Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

Read to know why you should not try to time the stock markets as it can be very dangerous.

In this article we will know why investors and traders fail to time the stock markets and end up making losses. Therefore it is highly recommended that traders should not try to time the markets and learn non-directional trading.

Read this article to know why emotional investing and trading must be avoided. This is one of the most important reason why traders try to time the markets and fail.

Historically Investor Behavior is bad and influenced by fear and greed

There are systems to track every investments made by an individual in the stock markets and also total money invested and withdrawn.

When the stock markets were on a huge bull run from 2003 to 2007 too many investors and traders joined the stock markets to make money fast. I too was one of them. The lure of making money fast is nothing but greed which got many investors in the stock markets with a lot of money. This is poor money management.

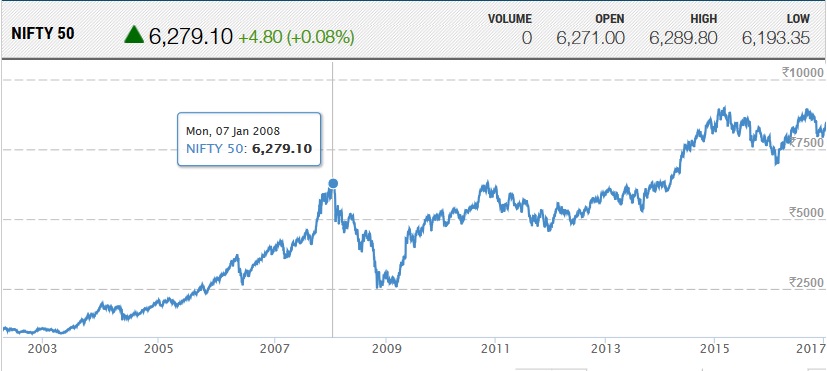

See the graph how the Indian stock markets were in big bull run from 2003 to 2008. Then from 7-Jan-2008, everything started to collapse:

This happened for almost one year till 1-Dec-2008.

Nifty 50 index went from 6279.10 to 2682.90. This is a fall of 42.75% in 11 months. This is pretty scary.

What happened from 2003 to 2008?

A lot of people must have received calls from their brokers to invest more money as this or that stock is giving huge returns. Many investors must be hearing that their friends, relatives, colleagues or associates made a lot of money from the stock markets or were in huge profits. This lured them to stock investing or derivative trading. I was into all of them and lost huge.

Lesson in Investing:

Avoid what your broker is telling or what your friends are telling and avoid tips providers. Just do your own research before investing in any stock. Educate yourself on investing and trading. This is only way you can make money in any business. Do not forget that stock investing and trading is also a business.

The above is happening still now, it is unfortunate but how can we stop people from being greedy and invest more than they should. Proper financial management is more important than investing in stock markets. Before investing your money in stock markets you should know the maximum amount of risk you can take or your financial condition is allowing you to.

That said, everyone should invest in stock markets with proper knowledge. Those who invest with knowledge are ones who make money. The speculators lose out.

It is well documented that maximum investments in stock markets and mutual funds came during the 2003 to 2008, and huge withdrawals started from mid 2008 when markets had already fallen more than 20%.

This is a clear indication that investors do not have patience to keep investing money slowly at different times and take out money gradually when the stocks are giving them profits. There is absolutely no patience. As soon as they invest in a stock they start looking at its rate form the very next day. When they initially invested it was planned for long term, then what is the point of looking at it rates from the next day onward?

Some exit the next day itself whether in profit or in loss.

IMPORTANT NOTE: It takes T+2 (Trade day + 2 trading days), time for the stock to come into your demat account if bought. Please do not sell before the stock is not there in your demat account. If you do there will be an auction and you may have to pay a penalty. This penalty differs from stock to stock and time to time.

Bad Investment Plan

At least 80% of investors invest 100% of the money they want to invest at one time and take it out whether in profit or loss at one time. This is not a good way to invest in stock markets.

Good Investment Plan

If you have chosen to buy a stock you must buy it systematically for the next six months at least, keeping the money invested the same. Note that if the stock prices falls down, you can buy more with the same amount and if it has gone high you buy less. This will average out the price and it is much better than timing the stock markets.

Media Intervention

Those who were investors or traders during 2007-2008 must be remembering that during September – October 2007 period media was talking a lot about the bull run of the stock markets since last 3-4 years, and other speculations that this will continue.

As you can see usually media talks about the stock markets bull run only when it has already reached its peak. Before mid-2007 the stock markets bull run was not there much in media, but from 2007 mid onward they kept reporting about it, luring investors to invest in stock markets at the bull run peak. This is emotional investing.

Fear starts if the stock markets starts to fall swiftly, and everybody runs to take out whatever is left, and take huge losses.

Conclusion:

- It is very difficult for an average investor or trader to time the markets. Therefore it is recommended that do not try to time the markets and expect huge returns. Invest into a stock slowly and spread it over six months at least.

- With Option and Futures traders the story is the same. Both Option & Futures buyers and sellers try to time the markets and lose heavily.

- Avoid naked buying or selling of derivatives you will burn your fingers. You must learn to hedge your trades.

- It is better you learn non-directional methods of trading with proper hedging where you need not time the markets or bother about the direction and still make money.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Comments on this entry are closed.

THANK YOU

Good article like it.

Regards