Note: This post is part of the newsletter I send to my email subscribers. The dates are Feb and Mar 2023. You can sign up to receive my emails by filling out the form above. You will also get a 5 days free course on options.

If you read my emails you may have exited all Adani stocks – but unfortunately, if you have not then most of the Adani stocks are hitting the lower circuit. Even if you want to exit, you cannot sell now as the stock is down by more than 50%.

What I did do with Adani stocks?

Before buying any stock I do due diligence and basic research. I do this mostly while travelling. I know most people talk/listen to music or just close their eyes and sleep. I try to read anything interesting on stock markets/economics.

Smart tip: I have a car, but when going out for any small work alone I usually take the bus/auto rickshaw or just walk if the place is within half an hour’s walking distance. This is for these reasons –

1) it saves money

2) it saves the hassles of parking the car

3) walking in the sun improves my health

4) I get some extra time to read about the topics I am most fond of without bothering about the traffic and traffic signals. This compounds my knowledge of the subject.

One day while travelling on a bus this happened:

Not sure if this happens on your mobile, but when I open chrome they show me some interesting topics, especially on stock markets. It’s not a blank screen like when you open chrome on a desktop/laptop. I am interested in this world so I read any topic I see interesting.

Of course, Google will not throw websites from non-credible sources. So you can trust and read.

On that day there was an article on “The reality of Adani”. I got interested and started reading. This was well before the https://hindenburgresearch.com/adani/came out on January 24, 2023.

There it was written that:

Adani profitability downward: While the company’s top-line growth has been healthy, its profitability has been on a downward trajectory since FY20 – this raised my eyebrows. Why? Because Adani stocks have shot up in the last 2-3 years only.

Adani Return on equity (ROE): ROE is calculated by dividing net profit by net worth. Generally, if a company has ROE above 20%, it is considered a good investment. Adani company’s Return on equity (ROE) is at a meagre 4.1 per cent on a trailing twelve-month (TTM) basis (as of September 2022). This again raised my eyebrows. The stock growing at an exponential rate while ROE is at 4.1%. Doesn’t the price defy logic?

Adani in significant debt: The company has significant debt on its books, and promoters’ stake has been pledged to take loans. If the promoters default, their stakes will be sold by the lender to recover the loans.

As of December 31, 2022, five out of the seven listed Adani companies have their promoters’ stake pledged. Adani Power has pledged 25.0 per cent of its promoters’ stake, whereas the flagship company, Adani Enterprises, has pledged a 2.7 per cent stake.

Adani pledged shares of ACC, Ambuja Cements worth about $12.5 billion.

What is Share Pledge? Definition: Pledging of shares is one of the options that the promoters of companies use to secure loans to meet the working capital requirements, and personal needs and fund other ventures or acquisitions. A promoter shareholding in a company is used as collateral to avail of a loan.

Basically, he has kept as a guarantee/pledged (actually half of ACC and Ambuja Cement) this much money and taken a loan to expand his business.

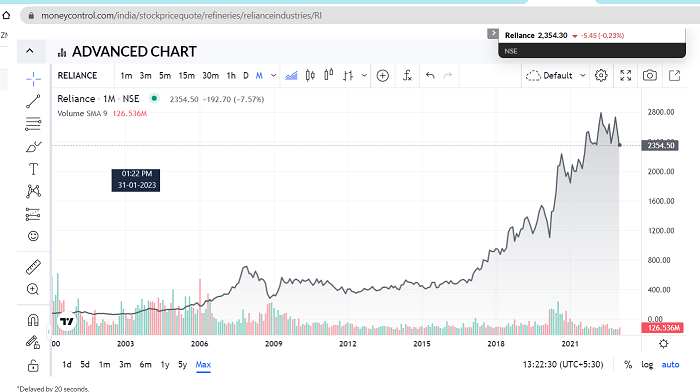

A loan that can be repaid with profits is fine. Ambani does this a lot so RIL shares will not fall, but pledging shares are in my view a well-read and experienced reading on how businesses work – is that this is a huge mistake which comes under the definition of greed.

Today Adani Enterprises Ltd. stock fell by more than 5% due to this news. One big news of the business failing – it may become half of what it is today.

Plus not sure why he has seven companies listed in the stock market. Reliance also has many businesses but Reliance has not come out with different IPOs of different companies.

IPO is basically free money from the investors which is never given back to them. I hope you can understand what I am trying to say.

Adani Enterprises’ revenue grew at 26.4 per cent CAGR in the past three years – but ROE at 4.1 per cent again raised my eyebrows.

Adani astronomical P/E: Price to Earnings Ratio or Price to Earnings Multiple is the ratio of the share price of a stock to its earnings per share (EPS). Adani enterprises’ P/E was at that time 361 times, which is 15 times more than its 10-year median P/E of 23.7.

To justify such valuations, the company would have to grow at an unprecedented rate, never seen before in the Indian markets.

What are the chances that they can do something that the Indian markets have never seen? 1%.

But I was interested as FPO was coming – this usually takes the stock to a higher level.

Now as an investor, I had to decide to invest in not a risky business but an overpriced and highly leveraged company.

