Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

There are two major problems with new traders. These two problems are main reasons why new traders lose money.

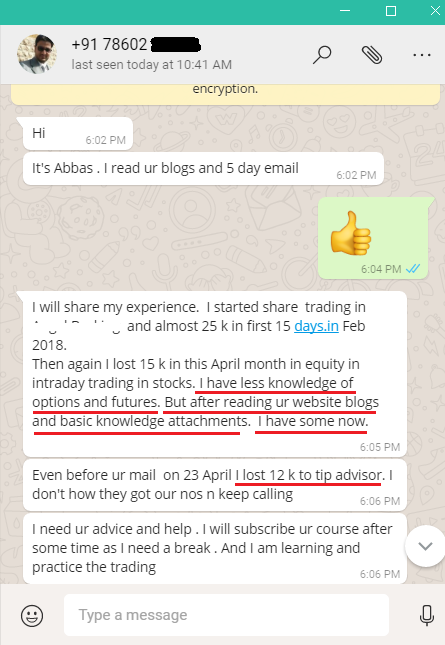

See this whatsapp message I got from a new trader:

Here is the text:

Hi it’s Abbas . I read your blogs and 5 days email.

I will share my experience. I started share trading in [broker’s name hidden] and lost almost 25k in first 15 days, in Feb 2018.

Then again I lost 15k in this April month in equity in intraday trading in stocks. I have less knowledge of options and futures. But after reading your website blog and option basic knowledge attachments. I have some now.

Even before your email on 23 April I lost 12k to tip advisor. I don’t how they get our numbers and keep calling.

I need your advice and help. I will subscribe to your course after some time as I need a break. And I am learning and practicing trading.

Lets look at the problems of new traders:

Problem no 1: Less Knowledge

Do you think with less knowledge you can excel in any field? Especially in stock markets where your hard earned money is involved it is very risky to enter with less knowledge. Your competitors are HNIs and DIIs. Do you think with less knowledge you will be able to beat them over the long period of time?

Think about it.

Luckily this person has lost only 30k till now. Look at this loss of 40 lakhs, loss of 2 crore and biggest of all 3 crore loss. 🙁 🙁

How can someone go on to lose this much money in greed for making more. I fail to understand this.

Is your story the same as any of the above? With less knowledge there is less than 0.1% chance that you will succeed.

Problem no 2: Tip Advisory Services

Once a new trader is unable to succeed on his own he turns to tip advisors. This is the next blunder. Name one person who became rich trading the stock markets by taking tips. I have written an post on why tips cannot make you rich.

Look at their promises – SMS or calls like we will make you 1 lac daily and the poor retail trader gets trapped. Forget about 1 lac daily. Average retail trader loss due to tip providers exceed 1 lakh. Loss on paying a monthly service to get tips and loss on trading the tips. Do not believe in guaranteed profit promises from the tip providers.

If you try to call them after losses there is no one to pick the phone.

They give 5-6 calls daily. They know very well that non of the service takers will be able to trade all of them. So if someone calls them they can easily say you did not trade all calls, so we are not to blame.

Then you leave their services, someone else joins. 🙁

Its sad but the problem lies with the trader too.

And the problem is this:

NEW AND EXPERIENCED STOCK TRADERS BOTH WANT TO GET RICH VERY FAST WITH EITHER SPECULATION TRADING OR TAKING TIPS.

Let me tell you clearly and honestly that making money in any business takes time. Stock trading is also a business not a magical source of income. And expecting 10% a month from stock markets is also a blunder.

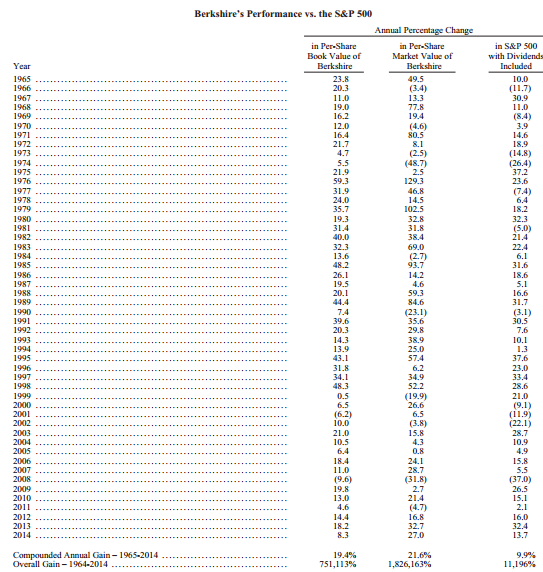

Look at this ROI (Return of Investment) Yearly graph of Berkshire Hathaway:

And a note on their Compound Annual Growth Rate (CAGR):

However you analyze it, Berkshire’s long-term performance has been awesome. Using market value, he says, its shares gained 21.6 percent annually compared with 19.4 percent for book value and 9.9 percent for the Standard & Poor’s 500-stock index, with dividends. Using market returns, the shares gained a cumulative 1,826,163 percent since he took control.

Read that again just a gain of 21.6 percent annually yet Warren Buffett goes on to become worlds riches man.

Yes its true that he compounded millions of dollars to make billions. But ultimately it was compounding that did its job.

History has it that even 21.6 percent annual gain is great return on investment. But yes this has to be consistent.

What you can do?

Stop speculating and stop taking tips. You can download this PDF file which well explains the basics of options and then you can do my option course to generate wealth over the long period of time trading options very conservatively with proper hedge to restrict your losses.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users