mean is that in the last week of expiry your broker will ask you to either close the position or get full margin to trade options and futures. Right now it is limited to 46 stocks. Read this for details:

https://www.bloombergquint.com/markets/2018/04/23/a-fifth-of-stocks-in-nse-derivatives-segment-to-move-to-physical-settlement-from-july

So its better to trade only index options – Nifty and Bank Nifty. Avoid trading is stock derivatives – if you want then you trade for first three weeks only – DO NOT ENTER THE LAST WEEK OF EXPIRY JUST TO AVOID MARGIN CALLS.

Note that the above rules may decrease liquidity or derivative trading from India markets.

Update 12-Sep-18: It looks like market makers realized their mistake and made another circular relaxing the earlier riles. This time they came up with another circular dated 12th Sep 18, which says that instead of adding the Additional Surveillance Margin as specified in the circular dated September 01, 2018 to the Exposure Margins, Price Scan Range (PSR) used for computation of Initial Margins shall be amended, in steps, to increase the coverage of risk arising out of change in underlying Index or stocks.

Here is the circular:

https://www1.nseindia.com/content/circulars/CMPT38879.pdf

The amended circular says that this additional increase in margin will be only on SPAN margin.

What this mean?

This means that this additional margin will be reduced on a portfolio that hedges its trades. Which means that if you hedge your positions then you need not worry. You are not required to keep additional money to sell options or trade futures. The margin blocked to sell options / trade futures will remain almost same if you hedge your positions.

So Who Suffers?

Traders who trade naked or without hedge. This is a double edged sword. One they pay more to take the same risk and reward, and another their risk will increase and reward will decrease.

Why? Because now they will pay more for the same trade. For example if they made 5000 on 1 lakh, now for the same profit they will make 5000 on 1 lakh 20 thousand approx. This 20k increase in margin is due to ASM rules. This effectively will reduce the return on margin blocked. However traders who hedge their position – the risk reward will be the same.

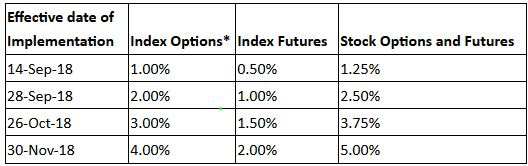

Hence margins for trading futures and options selling, especially for not-hedged trades will go up in 4 phases starting September 14th, 2018 (it has already started). Traders who do not hedge must make sure to have sufficient margins for your F&O positions to cover for this increase. Any shortfall in margin will attract margin shortfall penalty and your trades may be squared off at the discretion of your broker’s Risk management (RMS) team.

So you have two choices now:

Be stubborn do not hedge and take more risk by increasing your capital to trade FnO. Or,

Learn to hedge and trade peacefully – be happy with small profits and low risks.

DO NOT FORGET THAT FROM 1-OCT-2018 YOU WILL BE ABLE TO TRADE EQUITY FnO FROM 9.15 AM TO 11.55 PM.

Update: 18-09-2018

SEBI defers October 1 deadline for extension of trading hours. Here is the conformation:

Click here to read.

Your money will be eaten by HNIs, DIIs and Smart Trades who hedge their position. Do not let that happen to you. You will learn all kinds of hedging in my courses – option hedging, futures hedging and equity hedging. Details below:

Nifty Conservative Hedging Course: Course fees is one time fees, but you can ask me questions on the strategies for one year.

Bank Nifty Weekly Option Aggressive Hedged Strategies: It is more aggressive hedging for advanced traders.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users