Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

New traders and even the experienced ones fall for greed or show no patience and book profits early in a profitable trades but let losers ride for more losses in their trades. This leads to more losses and small profits. Ultimately their financial year ends in a loss.

I have told this many times in my blog not to speculate and trade but how many listen? Buying options as a pure speculation is gambling not trading – it will not make money. This falls under greedy trading not well planned trading.

Greed is your bigger enemy than fear in trading

Lets compare trader Greedy Trader A and Conservative Trader B.

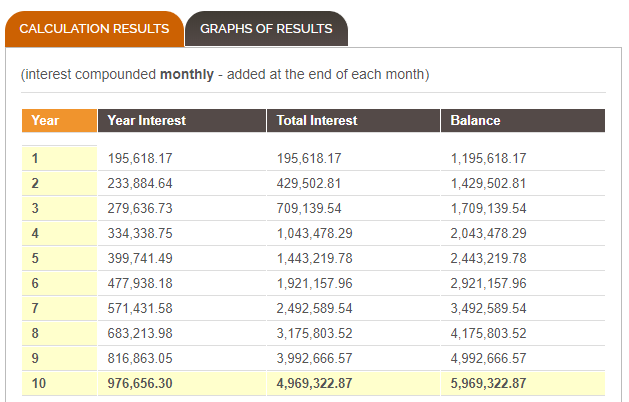

Both start with 10 lakhs and decide to meet after 10 years. Greedy Trader A keeps doing speculative trading and makes a loss of 9 lakhs in 10 years. Conservative Trader B makes just 1.5% a month and here is what he ends with – Rs.5,969,322.87 (Rs. Fifty Nine Lakhs 69 Thousand 322.87).

See this:

Rs. 10 lakh compounded For 10 years @ 1.5% return a month

Source: http://www.thecalculatorsite.com/finance/calculators/compoundinterestcalculator.php

Greedy Trader A wanted to make one crore in 10 years with 10 lakhs whereas Conservative Trader B wanted to be in profit even if it means making 1.5% a month. After 10 years who is a better trader Greedy Trader A or Conservative Trader B? The answer is obvious.

Can you see even 1.5% return a month is much better than losing money trading options, stocks or futures? You can do my conservative option course and make much better return than this.

The biggest problem with traders is they do not let the winners run in their trades. Here are some tips on How To Let The Winners Run In Stock Trading.

The Basics Of Trading

Your trading should consist of small losers and big winners. To do that you have to make sure your winners ride. Letting your winners run is very important to long-term success in trading. If you have a 50% win rate then letting the winners run is very important for you. Just taking the profit out because you fear losing out does not make sense in the long run.

Here is what you can do to let the winners ride:

Keep Three Profit Targets – Your Stop Loss Should Be Less Than Your First Profit Target

Divide your money in three equal parts. When your first target is hit, take profits out from 33% of your money in the trade and bring stop loss cost-to-cost. When your second target is hit, take out the next 33% of your money in the trade and bring stop loss to the first target. When your third target is hit, take out the last 34% of your money in the trade and start looking for next trading opportunity.

Moving Averages Are Important

Here is an article on moving averages. However moving averages is a vast topic and cannot be covered here. That said Moving Averages are a great tool to know the support and resistance of a stock of few days (for short positional trades) and even months (for longer positional trades). Use them extensively in your trades.

For example if a stock has broken its 9 EMA (exponential moving average, or EMA, is a stock chart tool investors use to watch trends in the price of a stock) either in the buy or the sell side its a great signal to trade and there is a lot of chance that the trade will be profitable.

Think About the Opposite Trader

If you are short on a stock think when the buyers may try to enter. This will help you to make the right targets 1, 2 and 3. This will allow you to stay patient with your trades. You will get a clear sign that the trend is over, and it is time to take profits.

Do Not Care For Minor Intraday Fluctuations or Mark To Market – MTM

MTM (Mark to market) creates the biggest fear in traders mindset to press the panic button and exit. Do not fear MTM if your stop loss is in place. For positional trades it is highly recommended that you hedge your postilions properly else overnight some news may come which will be bad for your trade and next morning your trade may exceed stop loss make huge losses for you. Do not let that happen and learn to hedge your positional trades. This is very important.

HNIs never take naked positions. They invest millions of dollars and make sure they hedge their positions so that they don’t lose millions in a single day or trade. They never do and almost always make money. Trade like HNIs even if you are a small trader.

If you are a small option trader and losing money trading options you can do my course to make a small 2-3% average per month, monthly income. You will learn some good well researched hedging methods not many retail traders follow.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users