So what I did do? Read – this is very important:

I knew greed was attacking me. My Demat account was opened on my mobile. My destination was still 10 minutes away. I had to take a decision. To invest or not? So yes I did – but bought only 5 stocks – a risk that I can easily manage.

At 3534.97 my total investment is just 17,674.85. This is less than the cost of my mobile. An investment that does not bother me. This is the reason I have not taken a stop loss, but advising you to take a stop loss. Why? Because your financial situation and mine are different.

I do not know how much you have invested so I can only advise you to take a stop loss and save whatever you can.

For me, 17k just does not matter. I can easily wait for years to make a profit from this bad investment without compromising my lifestyle.

But for you, my advice is to exit and save whatever you can.

Next time greed attacks you while making an investment decision – just remember this post and take the decision accordingly.

Update: 20-Feb-2023

So next time you read such a negative report of a company just exit the stock. If the loss is huge exit 50% – leave the rest for in case the stock rebounds. Exit the next day of the news. If you delay in the hope that the stock will rebound – the stock may go down so much that there will be nothing left to exit. This is what happened to stockholders of the Adani group who did not sell the stock in hope.

See where the Adani Enterprise stock is on 17-Mar-23, two months after the Hindenburg Research report came on Adani group.

Adani has control over almost all ports in India and too many businesses. If Adani will fail NSE could go down to 16000 levels.

But Adani is trying hard to repay debts in phases. Not sure if they will be able to repay 100% of the debt. But the damage has been done. Lakhs of investors may have booked huge losses in Adani shares. I do not know the exact numbers, but the loss will be huge.

So in this Hindenburg report effect who lost? Only the retail investors – you and me. Adani has nothing to lose. He was once the richest man on Earth. This was only on paper. His net worth was calculated by the total money of free-floating shares of his 7 companies in the world. That is not his actual worth. His actual worth is the debt-free money he owns and the value of the assets he can sell like his house, cars, jewellery etc.

Here is the real-time list of world billionaires:

https://www.forbes.com/real-time-billionaires/

this is updated every 5 minutes.

I saw a news article: Hindenburg effect: Gautam Adani’s net worth drops below $50 billion

Yes, it is showing in the Forbes post as well.

So is the list real? No, it is virtual – just on paper.

Today the Adani family lives in the same house in they lived before the Hindenburg report which came out on 24-Jan-23.

He still drives the same car, eats the food made by his same chef, he has the same clothes, and all his assets are ditto same as they were before the report.

So where has the $50 billion gone? If you took a loss in any Adani share – count yourself in, not Adani.

Next time you see a report saying that blah blah net worth has increased or decreased – just tell yourself that they are talking about his company’s share price – not his net worth.

No Forbes or any other company will ever come out with a real list of the richest people on Earth. Never. Because it’s impossible to contact every rich person on Earth and ask them their actual bank balance minus debts, and their sellable holdings.

Update on :27-Feb-2023:

Hi,

I do understand what investors must be going through for the last year. In 2020 it was Covid. Job gone, stock markets down. In 2021 – covid came again in Phase 2. This was as if a builder built a housing complex, then seeing its success made its Phase 2.

Stock markets again went down then recovered.

Then in 2022 Putin was the new Covid and still, he doesn’t get the sense that it’s not the land that is important – its human lives and the economy. He ended up destroying both and still doing.

Total death toll now in this war has exceeded 200,000 (2 lakh) 🙁

After almost one year of the war, there was hope that stock markets will ignore the war and reach new heights. It did a few months back – and then…WHAM

AADDAANI…

But then it’s our fault as well. If you had Adani shares before the report came I am sure you bought them seeing last year’s returns.

Was it a correct decision?

Look at this page:

https://www.adanienterprises.com/investors/debt-information

Straight coming out from Adani’s website.

This was easy research that one should not buy Adani shares.

Here is the reason:

Adani Enterprises FY21 Net External Debt was Rs. 9,767.00 Crore

And in

Adani Enterprises FY22 Net External Debt was Rs. 24,504.00 Crore

They have not written the figures are in Crores, but you can guess, its not lakhs.

What about the entire Adani company debt?

The group had a gross debt of ₹2.26 lakh crore as of September 30, according to a stock exchange filing. Total cash and cash equivalents was ₹31,646 crore. It faces a repayment obligation of ₹17,166 crore between January 2023 and March 2024.

Source: TheHindu.com.

And if you did just 5 minutes more research you would have found that hold your breath … Adani’s group’s debt accounts for 0.5 per cent of total loans across the Indian banking sector. For public sector banks (PSU), the debt is at 0.7 per cent of total loans and for private banks, it is at 0.3 per cent.

Source:

Livemint.com

It means for every Rs.1000 loan in public sector banks, Rs 7 was given to Adani. And for the private sector, it was Rs. 3 to Adani.

We are talking about entire India.

This was enough to decide not to buy Adani shares. Even if you wanted to take a chance then you should have bought 5-6 shares. This would have given you a comfort zone now. It doesn’t matter how much a stock will fall when your stakes are low. I am in that comfort zone club.

Next time please do such research if you want to invest a big amount in a company.

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users