Open ZERO Brokerage FREE Share Trading Account - Buy and Sell Stocks Without Brokerage - Set GTT (Good Till Triggered) Orders on System and Forget

This broker does not charge anything for stock buying and selling. You can set GTT (Good Till Triggered) order after buying a stock - the system will sell the stock automatically at your target price even if you are not monitoring the market. Only 25k is blocked for option selling with hedge. Get a lifetime account in Sensibull.com (virtual trading app & strategy builder) fee ₹800.00+GST per month for FREE. It takes 5 minutes to open an account online. Click Here to Open Free Account with Them Today and Join 1+ Crore Investors & Traders>>My Course Testimonials Year Wise:

Year 2015 | Year 2015 Page 2 | Year 2015 Page 3 | Year 2015 & 2016 | Year 2016 | Year 2017 | Year 2018 | Year 2019 | Instant Reaction Testimonial | Difference Between Othe Courses And Mine | Most Emotional Testimonial | Year 2020 | Year 2021 | Year 2022 | Year 2023 & 2024

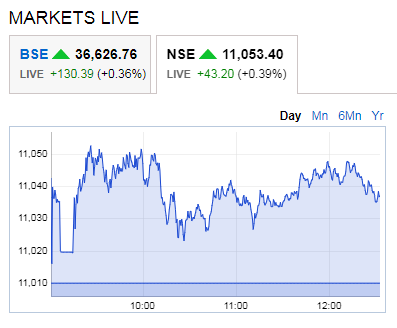

Look at BSE/NSE chart on 23-Jul-18 at around 1 pm – what trade an intraday trader would take? Buy or Sell?

Look at the ups and downs throughout the session. It’s up then down then up. I am sure even the algo-trading systems must be confused.

These choppy directionless trading days are most difficult for traders. These are not abnormal days. It happens 75% of the times. Only 25 trading days in 100 trading days have a clear direction. Rest 75 days the markets do not show any direction.

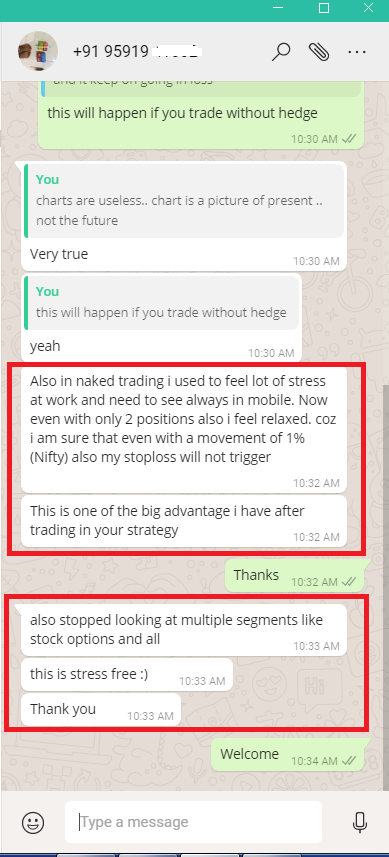

This is the reason I made a non-directional Nifty course. Our trades wins 75% of the times that too with peace of mind as they are fully hedged. You do not even have to check/monitor them continuously.

See these actual reaction of someone who did my course:

These are the things you can do on choppy direction less market days:

1. Do Not Trade:

If you cannot figure out what to trade the best way to trade is sit and relax. No one is forcing you to trade. If the direction is not clear there is a 90% chance that your trade will hit a stop loss. So it’s better to avoid trading on days when the direction is not very clear. On these days check your previous trade records and see if they teach you something.

Learning from your own mistakes or mistakes of others is the best teacher of living a good life, trading, managing money etc. So do not waste time just go and check your own bad trades especially on choppy days.

2. Do Not Do Revenge Trading:

If you lost money on your last trade on a trending day it does not mean you should take a revenge trade on a non-trending choppy day. Remember your current trade has nothing to do with your past trades. Only you know your losses – Nifty or any other stock does not. So no revenge trading on a choppy day. Be ready to lose more.

One of the biggest causes of failure for new traders is not being able to maintain a positive results with their trading. Most traders make one month profitable then the next month loss exceeds the profits made in last month.

Consistency is very important in trading results. Even if you win 50% of the times, you can change your risk-reward ratio to make sure you win more than you lose and you maintain a consistency. If you do not maintain a consistency you will be in huge problem/debt one day.

You must be able to be profitable over a longer period of time only then you can try to be a full time trader.

3. Do Not Jump Stocks:

On a choppy day it is seen that most traders will jump from one stock to another seeing no movement. This is basically entering into a trade, then taking a stop loss, then entering into another trade, then taking a stop loss, then entering into another trade, then taking a stop loss. Do not forget that by closing and opening another trade you are paying brokerages, taxes etc. Jumping stocks trying to find a good stock to trade will take you nowhere.

If you do not have a proper trading plan or no good strategy, you will jump from one plan to another.

It is very easy to deviate from your strategy in choppy markets (like the overall market has been the past few months). Do not deviate from your strategy unless you get your profit or your stop loss is hit.

4. Do Not Do Adjustments if Not in Plan:

Most traders gets emotional when seeing a loss and adjust their trades which is not according to the original plan. Adjustments without proper plan will lead to more losses.

5. Do Not Take A Trade If You Are Not Sure Yourself:

If you have any doubt whether a trade is worth taking or not, just imagine telling your mom the setup of the trade. If you feel she will get confused do not trade.

In choppy markets traders overthink. Do not overthink or over complicate your trading.

An uptrend is an obvious series of higher highs and higher lows. A downtrend is the opposite. If you cannot tell whether a stock is in uptrend or downtrend – you will almost certainly get chopped up if you trade it.

6. Be Patient and Wait for Trend to Come:

You never know when a good trading opportunity will appear. No one can control trading opportunities. Therefore it’s good to be patient and wait for the right time to trade.

I can understand that staying away from markets is tough so on these days you can study your own trades and research on trading styles.

If you follow the above rules the choppy market days will not take your money away.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I am an Authorized Person (AP) of a Stock Broker. I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

Find 200+ testimonials of my course:

What Traders Say About This Course

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users