Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

Fear is your biggest enemy in trading. In this article you will learn how to convert your fear into profits.

New traders start with greed but no fear. After a few losses their greed turns into fear and either they stop trading or they reduce the trading size quite considerably.

Stock trading is a calculated risk, people who take calculated risk almost always make money – those who do not take a risk or take too much risk almost always lose money.

If you fear trading you will never trade and never make any money or take a stop loss in panic losing money. Fear is responsible for a lot of mistakes new traders make.

Fear is of three types:

These are some tips to manage fear and become a better trader

Your past trades are your best teachers. Maintaining a trading journal is very important for a trader. If you will not maintain a trading journal you will forget your past trades and will never remember why you took that trade. Maintaining a record will help you to know which trades to take and which ones to avoid. If your confidence level is high you will not have any fear in trading.

If you do not have a record you will never know the probability of a trade and you will always fear trading.

No strategy wins 100% of the times, but any strategy that makes money 80% of the times and loses a small amount is considered a good trade. Positional trades needs hedging to make sure losses are small in case there is a gap opening against the trade. So you should learn hedging. You can learn hedging in my option trading course.

Once you know that the probability of success is 80% and losses if any will be very small then you will never fear trading.

Problem with new traders is that they do not know what to trade and end up speculating. Speculating is also one of your biggest enemy in trading. 100% of speculators lose money.

If you know the probability of success in your trades then the fear will vanish automatically. Jus5t make your set ups and ignore everything else. However if you cannot assign probability of success to a trade you are gambling not trading.

Markets move up and down but you must be well prepared for any situation. Preparation gives you confidence and eliminates fear. There should be a research time, there should be a time to take trade and there should be a time limit to take profits out. If nothing is planned you will speculate lose money.

Why you are taking the trade is more important that what you are trading.

If you know that a strategy works for you the your confidence level will increase you will not fear anything. By 9.15 am you must be ready with what to trade and wait for the opportunity.

You must also know how much you’re willing to risk on each trade, what direction you want to trade – long or short and why.

You must be ready with these questions before your trades go live:

1. What will I do if the stock opens weak?

2. What will I do if it opens strong?

3. How much money you are wiling to risk if what you thought did not happen. For example you may have thought about a trade if the stock opens gap up, but actually opens gap down etc.

4. If no.3 happens will you take the trade or not?

Being greedy and keeping all eggs in one basket just because you made money in last trade is WORST MISTAKE OF TRADING.

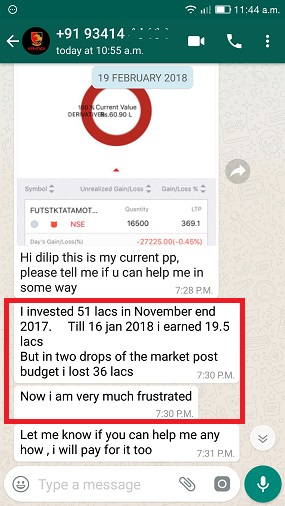

See this trader. He made Rs.19 Lakh in a few days and then lost Rs.36 Lakhs:

Rs.36 Lacs Loss after making a profit of 19.5 Lacs

So basically you win in a trade and lose control on risk management – greed takes over and you lose money.

Do Not Forget Risk Management – this will control both fear and greed.

Let me take an example. You think stock XYZ will fall and you shorted the stock with full margin in your account – after that you will tumble with fear. Even if stock moves up 1% from there you will fear and take a stop loss.

Later to find after taking the stop loss, the stock fell down as you had assumed. Had you managed your risk well, you may have waited for a reversal.

If you do the above mistakes you can do my course and learn hedging strategies to trade without fear and proper trading plan. You will learn which strikes to trade, what to sell and what to buy, when to enter and exit out of the trade. Hedge will manage your risk automatically so the trade will not bother you much as you will learn how to manage risk. The risk is just 1.5% of the margin block. Success rate is 80%. Over a long period you will make money without much stress. You can enroll for the course here.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users