Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

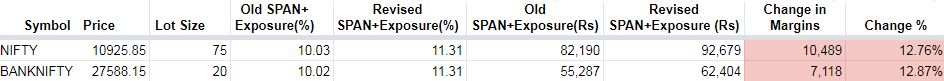

Here is the new change in future and option selling margin from 21-January-2019:

Here are the official circulars:

NSE: https://www1.nseindia.com/content/circulars/CMPT39766.pdf

There will not be any change in margin for option buyers. However if you are future trader or option seller – this might effect you. Mainly profits will reduce in terms of percentage on the margin blocked if you trade future or sell options.

Well there are a few things that you can do while trading options as a seller or trading futures:

- Try to scalp your trades: Scalping is an art where an trader calculates every expense in a trade like brokerage, taxes (STT), GST and of course short term tax and knows how much points he needs to make a profit after paying all the taxes. This is where he exits the position. For example let say in a trade 2 points are required for brokerage and taxes, he will try to exit in 5 points. This means he can take multiple trades in a day and come out good. Of course scalping is hard to do in positional trading. But its not that difficult. Its just that we target more profits and come out successful most of the times. My nifty and bank nifty courses teach exactly that. Strike selection, when to enter a trade, when to exit, how to hedge, adjustments if any required or hold without adjusting etc, everything is explained well.

- Trade with less number of lots: of course this is natural, if more money is blocked as margin then you cannot trade with the same number of lots as you traded a before Jan 21, 2019. Do not force yourself to trade with more lots by taking a loan or asking money from your parents or friends.

- Take less trades: Earlier you were able to take 3-4 trades in different stocks or index now you cannot do that. So reduce the number of trades you take at one time. When you have no other choice you have to trade less.

- Practice Intraday Trading: Less margin is required in intraday trading so try to trade intraday if possible. Of course if you have a job it gets difficult to trade Intraday, but whenever you can trade Intraday or just trade positional when you are more confident.

- Learn Hedging: In USA margin is blocked on the maximum loss in a hedged trade not more. India tends to copy US markets rules and regulations, so you never know when the same rules will be applied in India. Knowledge oh hedging will help you when such a rule is applied in India too. To give you an idea less than 25% of the margin blocked as on today (14-Feb-2019) will be done if the “maximum loss in a hedged trade” is blocked as margin. This will increase the volumes and of course you will get the first mover advantage of already knowing hedging the trades. You will learn hedging in my course.

The idea is not to get frustrated and force yourself to trade. Not take a loan or do anything drastic that will destroy your wealth. It is always better to make less in stock markets than lose money in trading.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users