Open ZERO Brokerage FREE Share Trading Account - Buy and Sell Stocks Without Brokerage - Set GTT (Good Till Triggered) Orders on System and Forget

This broker does not charge anything for stock buying and selling. You can set GTT (Good Till Triggered) order after buying a stock - the system will sell the stock automatically at your target price even if you are not monitoring the market. Only 25k is blocked for option selling with hedge. Get a lifetime account in Sensibull.com (virtual trading app & strategy builder) fee ₹800.00+GST per month for FREE. It takes 5 minutes to open an account online. Click Here to Open Free Account with Them Today and Join 1+ Crore Investors & Traders>>My Course Testimonials Year Wise:

Year 2015 | Year 2015 Page 2 | Year 2015 Page 3 | Year 2015 & 2016 | Year 2016 | Year 2017 | Year 2018 | Year 2019 | Instant Reaction Testimonial | Difference Between Othe Courses And Mine | Most Emotional Testimonial | Year 2020 | Year 2021 | Year 2022 | Year 2023 & 2024

This is a copy of my email sent to my subscribers on 04-Sep-2023. You can also sign to receive such emails directly in your inbox.

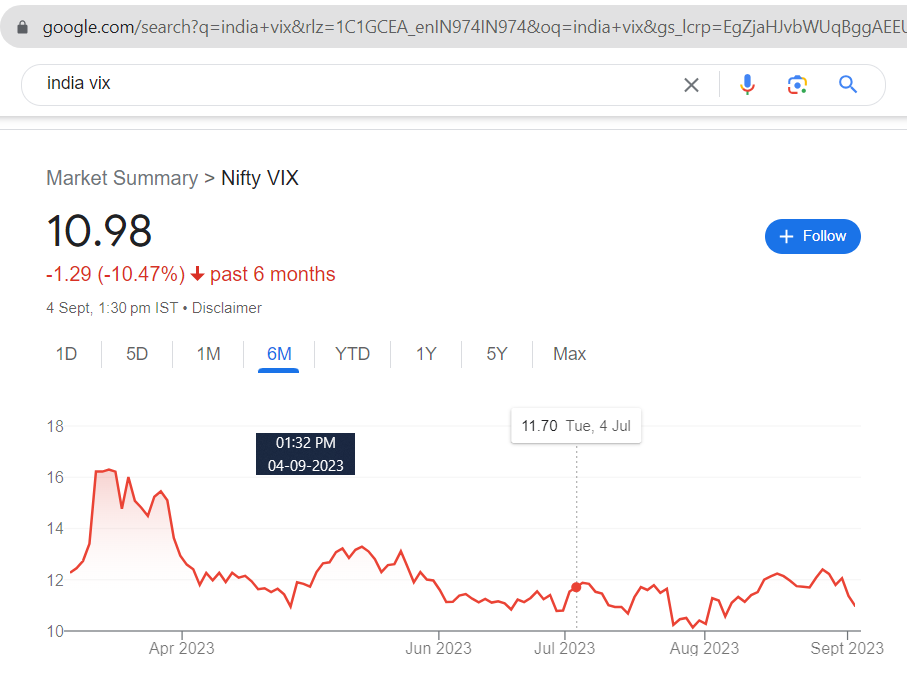

Low India VIX is creating a problem. The markets are in a strange situation neither is it volatile nor India VIX is getting on the higher side.

After so many years traders have seen this prolonged low India VIX for so many days. From April 2023, India VIX is below 15 making a tough call for option buyers as well as sellers.

For option buyers, this is a problem as slow movement kills the premium and for sellers, this reduces the profit and they get discouraged from trading.

If it is not volatile buyers of options will most likely lose money.

If the options premiums are lower, then sellers will make money but it will not be very satisfactory.

Therefore during low India VIX, the volume of trading gets reduced.

But my teachings have always been the FIRST RULE of what Warren Buffet has said:

Never lose money in stock markets.

My addition: Even 1 Rupee profit is better than losing money.

Here are his exact words:

The first rule of an investment is don’t lose money. And the second rule of an investment is don’t forget the first rule.

Here are some more very popular quotes from legendary billionaire investor Warren Buffett:

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

Be fearful when others are greedy, and be greedy when others are fearful.

If you have not lost money in stock markets you are very lucky. But if you have lost then ask yourself – which situation was better:

1. A profit of just Rs.1/- after paying brokerages and taxes, or

2. Your current loss.

Anyone would pick a profit of Rs.1/-, but when you were trading did you ever think of proper risk management so that you do not lose too much?

If you have still not lost too much then good. Still not lost too much is less than 5 lakhs. Anything beyond this is too much. I lost 7 lakhs.

Please do not do revenge trading – you will destroy more of your wealth.

Learn to be both a conservative trader and an investor. It will help.

How long will this continue?

Some major news has to come out which has to shake the markets. Once that happens India VIX will go up. And once India VIX goes up option sellers will join the markets. Once the sellers join the markets the volume will increase.

India VIX is good for option sellers as the likelihood of the profit goes up. But greed does not allow them to sell is a different chapter altogether.

If you are an option seller you can keep selling options. Your return on investments will reduce but the success rate will increase.

Please hedge and sell options as selling options is a huge risk. By hedging you reduce the risk.

You can learn option selling with hedging in my paid course.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I am an Authorized Person (AP) of a Stock Broker. I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

Find 200+ testimonials of my course:

What Traders Say About This Course

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users