Open ZERO Brokerage FREE Share Trading Account - Buy and Sell Stocks Without Brokerage - Set GTT (Good Till Triggered) Orders on System and Forget

This broker does not charge anything for stock buying and selling. You can set GTT (Good Till Triggered) order after buying a stock - the system will sell the stock automatically at your target price even if you are not monitoring the market. Only 25k is blocked for option selling with hedge. Get a lifetime account in Sensibull.com (virtual trading app & strategy builder) fee ₹800.00+GST per month for FREE. It takes 5 minutes to open an account online. Click Here to Open Free Account with Them Today and Join 1+ Crore Investors & Traders>>My Course Testimonials Year Wise:

Year 2015 | Year 2015 Page 2 | Year 2015 Page 3 | Year 2015 & 2016 | Year 2016 | Year 2017 | Year 2018 | Year 2019 | Instant Reaction Testimonial | Difference Between Othe Courses And Mine | Most Emotional Testimonial | Year 2020 | Year 2021 | Year 2022 | Year 2023 & 2024

When a trader begins option trading they are bugged by payoff charts and diagrams. They try to know everything possible under the sun and try to make money. This is mainly with highly educated option traders.

By educated I mean traders just passed out from colleges who have access to smart phones etc. No there is nothing wrong in reading about options or futures or payoff graphs, Greeks etc., but having a wrong assumption about it is wrong.

What is a Payoff Diagram?

A Payoff diagram is a graphical representation of the potential outcomes of a option strategy. What can be the profit or loss and sometimes the success percentage of the strategy. It gives a visual representation of the possible outcome of a strategy if played at that time on a stock or indices.

A lot of Option traders rely on these payoff diagrams to plan their trades. It also helps them to evaluate how a strategy may perform over a range of prices, thereby gaining an understanding of potential outcomes.

But is a payoff diagram really helpful? I will discuss in this article.

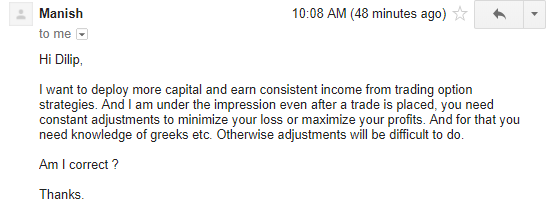

Here is an email I got from one of site visitors:

The Email:

Hi Dilip,

I want to deploy more capital and earn consistent income from trading option strategies. And I am under the impression even after a trade is placed, you need constant adjustments to minimize your loss or maximize your profits. And for that you need knowledge of Greeks etc. Otherwise adjustments will be difficult to do.

Am I correct ?

Thanks.

Read this article to see how by just investing Rs.10,000 could have made any of your senior relative, one of the richest man in India. I am sure at that time the payoff graphs for investing in ITC and WIPRO might be same as investing in any other company – one straight line – which is same as buying any stock. But payoff worked wonders for these two stocks only – for the rest payoff charts and diagrams failed.

I know you must be thinking that payoff does not work for investing – it’s for options trading only. You are right but I am trying to give you some logic.

Here is the payoff diagram of the most dangerous trades done intraday/positional everyday by day & positional traders – the ATM Call or Put option buy according to their views:

The Long Option Payoff Diagram/Chart:

The chart says: Limited Loss Unlimited Profit

But what is the FACT? This happens rarely – 80% options expire worthless.

But still a lot people rely on payoff graphs and take a trade. The result is known to them only after the trade is over.

Please remember – once the trade is over the stock takes over. Its now in the hands of the trader to take a profit or loss anywhere he likes. Now a payoff diagram is a trash/worthless.

Let me take another example. Make a payoff diagram or chart for Nifty Future buy and sell.

Both will be same but one payoff diagram will fail.

Don’t go for things that will confuse you. Blindly following anything is a mistake in stock trading.

Does Adjustments Work?

Fact is traders who keep adjusting their trades according to payoff charts or diagrams or any of the Greeks are bound to fail and make their brokers rich.

When automated trading has failed badly in the US how on Earth adjustments manually will work?

Read these articles to see how Automated adjustment trading has destroyed wealth:

The 7 worst automation failures

High-frequency trading and the $440 m mistake

That’s $440 million gone.

I have never seen a payoff diagram ever in my life. I have never adjusted a trade. Its either profit or loss for me – but I never panic and do any adjustments to a trade as I know all my trades are properly hedged – so why bother?

Adjustments Will Cost You Brokerage

Option Greeks will change for every 50 points move in Nifty. So for every 50 points move the trade will exit one position and get into another one. This is not free. He has to pay a brokerage for that and is it really an adjustment?

By shifting the trade he either took a profit or loss in the earlier trade. In most cases its a loss.

Basically he took a loss in one trade and entered into another trade. Where is adjustment?

Adjustments Will Give You Stress

As soon as the stock moves away – the trader will check option Greeks ans the stress follows. What to do now? Adjust? Ok done. Stock moves again. Stress for the trader. What to do now? Adjust. 🙁

While the broker will bless him a lot. 🙂

Adjustment is a psychological myth for a trader. Its the most foolish trade in the world.

Adjustments Will Cost You Brokerage

Conclusion:

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I am an Authorized Person (AP) of a Stock Broker. I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

Find 200+ testimonials of my course:

What Traders Say About This Course

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

I like you