Part of newsletter sent on Sunday, October 11, 2015 to my newsletter subscribers. If you want to receive such newsletters please subscribe at the end of the post.

Read to know how you can trade Infosys (Infy) on quarterly results day – this can be traded after the results are declared.

Refer my yesterday’s email on trade to be taken on Infosys tomorrow.

One of my subscribers informed me this – “Infosys results are to be declared before opening of Markets on Monday. If the strategy is on Infosys, can we still take position after results declaration as market would have already moved in one direction.”

I have confirmed and I see that Infosys will announce results at around 8.45 – 9 am tomorrow. In that case the movement will occur as soon as markets open. There will be a gap opening. The directional trade of my course needs movement – it does not matter where. Those who traded on Friday will get lucky. If the movement has already happened, then its better not to take that trade.

The news is out by that time means VIX also would have dropped as on Friday it rose by almost 20% before closing. So there is no point in selling options. It is now almost 3 weeks to expiry – we have enough time on hands.

How To Trade Infosys On Quarterly Results Day

If the Infosys drops too much say more than 5% – just buy a Future and hedge with buying ATM PUT in the hope that the trade will be profitable in the next few days.

And of course if Infy opens more than 5% up – sell a Future and buy ATM call in the hope that Infy will fall and the trade will be profitable before expiry.

Where to take profits out?

Since I am a 3% man – take profits out when you are making 3% on margin blocked. 🙂

What is the maximum loss in the trade?

The premium you pay to buy options – that’s it – therefore you can stay long in trade.

When to take Stop Loss?

No need since the trade is hedged and max loss is defined.

Why am I taking the opposite trade?

Infy traders are known to give knee jerk reaction to quarterly results which makes the price either too cheap for short term or too costly – both will correct over time.

What happens if you make a profit?

Just say a Thank You. That’s enough for me. 🙂

What happens if you make a loss?

Yes that’s a possibility that’s the reason I am asking you to hedge and not trade naked. The real idea is you learn the benefits of hedging.

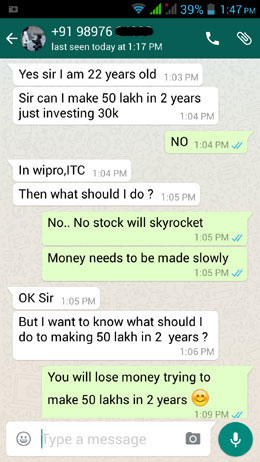

Do not lose money friends – the stock market is there to help us increase our wealth NOT destroy it. So please trade sensibly.

Still I will be sorry if you make a loss in this trade, but my intention is to help. Stock market trading is a risk and that risk you will have to take. However with hedging your risk gets minimized.

Thank you Mr. Purushottam. Your email helped me to inform others well before opening of trade on Monday.

Please keep such emails coming. Though I read a lot, its humanly not possible to read everything related to stock markets. If you send me suggestions I will be able to help others as well. That way we all can grow. Its not possible for me to keep track on everything so please inform me of any events that may shake markets or a stock.

By helping others you always feel good.

Thanks for being my subscriber.

Learn Conservative Trading Today and enjoy the benefits of Hedging and conservative trading.

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users