Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

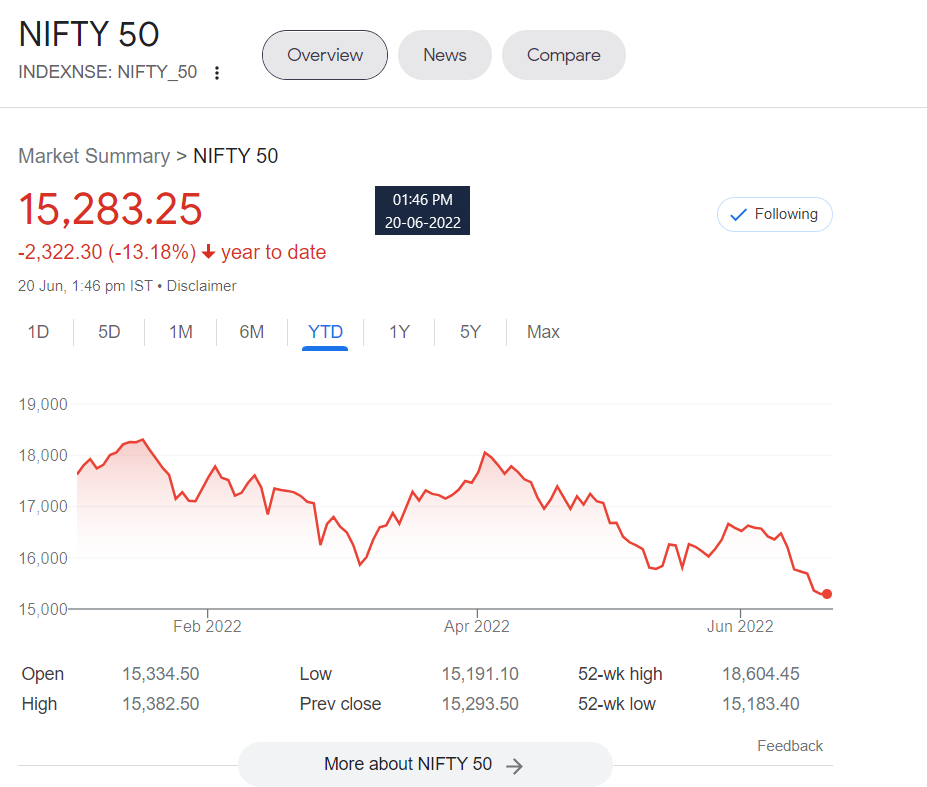

As I am writing this on Monday, June 20, 2022, Sensex and Nifty are at the lowest level this year 2022. Not sure that it will go down further, but one thing is for sure it will move up someday, it’s just a matter of time. Here is the Nifty live chart at 1.46 pm on 20-Jun-2022 – Source: Google:

From 18,000 levels down to 15,300 levels. That’s a decline of 13.18% this year. Is this good? No, it isn’t good for short-term equity investors, but it’s just another day for long-term equity investors – this kind of volatility they have seen many times.

From 18,000 levels down to 15,300 levels. That’s a decline of 13.18% this year. Is this good? No, it isn’t good for short-term equity investors, but it’s just another day for long-term equity investors – this kind of volatility they have seen many times.

This cannot be classified as a stock market crash – it is just a mini-crash. This is not the first mini-crash. Indian investors have witnessed much deeper and strong crashes before.

Here is the Indian Stock Market Crash List:

Crash of 1982 – short-selling shares – primarily of Reliance. Stocks around 110,0000 was short sold. The value of shares decreased significantly. The BSE was shut down for three consecutive days.

Crash of 1992 – On 28 April 1992, the BSE experienced a fall of 12.77% – due to the Harshad Mehta scam.

Crash of 2004 – UPA 1 election crash. On 17 May 2004, the BSE fell 15.52% – its largest fall in history (in terms of percentage).

Crash of 2006 – On 18 May 2006, the BSE Sensex fell by 826 points to 11,391.

Crashes of 2007 & 2008 – The Great Recession a.k.a The Financial Crisis of 2007-2008 – on 21 Jan 2008, the BSE fell by 1,408 points to 17,605 leading to one of the largest erosions in investor wealth.

Crash of 2009 – On 6 July 2009, the Sensex fell by 869 points to 14,043.

Crash 2015 – On 24 August 2015, the BSE Sensex crashed by 1,624 points and the NSE fell by 490 points.

Crash of 2016 – The stock markets in India continued to fall in 2016. By 16 February 2016, the BSE had seen a fall of 26% over the past eleven months.

Crash of 2018 – BSE and NSE fell sharply on 2 and 5 February 2018, sparked by the comments of the Finance minister’s proposal in the budget speech to introduce a 10% long-term capital gains tax (LTCG) on equity shares sold after 12 months.

