Open ZERO Brokerage FREE Share Trading Account - Buy and Sell Stocks Without Brokerage - Set GTT (Good Till Triggered) Orders on System and Forget

This broker does not charge anything for stock buying and selling. You can set GTT (Good Till Triggered) order after buying a stock - the system will sell the stock automatically at your target price even if you are not monitoring the market. Only 25k is blocked for option selling with hedge. Get a lifetime account in Sensibull.com (virtual trading app & strategy builder) fee ₹800.00+GST per month for FREE. It takes 5 minutes to open an account online. Click Here to Open Free Account with Them Today and Join 1+ Crore Investors & Traders>>My Course Testimonials Year Wise:

Year 2015 | Year 2015 Page 2 | Year 2015 Page 3 | Year 2015 & 2016 | Year 2016 | Year 2017 | Year 2018 | Year 2019 | Instant Reaction Testimonial | Difference Between Othe Courses And Mine | Most Emotional Testimonial | Year 2020 | Year 2021 | Year 2022 | Year 2023 & 2024

People who are smart traders will always keep making money irrespective of what happens to the markets.

After almost 1 year of offering the option course, I have found that some of my customers are smarter than me. I have no problems admitting that. This in fact is quite natural. Students doing better than their teachers is very normal. One reason could be my conservative nature that you can see in the below chat as well. 🙂 After suffering huge losses initially I do not want to take any more chances.

Some of the smart traders do my course and end up making more than 3% per trade (not per month) especially from the directional strategy. These trades can last for about a week or so. If done correctly imagine the kind of returns it can make. I feel very happy when a smart trader emails me their success. 🙂

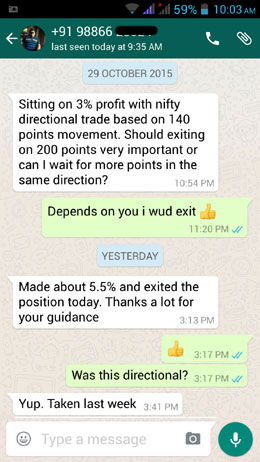

Look at the WhastApp message I got from a client who did my course early October, 2015:

When asked about the trade, this is what he said in his email:

Hello Dilip,

After a long time, I had a profitable trade with low pressure on my mind, took trade as per the directional strategy from your course.

I had taken similar position couple of months back but had lost money. What I learned was when the expiry is near; it may not make sense to take the position as it had lead to losses.

The above was the precursor for taking the current position, taken on 20th October, details as under:

* Bought one lot of November Nifty Future @8,317.

* Rest of the Details of the Trade Edited as this will go in public domain and is part of my course *I squared off my positions today (i.e. on 30th of October):

* Nifty future: 8083 – 8317 = -234 points; loss of Rs.17,550/-

* Rest of the Details of the Trade Edited as this will go in public domain and is part of my course – however he made profit here in options, beating the losses in Futures * 🙂Summing up both credits, the overall profit from this trade is Rs.3,375/-. 60000 INR was blocked by the broker for this trade. I made a neat profit of 5.6%.

This was probably one of the best trades in the whole of my 4 years of trading career. Very low pressure about potential loss and made decent profits.

Thank you for the course and the constant guidance and support.

Wish you good luck!

Regards,

Krishna

Trading Without Stress is Important to be a Smart Trader

You know what makes me more happy in the above email? This sentence – “This was probably one of the best trades in the whole of my 4 years of trading career. Very low pressure about potential loss and made decent profits.”

Read that again – very low pressure about potential loss. This is extremely important. If you are trading and stressed about the trades what do you think will be the outcome? Obviously a stressed result: losses or minuscule profits which you know very well that, it will go away the next trade.

I get many success messages in my WhatsApp/email. Some call me to thank. Most I do not share with you but this one is different. Why? Because this trader DID NOT copy my directional trade. He is a smart trader – he changed the option strikes as per the VIX and other parameters and made a good profit.

Smart Traders Think About Losses First, Then The Profits

In trading business one who is trading smartly is the one who will make money – and smart traders DO NOT speculate. The first thing that’s there in their mind is “what if this trade turns into losses?”

Agreed this is a very negative way of thinking but this is what works in this business.

Smart Traders Hedge

Obviously when you start worrying about the losses you will hedge your trades and not leave it naked, just because you think the losses will not happen. Well the stock will not move in that direction because you think so. It will move in that direction because most people think so and there in no way to find what most people think. Stocks don’t have emotions – so if they have to fall 25% in one day they will – and you cannot blame them if you need to sell your house to pay the losses. The stock will in fact ask you back – why you did not hedge when you had options? You will not have any reply.

