Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

Date: Monday, 05-June-2017

Nifty has rallied from 8000 levels to the highest in history today: 9685.15

Today highest:

Learn why you should avoid temptation to buy stocks in a bull rally, wait for a fall and then buy stocks as per your choice.

In a bull rally most investors get lured by temptation to participate in the rally and make quick money and end up getting caught at the peak.

In the history of stock markets which bull rally ran permanently? None. What goes up has to come down and what comes down has to go up. This is the nature of stock markets.

Mistakes To Avoid In a Stock Rally

1. Temptation to Buy Stocks – Too many investors are now in a buying frenzy mode as if stocks will never fall. This is a huge mistake. This is the time to sell not to buy. Of course to sell you must have stocks in your portfolio that are making good profits. If you did not buy earlier when the stocks were at attractive prices, you did a mistake. If you buy now you will do a double mistake. Avoid your temptation to buy stocks now.

2. It is A Very Costly Market Now You are getting a deal but its very costly. Will you go for this deal? Yes there is a feeling that Nifty may touch 10,000 who knows but the deal is costly and the risk is too much. It is better to leave a costly deal and wait for a better deal.

3. Chance of a Bubble – Agreed now government across the world have taken considerable steps to avoid the recession like situation in 2007-08, but who knows what is happening? Why risk your money when it can be avoided. There is little chance of a bubble, but its better to sit sideways.

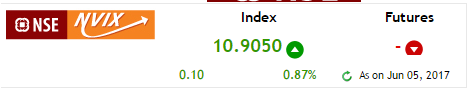

4. Aggressive Shorting – There are a lot of contrarian traders. They always short the markets whenever they see a bull market. Positional shorting cannot be done on stocks so they take aggressive bets on options shorting. I am sure a lot of traders are now shorting at the money options or just out of the money ones trying to capture the maximum profit. They forget that in a bull market option premiums are very low so the risk reward ratio is very bad. See India VIX on 05-June-2017. It is less that 11. Range of 9-12 is considered low for VIX. VIX or Volatility Index has a big role to play in deciding option premiums. It forces trader to come near the money to short options to make more money. They do not even hedge and if the rally continues they end up making huge losses.

India VIX as on 05-June-2017:

Learn proper option hedging methods in my conservative options trading course.

5. Depending on Trading Software – I am sure all trading software must be giving a buy signal. A software does not have a brain. When it sees no downfall for days it will obviously make a straight line up. The software cannot predict a fall. No software ever predicted a bull run or a great fall and they will never do. I have never traded based on any software because I believe business is done by humans not machines. The article you are reading now is written by me not a machine. Similarly, the money you will keep to trade will be yours, the profit and losses will be yours – then why follow a software? Like your place in your job/business cannot be replaced by a robot or a machine, what makes you think software can trade?

Read this how automated trading systems can fail big time. Here are the disadvantages as per the wiki article:

Disadvantages of Automated Trading System:

Mechanical Failures:

Even though the underlying algorithm is capable of performing well in the live market, an internet connection malfunction could lead to failure.

Monitoring:

Although the computer is processing the orders, it still needs to be monitored because it is susceptible to technology failures.

Over-Optimization:

An algorithm that performs very well on backtesting could end up performing very poorly in the live market. This point is very important for traders who backtest a strategy, get great results and think the strategy will work in future as well. This is simply not true. Good performance on backtesting could lead to overly optimistic expectations from the traders which could lead to big failures.

The following text has been taken from Futuresmag.com:

The system wins only 38% of its trades. The average winning trade lasts 153 days, whereas the average loser lasts only 55 days. If we look at monthly returns, however, six out of 10 months make money. Our winning months average $7,028, and our average losing month is –$5,805. At first glance, this may seem like a paradox—how can only 38% of the traders make money, while 60% of the months are winners? The answer lies in the role of time. This is a trend-following system; as such, a large percentage of trades shows an interim profit at some point even though (per the rules of the system) only 38% are closed out as winners.

Because the average winning trade lasts 153 days, we can assume we must trade for at least 600 days before we make money. That would be just four winning trade periods. Even though it may seem like a long time (almost two years), it is still a short period measured in terms of trade time frame.

The following text has been taken from https://en.wikipedia.org/wiki/Automated_trading_system:

On May 6, 2010, the Dow Jones Industrial Average declined about 1,000 points (about 9 percent) and recovered those losses within minutes. It was the second-largest point swing (1,010.14 points) and the largest one-day point decline (998.5 points) on an intraday basis in the Average’s history. This market disruption became known as the Flash Crash and resulted in U.S. regulators issuing new regulations to control market access achieved through automated trading.

On August 1, 2012, between 9:30 a.m. and 10:00 a.m. EDT, Knight Capital Group lost four times its 2011 net income.[14] Knight’s CEO Thomas Joyce stated, on the day after the market disruption, that the firm had “all hands on deck” to fix a bug in one of Knight’s trading algorithms that submitted erroneous orders to exchanges for nearly 150 different stocks. Trading volumes soared in so many issues, that the SPDR S&P 500 ETF (SYMBOL: SPY), which is generally the most heavily traded U.S. security, became the 52nd-most traded stock on that day, according to Eric Hunsader, CEO of market data service Nanex. Knight shares closed down 62 percent as a result of the trading error and Knight Capital nearly collapsed. Knight ultimately reached an agreement to merge with Getco, a Chicago-based high-speed trading firm.

One small mistake by the software and the trader loses his shirt or may have to sell his home to at least put food on the table.

Never do these mistakes in your trading life especially in a Bull Run which attracts most investors to stock markets.

Conclusion:

Do not let Automated Systems take ownership of your trading money – if they do mistakes you will pay the price not automated systems. Take control of your money yourself. God has given you a brain and two hands to take control of your future so do not let anyone else either a machine or an unsolicited advisor or tip provider take control of your finances.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Comments on this entry are closed.

Hi Dilip,

I am currently in US until end of Aug as I advised you when we spoke.

You are doing a great job educating your clients as well as non-clients. Your study is thorough and deep. I believe studying and writing has become your passion from which you get more satisfaction than simply making money through trading.

Thanks once again. Keep up your enthusiasm as a teacher with a helping attitude.

Will get in touch when I return to India.

Regards,

Ratan

Thanks Ratan. Yes studying stock markets and writing has become my passion now.

sir , trying to make re entry but not having courage .