Crash of 2020 – On 1 February 2020, as the FY 2020-21 Union budget was presented in the lower house of the Indian parliament, the Nifty fell by over 3% (373.95 points) while Sensex fell by more than 2% (987.96 points). The fall was also weighed by the global breakdown amid the coronavirus pandemic centred in China.

Source: https://en.wikipedia.org/wiki/Stock_market_crashes_in_India

But if you look at one year chart of Nifty (from Jun 21 to Jun 22), you will see that it’s not fallen too much from June 2021 to June 2022:

So is there any reason to panic? No. Why? Because this too shall pass. Experts will keep saying in every crash that – this time it’s different. But they have been proven wrong every time.

So is there any reason to panic? No. Why? Because this too shall pass. Experts will keep saying in every crash that – this time it’s different. But they have been proven wrong every time.

Here is 15 and 20 years return of Nifty as of June 2022:

Even when a crash of 2022 is going on Nifty has given a CAGR (Compound Annual Growth Rate) of 11% and 15% in the last 15 and 20 years respectively. Please remember the crashes written above. In spite of these crashes, the returns are well above 10% for investors who have stuck with their investments with patience.

Even when a crash of 2022 is going on Nifty has given a CAGR (Compound Annual Growth Rate) of 11% and 15% in the last 15 and 20 years respectively. Please remember the crashes written above. In spite of these crashes, the returns are well above 10% for investors who have stuck with their investments with patience.

So my advice is – just keep calm during a crash. Do not take panic decisions and exit when you see a small loss. This is normal in stock market investing. You can hold the stock till you get a reasonable profit and exit.

How to Profit in a Stock Market Crash?

Do you remember the most popular advice from none other that the greatest investor in the world – Warren Buffett (CEO of Berkshire Hathaway)?

Side note: Warren Edward Buffett is an American business magnate, investor, and philanthropist. He is currently the chairman and CEO of Berkshire Hathaway. He is one of the most successful investors in the world and has a net worth of over $113 billion as of June 2022, making him the world’s fifth-wealthiest person. Source: Wikipedia

Warren Buffett once said that it is wise for investors to – “be fearful when others are greedy, and greedy when others are fearful.“

There is another saying credited to Baron Rothschild – “the time to buy is when there’s blood in the streets.” He was an 18th-century British nobleman and member of the Rothschild banking family.

I am sure you must have read it somewhere probably when you were in school/college. But did you ever do that? If not the best time is NOW – not tomorrow.

So how can you profit in a stock market crash? Just hunt for great fundamentally strong companies going for a bargain. Try to buy stock of companies that are at least 20% down from their recent high. These companies will be the first choice of HNI and retail traders when whatever situation that brought the crash gets over. These stocks will soar like there is no tomorrow – but you cannot pinpoint the exact time. It’s better to buy them now.

Suggested read: I have written an article on lessons from Warren Buffett’s letter to shareholders. This will give you some idea on how to choose good stocks at a bargain and for the long term.

Patience is the Key

After you buy you may see the stock going down further. You must show patience during these times. If you have the money and if the fundamentals of the company haven’t changed you can buy more and average out the investment in the stock to bring the buy level lower. But make sure to average out a minimum 10% lower than the previous buy price otherwise the averaging out will be useless. And just buy the same number of stocks or 50% less than what you bought the first time. Anything above this can be risky. Do not average out the third time. You have only one option wait for the crash to get over. Once the crash is over the stock will surge.

When to Book Profits?

10% is a good return or if you think the stock is good and you want to keep it longer, then sell 50% of the investment and keep the rest. This way some profit will be booked forever and you can exit the rest of the stocks at 20 or more % profits.

Do not go overdrive with your investments. Managing finance is more important than investments. You must invest the money in stock markets that you do not need for the next 5 years minimum.

If you need my help I have a course for this – Long Combined With Short Term Investment Ocean Wave Profit Booking Strategy Course

Here is the course content:

• List of 21 stocks that you must own for your entire life

• An explanation of why I chose these stocks – what were the criteria etc.

• A detailed explanation of how to invest in each stock

• How much to invest as per your income (optional)

• How to maintain a tab on these stocks

• An approach to investing

• How to start investing in these stocks

• The Ocean Wave Profit Booking System – (Swing Trading Explained – This is the MOST important chapter)

• And a lot more on how to increase your investments

… And in the email, I will explain how to make a monthly income by selling options against it.

The best part is – You may do the same logic in your current investments as well to increase the return from the stock – whatever the stock it doesn’t matter – you can implement the strategy.

You can read more about the course here:

Long Combined With Short Term Investment Ocean Wave Profit Booking Strategy Course

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users