Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

Date of Article: Friday, 28-February-2020

Do not worry over this huge fall in Indian stock markets:

Source: https://money.rediff.com/index.html

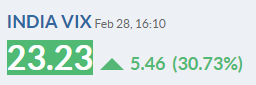

India VIX has also shot up by 30.73% – above 20 is dangerous for derivative trading:

Source: https://www.moneycontrol.com/indian-indices/india-vix-36.html

Why This Happened?

It is due to the fear of coronavirus, the markets world over are going through a bad phase.

You can track real-time reported cases of coronavirus all over the world here:

https://infographics.channelnewsasia.com/covid-19/map.html

It is still NOT a crash. A crash is declared official if the markets fall at least 25% from its recent peak.

On 14-Jan-20, Nifty closed at 12362.30.

12362.30 – 25% = 9270.00 (Approx)

So if Nifty falls and closes below 9270.00 – it will officially be declared as CRASH.

This is NOT going to happen unless more than 10,000 deaths are reported from coronavirus. That may not happen.

What the world is going through is a mini-crash which should not be taken seriously.

What you can do?

Investors: If you are an investor just hold your stocks – do not exit in panic unless you need money now – today.

Future & Option traders:

If you were on Put Buy/Call Sell/Future Short – You have made enough. Close the trade and exit in profits.

If you were on Call Buy/Put Sell/Future Long – Take a Stop Loss and exit. Do not wait for reversal – there can be more pain on Monday.

After that don’t trade. I think in 15 days things will be normal and Nifty will start moving up.

Hope that helps.

I have been teaching non-directional strategies since 2015 and all of my students are pretty happy as they do not have to see the charts yet they make money. In a situation like this is max loss is limited as the positions are hedged – so even a black swan event DOES NOT bother them.

I suggest starting with my most conservative course – Nifty Options Monthly Income Conservative Course. Right from Mar 20, you will start making a monthly income. Strike selection, entry-exit – everything will be taught.

What you will learn:

– Conservative Options hedging

– Conservative Futures hedging

– Conservative Equities hedging

– Bonus strategy for reversal benefit

Here is the complete process of my course:

Once you pay I will send you the course materials for studying to your email. They are well explained in step by step manner with examples in PDF files. There is a total of 6 pdf files in Nifty and bank nifty courses.

Whenever free you read these files strategy by strategy and ask me questions via phone/WhatsApp/email to clear doubts.

This will take about 2 days. Then you start paper trading and still can ask me questions. This will take about 10 days. After this, you can start trading. You can still ask me doubts in live real trading for one year from the date of payment.

Course Content:

Strategy 1:

Is pure options only non-directional strategy where a trader makes money irrespective of direction or the trend of the market. I will teach how to enter and exit strikes to buy/sell when to do it, how long to hold etc. It’s properly hedged so there is NEVER a HUGE LOSS. Your loss if any will be 1500 only which is recoverable by strategy 2.

Strategy 2:

Is again options only strategy which is very hard to beat. For this to be beaten Nifty has to travel 1500 points continually in one direction – which is only once in a year. So even 1500 lost is recoverable in the money lost in Strategy 1.

The success rate of the above-combined strategy is 80%

1.6 lakh required to trade the above strategies as in Feb, 2020. It may reduce in May 2020.

Strategy 3:

Is for High Net Worth traders. This is again a monthly income where a trader learns to hedge equity stocks with options and make money every month. If you are a high net worth trader you can make up to 5% every month using the above strategies.

Strategy 4&5:

Are futures properly hedged with options. Where a trader learns how to trade futures and hedge it with options in the correct way so that there is never a huge loss trading futures. In fact, you may make money even if wrong in the future direction.

Bonus trade is how to take the benefit of the reversal of Nifty.

Click here to know the fees and pay for the course.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users