Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

Keep it Simple Stupid Works in stock market investing. We have given an example of Reliance stock.

Since Covid-19, stock markets have just moved randomly – deceiving investors and traders.

There are many proverbs in English and Hindi and I am sure in other languages too which teach us many things about wisdom and the truth of life and stock markets.

There is one that makes sense in almost everything we do: KISS – meaning – Keep it Simple, Stupid.

It is a design principle that states that design and/or systems should be as simple as possible. Wherever possible, complexity should be avoided in a system—as simplicity guarantees the greatest levels of user acceptance and interaction.

Now compare this with investing or trading or even a business.

Suppose you want to invest in Reliance, what will you look at?

Option A) 5 minutes charts?

Option B) Bollinger Bands?

Option C) Relative strength index (RSI)?

Option D) Price Action?

Option E) Fundamentals of the company?

Of course Option E. If the fundamentals of the company are strong – just invest – do not look at the price or any charts. This is what the greatest investor of all time said – Warren Buffet.

But how many follow?

Randomly chose 100 traders and ask them to invest in Reliance. Do not give them any option written above. I can guarantee that 95 of them will start looking at charts. Based on that they will take a decision.

Here is a fact – when a stock falls, nearly all Technical Analysis tools/strategies will indicate not to invest or short.

For the short term you either make money or lose. This returns a net zero or loss.

However, fundamentals almost always win.

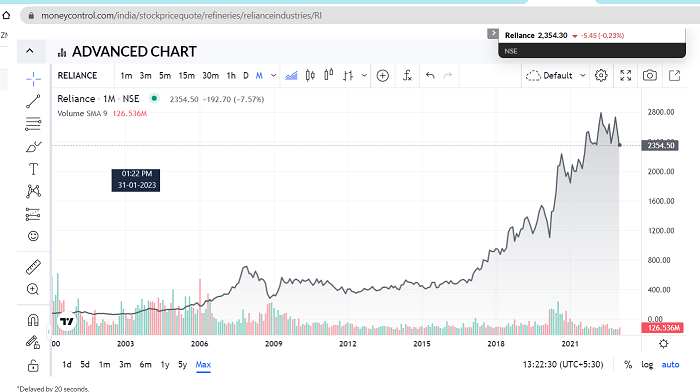

Here is the lifetime (till date) return of Reliance:

Source: moneycontrol.com

So the investor who followed the basics of stock market investing won by a huge margin over a trader who looked at charts for a short-term profit.

Fundamental investing is following the Keep it Simple Stupid strategy and not making the entire process of investing complex.

The same strategy can be applied to options trading. Just keep the strategy simple and it will work most of the time.

The strategies in my paid courses are simple and easy to understand. They have a simple logic that options have theta (time value) – so it takes benefit of that but with a hedge so that the losses are capped at max 1500.

Option buyers run against time whereas time is with option sellers. This is the reason HNIs are option sellers, not buyers.

There are many strikes to trade options – you will learn strike selection in every strategy. When to take the profit out and when to exit the trade all is well explained.

They are so simple that execution will not give you any stress neither will the trade give.

There are seven strategies in the course.

• 4 are option strategies

• 2 are future hedging strategies – how to find the direction will be told here

• 1 is the HNI strategy for investors having 5 lakh+. This is renting the stock to make a monthly income with ZERO work.

After payment, I will send the strategies to your email in PDF format. You can start reading and for any doubts, you can contact me by Phone/Email or WhatsApp.

This support will be there for one year from the date of payment.

You can find the course fee here.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Comments on this entry are closed.

Dear Sir

Your newsletters are very informative and interesting.

And the language is also very simple and easy to understand.

I am a retired person and am not very sure if I should invest in options.

However, before plunging into it I would like to take your course with a discount.

Expecting a favourable reply

With warm regards

George Joseph

George thanks for reading my newsletters. I have sent you an email regarding your query.