This does not mean you should never trade them – it only means what have you done to protect your losses? Lets look at my Axis bank trade. The call was given when it was 484 – in couple of days it went to 468-470 and now today back to 482. A naked Future buyer may had taken a stop loss only to see the stock bounce back. But my customers are still in the trade because their money is protected. They will take out profits when it comes – that’s the beauty of hedging.

On top of that if you can take my strategy and use it in a better way then you can make even better returns. Some hard work on your part is required.

I can show you the direction – the strategy – but the path has to be traveled by you. So start thinking differently – start using your brains to get a better return.

Smart Traders Think Differently

My simple advice if you have taken my course is to start using your brains now. After 2-3 months of practicing you must start thinking differently on how to make it better and snatch a better return.

Smart traders like Mr. Krishna and Mr. Inder do not copy paste the strategies especially the directional – but think before trading. The results are for you to see.

Do not just copy the strike prices given in the course but change them according to the risk in the trade, option premiums and your view with respect to that particular trade. Practice it with one lot and see how it works. Next time when you trade, change the strike price according to your view and see if you can get a better return.

Smart Traders Experiment, But Know That If It Doesn’t Work They Can Always Go Back to What Worked

In the worst case scenario if it’s not working as per your wishes, then of course you can come back to the original strikes. Nothing is lost as you traded with one lot or you can always paper trade.

Smart Traders Paper Trade A Lot

Do you know you can do thousands of paper trade in a year? No power on this earth can stop you from paper trading. And you don’t pay a dime to your broker for that neither you need any cash to trade thousands of lots on paper. 🙂

BTW when I used to research on paper (I still do), I always traded with 1000 shares (not lots shares) irrespective of the stock – so that profits or losses can be multiplied by 1000 and I get a significant number to see. If you lose only Rs. 100 in a trade on paper you will feel that that the strategy is good except it needs a small change. Fact is if you trade with 1000 shares you get a different figure and of course the way you think after the result will be different.

Smart traders will almost always come out winner. See even if they make 2% per trade and if this comes in 10 days – we are talking about 6% or more return a month.

Let me be very frank – the results will differ from trader to trader, but mostly people who use their brains and not copy paste the strategies are the ones who will almost always make more. You have to know what works best for you – that’s the ultimate in option trading research.

Smart Traders Do Not Listen To What Others Say

For example if you are comfortable in Future trading then do not stop trading Futures just because someone told you that something else works better. Try the best possible hedges on that and see how you can manage them. This advice is applicable to everyone irrespective of whether you have taken my course or not.

Let me talk about the non-directional strategy. This is for people who have done my course. Have you ever tried to make more from the non directional? I mean changing the strike prices according to VIX or pending news etc. Have you ever tried that?

You see we are totally hedged. When the losses are limited why not try to make more while still making sure that the trades are fully hedged.

Do not change the essentials but you can always experiment to see what works best for you.

And of course send me testimonials. 🙂 The happiness I get by seeing you succeed is unparalleled.

Just one testimonial and I got motivated to write a 1500+ word article. Keep them coming – makes me very happy.

This was a comment by Mr. Sunando – one of my blog’s avid readers. It was so relevant I shifted it to main article – because few people read comments:

Its necessary to be smart as a trader to acquire the winning trades having mostly the institutions as main opponents. We can’t move the market a single paise with our money and buy sells. We can just follow the market, and being smart is the main thing to get emerged as a winner.

Some of us learn this fast some delayed and some never.

Whatever written by you above including hedging, adopting a simple plan with no deviation (holy grail never exists) and executing the same with consistent consistency is all.

A clear mind with simple calculation skill can make trades a success. We are here not to donate money to the market , rather acquire.

Golden two rules says :

1) Don’t loose money

2) Don’t forget rule number 1.

So hedge and win. Calculate the return in % – control your mind and be happy beating the bank rate in double/triple, cumulate the capital year after year.

Finally I end with a quote by Michael Marcus (sent on my WhatsApp by Mr. Kirank another avid reader of my blog):

“The best trades are the one which are in synchronization of three aspects which are Fundamentals, Technicals and Market tone.”

Thanks.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I am an Authorized Person (AP) of a Stock Broker. I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

Find 200+ testimonials of my course:

What Traders Say About This Course

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Nice post Dilipji.

** This portion was so relevant I shifted to main article **

Thanks Dilipji for your wonderful site and posts , I am not your paid member but I like your writings a lot.

Thanks Mr. Sunando. Your comment was very relevant so I had to edit that portion and shift it to main article.

Thanks again for the valuable comments.

Dilip ji,

Namasthe.

Learning points from this post :

Smart Traders Think About Losses First, Then The Profits

Agreed this is a very negative way of thinking but this is what works in this business.

ThanQ.

M S Rao

Yes you must learn to protect your losses first. Thanks.