Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

Read how a trader stuck with stock market trading basics and made crores.

Please Read This Disclaimer Before Reading This Article:

Stock market investments are subject to market risk. Please invest carefully after thorough research. This article explains how if you stick to the basics of investing and do proper research, you can make millions or even crores.

Year 2005: I started reading bits and pieces about stock markets, but never traded until 2007. Finally I started trading the stock markets in 2007, though for 2 years had read a lot about stock market investing especially basics. Like other retail traders, initially for first three years I made huge losses, now recovered, fact is even after knowing the stock market basics when I was making losses I did not stick to the basics of stock investing.

My regret is that even after I knew the basics I did not stick to it and lost more than 7 lakhs. You can read the mistakes I did while trading here.

I was yearning to meet a trader since 2007 who stuck to the trading basics and made a lot of money.

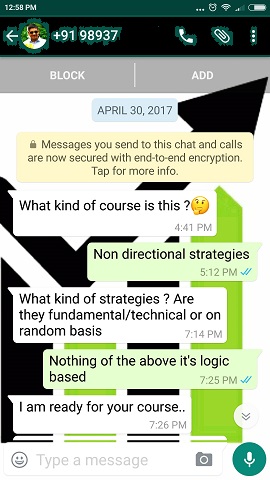

As luck would have it I met him via my site, www.TheOptionCourse.com. He contacted me through WhatsApp on April 30, 2017. Here is the screenshot.

A Stock Trader Who Sticks To The Basics Of Trading

What follows is a long and interesting conversation.

What Is Stock Market Trading Basics Dilip?

Well it is just one line which 99% or more traders DO NOT follow. Here it is:

Cut Short The Losing Trades Fast, And Let The Wining Trades Ride As Long As They Can

That one single line 99% traders do not follow instead they do this:

Cut Short The WINING Trades Fast, And Let The LOSING Trades Ride As Long As They Can ON HOPE THAT THEY WILL RECOVER

Next what he said amazed me, because this is only the second time someone called me in the last three years and said he is in profit. The first time was sometime back in 2015, but his profits were negligible. This trader is in huge profits.

This is what he said:

I am also trading in stock since 2001. Currently now in profit of around Rs. 1 crore.

WOW! 🙂

I wish everyone said that, but alas it is not the case. 🙁

I asked him what kind of strategy you follow or it is tips/advisory service?

He said, no he never take tips, but used this strategy:

Book Loss At The Earliest And Carry Profit As Long As Possible

There you go. At last I met one trader who stuck to the basics of stock trading and made a whooping profit.

Rs.1 Crore is not a matter of joke, right?

Obviously my next question was: This is amazing then why my option course?

He said he is keen to learn new things, that is the only reason.

At the time we were having chat, Nifty was around 9300. (30-April-2017)

Now this is what he said that surprised me the most:

Presently carrying 450 (6 lots) nifty @ 7950, but not booked profit till.

I thought strange.

Since I am mostly into options I asked him – you mean 7950 CE (Call Option)?

He said, no I bought Nifty Futures at rate 7950 in November, and rollover-ed till now.

Let us do some simple calculation.

He is not a small trader for sure. 450 means 450/75 = 6 lots.

Here is his profit if he books at 9300:

9300-7950 = 1350 * 75 * 6 = Rs.6,07,500.00

Profit of Rs. 6 Lakh, 7 Thousand, 500 in 5 months.

Average profit per month:

6,07,500.00 / 5 = Rs.1,21,500.00

Rs. 1 Lakh, 21 Thousand, 500 profit per month.

How many people earn this much per month in India from stock trading?

Amazing. This is what stock markets can do if you stick to the rules of trading.

I think it is an art, not a science.

So where do we go wrong?

Panic, Greed, Emotions is the answer.

Panic: We book profits early.

Greed: Not managing our finances well and taking a loan sometimes to trade (bad idea), or trying to make 10% every month from trading. Impossible. See how much this greedy trader lost and this trader lost 2 crores.

Emotions: In hope that losses will recover, we let the losses ride.

All of the above combined, traders keep doing mistakes time and again.

He fixes loss or takes a stop loss at a certain percentage but profits, he did not tell exactly where he takes.

This stop loss percentage can be flexible depending on the trade taken but it should be fixed before the trade is taken, not after.

I agree that this trader does good research before selecting scripts and I think he is a naked futures trader. Naked trading means he does not trade with a hedge. I personally feel this is not good for most traders. But if you are an exceptional trader with proper planning and full control over your emotions then it is fine on some percentage of your account not all.

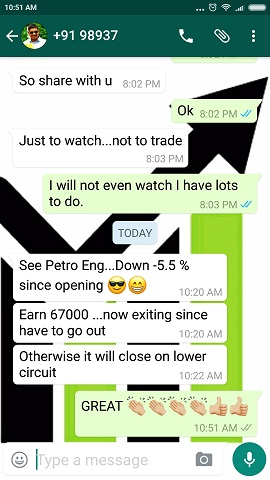

Look at his today’s (04-May-2017) profit. Rs.67,000 profit in one day, isn’t this amazing?

Your Results May Vary

Yesterday one of my free subscriber whatsapp me that this person is FAKE as Petro Eng does not have futures trading.

I think it is misunderstood.

He traded in CASH not Futures and this was an Intraday trade.

Though I personally do not like Intraday trading looks like this person is good at his job.

If you are so good then fine, but if you are not then please stay away from Intraday trading.

Intraday trading has the power to suck you in, but for most traders it is a lose all trading game.

My advise is stay away from intraday trading.

Look how this traders lost 40 lakh trading intraday.

And he is the father of all losers in intraday trading – he lost 2 crores.

Read the above and I bet your bones will shiver.

If you are losing money trading intraday, stop trading today

I respect your money and it is completely your choice to do my course or not. But as you can see a lot of traders are doing very well after they did my course.

Positional hedged trading has a lot of benefits like low tension, no need to watch markets every second like intraday traders do, and it has the benefits of compounding which intraday day trading lacks.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Comments on this entry are closed.

Very good Sir.

U write so well Dilip. Cheers

SIR,

CAN I BE EXPLAINED ROLL OVER IN FUTURES AND OPTIONS.MOST OF MY OPTIONS ARE SQUARRED OFF

Rollover is done mostly in future trading. When a trader closes current month open position either on expiry day or before and takes the same future position of next month buy/sell then this process is called as “rollover”. In the above example the trader bought November 16 Nifty future contracts and kept on rollover to next month contacts, and as on today his future position is at 9300.