Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

A lot of you might know the Iron Condor trade. However if you do exactly the opposite it becomes a Reverse Iron Condor trade.

Reverse Iron Condor is a slightly risky trade with limited profits and limited loss for the trader. This trade cannot be traded every time as the chances of this trade not making any money is more than the chances of this trade making money. Why? Because time is enemy of the this trade. If what the trade wants does not happen fast, the trade will lose money. We will shortly know why.

If you trade Reverse Iron Condor 5 times, most likely you will win 1 time out of 5. So the success rate is almost 20%. Therefore timing this trade is very important. We will discuss best time to trade Reverse Iron Condor and a lot more.

Reverse Iron Condor Explained:

Reverse Iron Condor as the name suggests is nothing but an Iron Condor traded reversed. An iron condor trade is nothing but doing a short strangle combined with long strangle. The reverse iron condor is also doing a short strangle combined with long strangle. The difference is that in an Iron Condor trade, the trader sells the strangle that is more costly and buys the one that is cheaper (essentially done to save the unlimited loss), but in the Reverse Iron Condor trade the trader buys a more costly strangle near to the money and sells a further away and cheaper strangle. This is primarily to save money buying the costlier option.

If you did not understand it is OK, we will discuss further. We will also discuss how to be successful trading the Reverse Iron Condor.

How To Trade Reverse Iron Condor:

1. Buy near the money Call options,

2. Buy near the money Put options,

3. Sell far out of the money Call options, and

4. Sell far out of the money Put options.

Note that for a perfect Reverse Iron Condor all strikes should have the same lot size and done on the same expiry and on the same stock.

When Should You Trade Reverse Iron Condor?

This is very important so please read twice: You should trade this when you expect volatility to increase or you expect one sided movement (any side) for some time due to any reason like an upcoming news or any other event on a stock or Nifty. Note that the increase in volatility does help a reverse iron condor, and a drop may hurt – but its the movement any direction that makes it profitable. An increase in volatility will also negatively effect the short options, so overall it decreases the profits. Moreover reverse iron condor is not played with at the money (ATM) strikes where the volatility increase has huge impact. Movement is what is really required to make this trade profitable.

Lets make this thing very clear – when you expect a huge movement near term in any stock or index either side you should trade reverse iron condor. Aggressive traders like to trade long strangle – a long strangle is nothing but a reverse iron condor minus the short strangle. Prime reason is to benefit fully from the movement (and make a lot more money if right). However when it does not happen a lot of money is also lost. Reverse iron condor is created to limit the losses of a long strangle. Since the losses are already limited taking the stop loss is optional. Another benefit of this trade is we will know exactly where to take profits out. That we discuss later.

Lets us Trade a Reverse Iron Condor Now:

Nifty on June 12, 2015 closed at 7983. Now taking 8000 as ATM (at the money) I will try to trade a Reverse Iron Condor.

Remember that Reverse Iron Condor should be traded closer to the money because we need movement here. Deep out of the money options will not move significantly with the move in Nifty, therefore they are not good candidate of the reverse iron condor (they are good candidate of iron condor though). Still if the movement does not come the trade will lose money.

So we trade the following:

1. Buy 8200 CE @ 23

2. Buy 7800 PE @ 36

3. Sell 8400 CE @ 6 and

4. Sell 7600 PE @ 11.

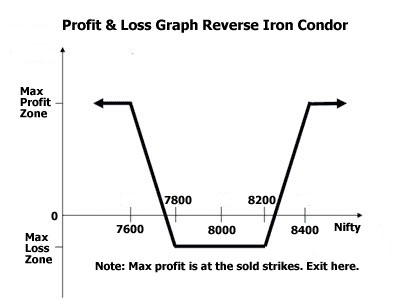

See the image below to understand the profit and loss of the reverse iron condor:

An important point here: Don’t think that just if Nifty hits any of the short strike the trade will be in profit. That may not be the case. If Nifty goes up the Call buy and Put sold makes money, but the Call sold and the Put bought will lose money. So there is no guarantee that if any short strike is struck, the trade makes money. And yes volatility also plays some role here if not a major one. If it drops there will not be any significant profit in the option bought and the whole trade can be in loss. However if the sold strikes are struck – in our case the 8400 CE or 7600 PE, the the trade can bring substantial profits.

