Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

First what is India VIX Index?

Volatility Index is a measure of market’s expectation of volatility over the near term. Volatility is often described as the “rate and magnitude of changes in prices” and in finance often referred to as risk. Volatility Index is a measure, of the amount by which an underlying Index is expected to fluctuate, in the near term, (calculated as annualised volatility, denoted in percentage e.g. 20%) based on the order book of the underlying index options.

India VIX is a volatility index based on the NIFTY Index Option prices. From the best bid-ask prices of NIFTY Options contracts, a volatility figure (%) is calculated which indicates the expected market volatility over the next 30 calendar days. India VIX uses the computation methodology of CBOE, with suitable amendments to adapt to the NIFTY options order book using cubic splines, etc.

Source:

https://www1.nseindia.com/products/content/equities/indices/india_vix.htm

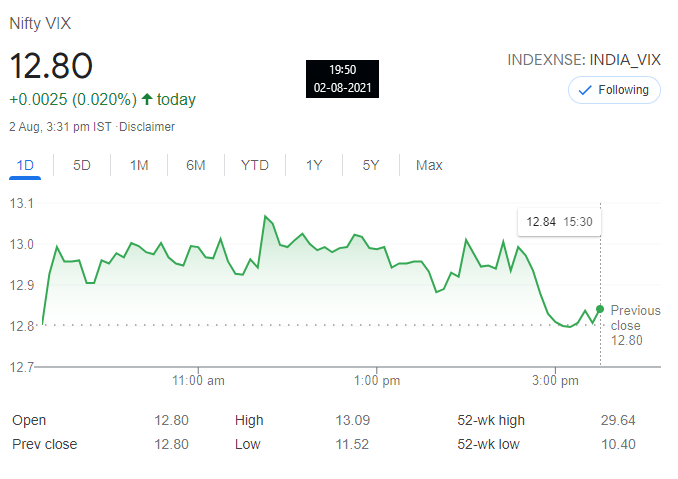

After a lot of months INDIA VIX has come to a normal level. Normal level of INDIA VIX is considered between 10 and 15. Anything above 15 is considered high.

Look at INDIA VIX on 02-Aug-21 at 7.50 pm:

And then look at how it remained near 25 for last 1 year which is considered high:

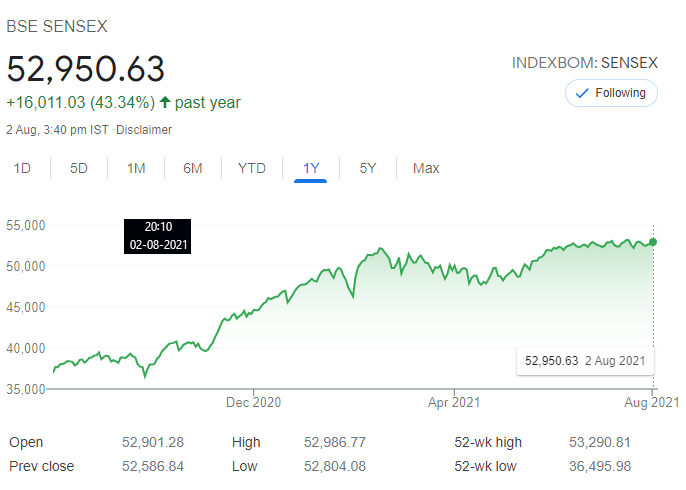

Look at Max chart of India VIX – you can clearly see that it remains below 15 most of the times except for Mar-Apr 2020 to June 2021. I think the reason is coronavirus scare.

Now that the vaccine is available the stock markets have gone up and the INDIA VIX has gone down.

INDIA VIX an stock markets are inversely proportion to each other. See how in the last one year BSE SENSEX has gone up while INDIA VIX has gone down.

More in INDIA VIX

If you do not know, option premiums are heavily dependent on INDIA VIX.

You can see India VIX here:

https://www.moneycontrol.com/indian-indices/india-vix-36.html

Or just Google INDIA VIX.

What happens if INDIA VIX drops?

Volatility in the stock markets will be low but option premium will also be low. So option seller’s return on investment will decrease. To increase the return on investments you can hedge your trades.

To learn hedging and managing option selling you can do my Conservative Options Course and Bank Nifty Weekly Options Course.

You can pay the course fee here.

What happens after payment?

After payment, I will send you the strategies in your email. For any doubts, you can ask me qustions to clear your doubts via call/WhatsApp on 9051143004.

Support will be for one year from the date of payment. You will also start getting paid emails for the strategies to trade.

After payment, I will send 6 PDFs where I have explained the strategies like a video with screenshots of Nifty/BN and then the explanation – STEP by STEP of what exactly you need to do.

You can ask me questions on WhatsApp, email or phone for one year the doubts on the strategies in LIVE markets.

If you are unable to make the strategy I will make it for you to follow-through and learn.

Articles on my site on India VIX:

https://www.theoptioncourse.com/how-india-vix-is-calculated-and-what-to-expect-after-seeing-high-or-low-india-vix/

https://www.theoptioncourse.com/india-vix-over-17-what-it-means/

https://www.theoptioncourse.com/union-budget-2021-india-vix-will-crash/

https://www.theoptioncourse.com/sudden-drop-of-india-vix-means-what/

https://www.theoptioncourse.com/india-vix-surges-26-74-caution/

https://www.theoptioncourse.com/impact-on-nifty-bank-nifty-india-vix-due-to-general-elections-2019/

https://www.theoptioncourse.com/what-is-india-vix-and-why-it-changes/

https://www.theoptioncourse.com/india-vix-increasing-by-22-in-a-single-day-is-not-good/

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users