Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

Learn options pricing difference between ask, bid, LTP, best sell and best buy and how they are traded.

Nothing can be traded without money and a price. Options are also traded the same way. To buy an Option one has to pay a price or it comes at a cost. The price is decided by the premium of the Option. In other words every Option has a premium or in simple words a price or cost on which it has to be traded or bought and sold.

The buyer pays this premium to the seller through a stock market exchange. In India NSE – National Stock Exchange of India Ltd., BSE Ltd. (Bombay Stock Exchange) and MCX – Multi Commodity Exchange of India Ltd. are the major stock trading markets known as Stock Exchanges.

Please note that if someone buys an Option through the exchange NSE, a seller has to be trading in NSE only on that Option. A seller in BSE cannot sell that Option to a buyer in NSE. Same for MCX. Treat stock market exchanges as a business where people come and trade.

How The Stock Market Exchanges Benefit?

If you see your contact note you will see brokerage charges and other charges like STT and others. The highest among them is the brokerage charges which your broker keeps. Rest he has to give to the exchanges where the trade was done every month. If you are paying too much to your broker please fill this form I can help you save money in multiple of thousands and please do not worry they have been awarded the best broker by NSE for three years in a row. They have lots of study modules in Options and trading too.

That money is the profit of the exchanges. However that is not the full profit. Do not forget the infrastructure costs like building, electricity, employees salary, taxes and other expenses. After that whatever is left is their profits.

What Is Ask and Bid Price of An Option?

Now let me take a live example.

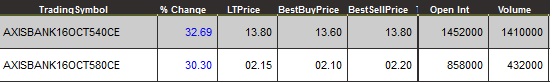

See the image below:

I have selected Axis Bank Options. Axis bank is currently trading at 543.15 so At The Money (ATM) Option is 540. I chose the October 2016 expiry Call Option because when a Stock is moving up trades love to buy ATM CE, when moving down they will buy ATM PE.

As you can see its premium is 13.80. LTP is the Last Trading Price. LTP means the last trade was done at 13.80 at the exchange. Best Buy Price is at 13.60 and the Best Sell Price is at 13.80.

This is known as Ask and Bid Prices.

The Bid and Ask is kind of a bargain between a Seller and a Buyer. The sellers asks for a premium (Ask Price or Best Sell Price is the lowest price in the market place for that option where it is being traded for that time) and the buyers asks for a discount because they need to pay (Bid Price or Best Buy Price is the highest price any buyer is offering to pay for that option in that point of time in the same market place). This is just like in any market place where the shopkeeper tells the buyer a price and the buyer asks for a discount.

Ultimately where they agree and trade is the LTP of the Last Trading Price. This software cannot control. This is directly between the buyer and the seller, once the trade is complete the record is sent to the exchange software and they show it on every traders trading platform. By the time you have finished reading this the Ask, Bid and the LTP price might have changed for that Option because of the trades that got completed and the movement of Axis bank price in Equity Markets.

Now let us look at the second Option Price which I chose slightly Out of The Money (OTM). October 2016 580 CE of Axis Bank. As you can see the LTP is 2.15. Best Buy Price (Bid) is 2.10 and the Best Sell Price (Ask) is 2.20. So at whatever price the trade will get completed that will become LTP or Last Trading Price and then new Ask and Bid will start showing according to the traders doing a trade.

Also see that the Open Interest is much more in the 540 ATM CE than the 580 OTM CE. We have already read about Open Interest and why it is more at ATM (At The Money) Options. If you have not read that article click here to read about Open Interest.

Frankly I feel surprised that where the trades should be done more there it is not done rather greed takes over and trades trade only where there is home run of money. One day there is Home Run next day they lose their home. This proves trades do not have much knowledge of Option Trading therefore keep losing money.

That is the reason I opened this website to educate traders on Options and started a conservative option trading course because a lot of my time is consumed in teaching people about Options.

If you are losing money trading Options I recommend my course. If you are making more than 3% a month consistently then it is ok please do not do my course.

The earlier you learn about hedging techniques in my course the better because life has a limit. You cannot keep trading on hope that is the worst form of trading. If you lose 10 lakhs and then do my course and start seeing profits you will regret not doing my course earlier.

Fact is I do get calls from people who cry and say sorry to me and them pay after losing like 40 lakhs in trading Options. Some have even lost 2 crores. Both are my paid customer now doing well. I was so happy when they told me Thank You we are making money now.

Next we will discuss – Call Option Put Option Pricing Differences as Stock Moves Up and Down.

[ninja_form id=10]

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users