For 8400 and the 7600 to be hit every time the chances are low, therefore its much better to trade Iron Condor than a reverse iron condor.

Now lets calculate our max loss in the trade.

23+36-6-11 = 42 points

And lets calculate the maximum profit this trade can make:

To make the maximum profit on expiry Nifty has to be above 8400 or below 7600.

If it is at 8400 on expiry day:

8200 CE will be 200: Profit: 200-23 = 177

8400 CE expires worthless: Loss: -6

7800 and 7600 both the puts expires worthless: Loss 36-11 = -25 points.

Total profit in the trade: 177-6-25 = 146 points.

The risk reward is great in the trade: 42:146. You either lose 42 points or you make anywhere between 0 to 146 points.

Read the previous line again – You either lose 42 points or you make anywhere between 0 to 146 points.

Some traders think that risk reward ratio of 42:146 means either they lose 42 points or make 146 points. This is wrong. To make the max Nifty has to be above 8400 or below 7800.

As an example if Nifty is at 8300 see what happens:

8200 CE will be 100: Profit: 100-23 = 77

8400 CE expires worthless: Loss: 6

7800 and 7600 both the puts expires worthless: Loss 36-11 = -25 points.

Total profit: 77-6-25 = 46 points.

I hope you understand how this trade makes profits or losses. It depends on where Nifty is on the expiry day.

The trade looks great right? Yes, but the same issue of option buyers will haunt you in this trade as well.

1. No movement for a long time – the option will lose premium.

2. Volatility decreasing – again the options lose premium. If volatility decreases significantly, even if a movement comes the trade will be in loss and then you will wonder why such a thing is happening.

So When does it Work Best?

Trade the reverse iron condor when you expect a major news is coming in a few days. The volatility will increase – people will either sell or buy stocks creating a movement. Both works in your favor. Just before the news is out you should also close your trade and take profits out.

Where to Book Profits?

The trade can make max profit at 8400 or above or 7800 or below. So why wait for further increase or decrease if these levels have been reached? After that you will not make any profit anyway so you should exit when these levels are breached.

Where to Book Loss?

Unfortunately there is no definite answer. You can wait till expiry and lose all points if you are comfortable with the max loss or you can take stop loss when you reach a point where you are not comfortable with more loss, or when only a few days are left for expiry and there is no news to come before expiry. Nifty will not move dramatically so you should exit.

Whatever be your stop loss strategy you should stick with it for all trades you take in life.

Whats the max loss where you should be comfortable? This depends from person to person. But for me I am not comfortable if the max loss is 30 points or more.

Points to Remember Before You Trade Reverse Iron Condor

Never trade this if you are not comfortable with the max loss. If you still want to go ahead and trade you can stick to a max loss. If there is no movement in few days just get out of trade.

In fact most professional traders take this trade for 10 days before any news is expected. If they make a considerable profit, they exit but they stick to the 10 day or before exit rule. Which means they exit if the stop loss is hit or exit when the trade hits its 10th day. Whichever comes first.

I hope this article will help those traders who love to buy both call and put option (long strangle or long straddle), and think that every time Nifty moves they will be in profit. When it does not happen they scratch their heads thinking why they did not make a profit.

Buying long straddle or strangle makes profits rarely, else we all can trade long strangle or straddle and make a lot of money. 🙂 However reverse iron condor is a better trade than long strangle because it limits the losses.

Have you ever traded this strategy? If yes please share your experiences or ask any question on reverse iron condor. I will be happy to answer.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Comments on this entry are closed.

When trading the reverse condor how do we know that the volatility is going to be high ant any time, and if volatility goes high on any day the next day it can be low. Am I correct?

The only way to guess about VIX is to read News. If any major news is coming you can expect the VIX to increase from about 10 days till the day news is out. And then the VIX should decrease. It’s a simple thing. When any news is coming, people do a lot of speculations resulting in too many trades and the VIX increase. When the news is out, normal trading resumes. VIX comes back to normal. Hope this helps.

good article

Thanks You Sir. I know you are a big Technical Analyst. 🙂

Good, sir ji