Open ZERO Brokerage FREE Share Trading Account - Buy and Sell Stocks Without Brokerage - Set GTT (Good Till Triggered) Orders on System and Forget

This broker does not charge anything for stock buying and selling. You can set GTT (Good Till Triggered) order after buying a stock - the system will sell the stock automatically at your target price even if you are not monitoring the market. Only 25k is blocked for option selling with hedge. Get a lifetime account in Sensibull.com (virtual trading app & strategy builder) fee ₹800.00+GST per month for FREE. It takes 5 minutes to open an account online. Click Here to Open Free Account with Them Today and Join 1+ Crore Investors & Traders>>My Course Testimonials Year Wise:

Year 2015 | Year 2015 Page 2 | Year 2015 Page 3 | Year 2015 & 2016 | Year 2016 | Year 2017 | Year 2018 | Year 2019 | Instant Reaction Testimonial | Difference Between Othe Courses And Mine | Most Emotional Testimonial | Year 2020 | Year 2021 | Year 2022 | Year 2023 & 2024

Date of post: 25-Feb-2019

Some reasons why there is too much volatility in the markets:

- Indo-Pak Tension – This could have tanked Nifty but luckily it did not break 10600, but created confusion in traders mind. It did go down but not too much.

- Tussle Between Government and RBI. This problem is going on since very long and I do not think this will get over soon.

- General Elections in Apr-May 2019 – This is a major source of volatility and will keep moving the markets till the elections are not over.

My advice is trade with the basics of trading – do not let the stop loss be violated. This means if you have decided to keep stop loss on certain point – it’s better to exit the trade at that point. And when it comes for time to book profit – just do that. Do not wait for more.

If you want to play safe my courses will help you. Please note that option selling is required so you must have at least 75,000 in your account to do my strategies.

Though 150,000 is better you can still trade with 75k – just that your profits will reduce.

There is nothing better than trading options with limited risk and without looking at charts and without giving too much time to stock markets yet make a monthly income – this will help you surpass results of many technical traders who scratch their heads in the morning everyday to find direction of nifty. Technical traders forget that Nifty is not a stock – it is an average of 50 stocks – so essentially they are doing technical analysis on 50 stocks combined not one. Is that possible?

Update: 26-Feb-2019

Is Volatility Killing You?

How long will you keep speculating in this volatile markets?

Today morning at 3.30 am while you were sleeping, several Mirage 2000 aircraft form the IAF dropped 1,000 kg bombs on terrorist camps across the LoC.

Why am I telling you this?

Because if you are positional trader you have no control on what is happening when markets gets closed at 3.30 pm. Yes trading gets closed but the world and its business runs 24*7 – it never stops. You do not have control over what happens when the markets gets closed. Something may happen in US and our markets may suffer. But today morning what happened has definitely given fear in the mind of traders so this happened:

And have a look at India VIX:

I have a question for you – how long you want to suffer such casualty in trading? Yesterday Nifty was up by almost 80 points and today by the time I am writing this it is down by 102.25 points. I am sure many future traders must be long in Nifty futures after seeing a strong bull trend in Nifty yesterday, and today they are down by more than 7000 rupees. In one day 7k gone just because they are trying to chase direction.

But if the position is hedged traders can wait for the tide to turn in their favor.

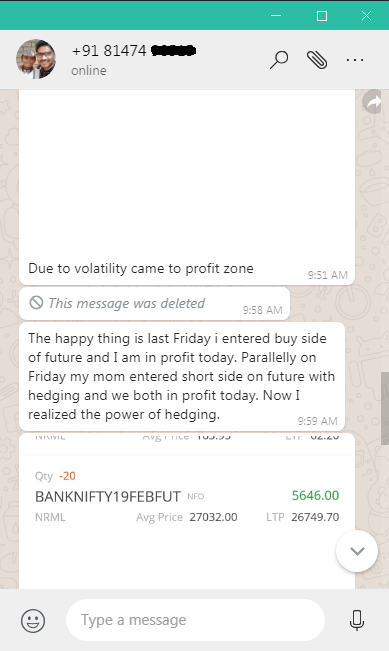

Look at how hedging helps traders. Both mom and son in profits in future trading one long and at the same time one traded short:

This is why hedging your traders and trading with proper risk management is very important in trading else it’s easy to lose all the money you earn in your entire life in stock markets.

Note: My Nifty Conservative Course and Bank Nifty Weekly Options Course will help you to earn monthly income without giving too much time to stock markets. Please note that they are non-directional strategies which means unlike stocks which can make a profit only if they go up – these strategies does not need a direction. These trades will make money irrespective of Nifty going down or up – month after month.

Look at a good stock like Tata motors – it’s going down since last one year.

An investor must be losing a lot in this stock – however unlike this with my strategies even if Nifty after one year will be at 9800 – you will still be in profit – and if it comes back again to 10800 you will still be in profit. This is non-directional trading. This is possible only with hedging.

If interested to learn the strategies (5 in Nifty course and 2 in bank nifty weekly options course) click here to pay the course fees. Please note that support of one year is also included in the fees. The support is also very important because when you chat with me I may tell you things that are good for your knowledge and way beyond the strategies in the course which itself is worth 10k.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I am an Authorized Person (AP) of a Stock Broker. I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

Find 200+ testimonials of my course:

What Traders Say About This Course

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users