I have written a book on Personal Finance. You will learn practical ways to save money and invest well to grow your wealth with time so that you can retire early. Click Here to Buy the Book on Amazon - on Kindle Unlimited its Free or just Rs.49/-!!!

Article Date: Monday, 27 August 2018

Many traders and investors must be wondering why Nifty 50 (NSE) is rising continuously since last one year. Here is the chart:

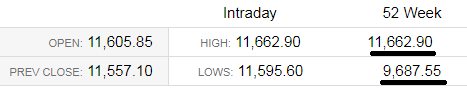

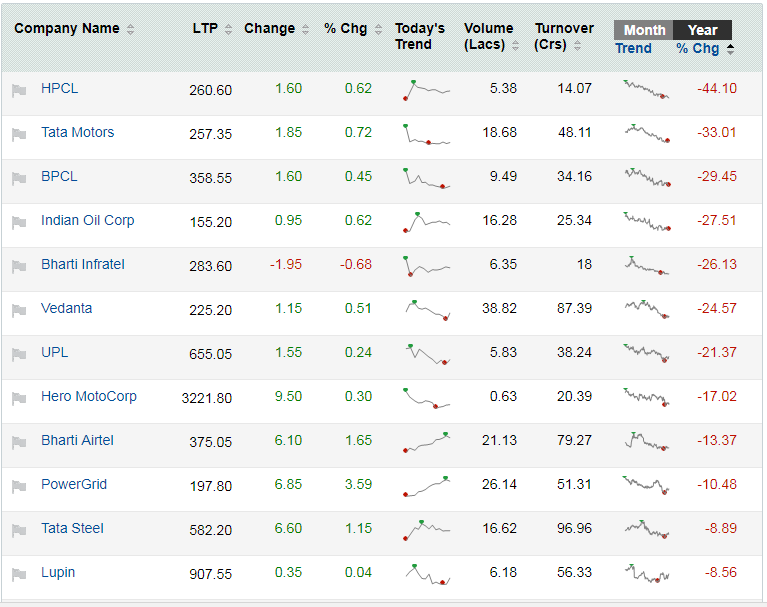

52 Week High and Low:

Percentage Increase (20.39%):

Some important notes before you read further:

NIFTY 50 is a diversified 50 stock index accounting for 12 sectors of the economy. It is used for a variety of purposes such as bench-marking fund portfolios, index based derivatives and index funds. NIFTY 50 is owned and managed by NSE Indices Limited (formerly known as India Index Services & Products Limited) (NSE Indices). NSE Indices is India’s specialised company focused upon the index as a core product.

Source: https://www1.nseindia.com/products/content/equities/indices/nifty_50.htm

Basically Nifty tracks the market performance of 50 largest cap companies’ stocks of india, and hence, broadly reflects the sense of the Indian economy.

Is NSE (National Stock Exchange) same as Nifty 50?

No. Nifty 50 is a collection of large cap or in other words very big companies which may not collapse. NSE is a stock exchange where thousands of companies stocks are traded – bought and sold. NSE has more than 1,600 companies listed on its platform. Nifty is a collection of 50 large companies which are traded in NSE.

Similarly BSE (Bombay Stock Exchange) is also a stock exchange just like NSE where shares can be bought and sold for companies listed there. There are about 5,000 listed companies in the BSE.

If you check the difference approximately 3000+ companies are not listed in NSE, hence not traded in NSE. Thousands of companies are listed in both BSE and NSE. If you want to buy stocks of a company listed in BSE but not listed in NSE – you have to buy from BSE exchange only and sell in BSE exchange only. You cannot buy a stock listed in BSE and sell in NSE, if not listed there.

Companies listed in both NSE and BSE can be bought from one exchange and sold in another and vice versa. But this cannot be done intraday. Means you cannot buy a share in BSE and sell in NSE and vice versa the same day. This is arbitrage and hence not allowed.

Full form of NIFTY is “National Stock Exchange Fifty”. When you want to see chart of NSE you will end up seeing charts of NIFTY everywhere. In fact you will see NIFTY being branded as The National Stock Exchange (NSE). Fact is NIFTY is only a part of NSE but index of NSE is calculated based on NIFTY, therefore when you search for chart of NSE you end up seeing chart of Nifty 50.

People get confused thinking its NSE chart. Market apps and websites show the Nifty 50 chart and brand it as NSE. It’s not wrong as Nifty 50 is most popular and most traded index derivative (future and option).

Now coming to the question of why NIFTY is rising since last one year. If the stocks in the Nifty 50 rise then NSE will also rise.

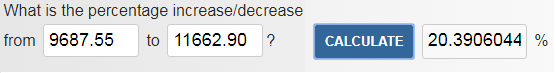

See list of stocks in NIFTY 50 that have risen the most in last one year (from Aug 2017 to Aug 2018):

Please note that by the time you see the list may change.

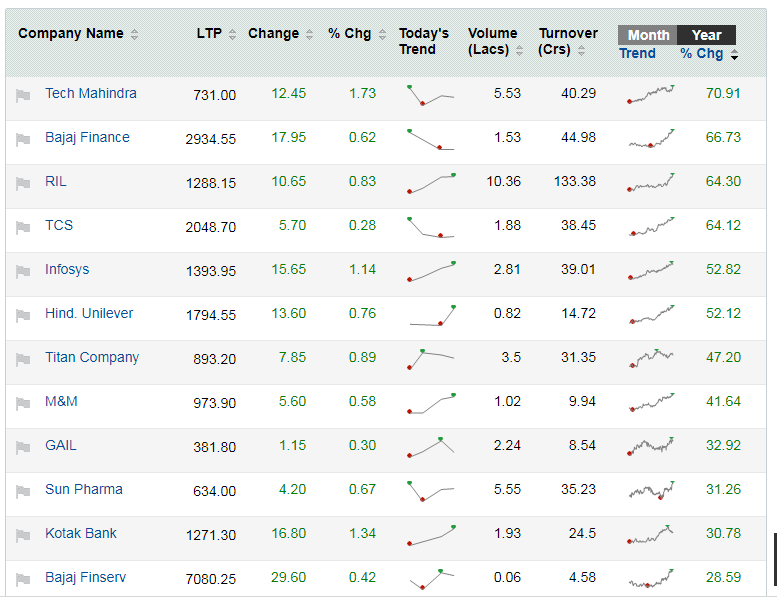

You can see that the top companies have risen approx 30-70%, but NIFTY has risen 20.39%. Why only 20.39%, why not 50%? Here are companies that gave a negative return in the same period in NIFTY 50:

On top of that some companies are given more weightage in evaluating the price of NIFTY. So if all the averages are taken along with the weightages of these 50 companies you will see that it’s a 20.39% rise only.

Some more information on Nifty calculation:

Base year of NSE is 1995 and base value is 1000.20. NIFTY is calculated based on 50 stocks. List of 50 stocks can be found here.

The main difference between SENSEX and Nifty is that SENSEX is the stock market index for BSE Limited, while Nifty is the stock market index for National Stock Exchange (NSE). SENSEX is comprised of 30 stocks, while Nifty is comprised of 50 stocks.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users