Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

Lot of new traders get confused on difference between shorting a Call Option and buying a Put. Almost all new traders buy a Put when they feel a stock will fall down instead of shorting a Call.

Note that in technical terms the objective of both trade is the same – to make money when a stock falls. The trader can either buy a Put or sell a Call, if correct both makes money, however there are some differences.

Here is the difference between shorting a call and buying a put:

On paper shorting a Call has unlimited risk and limited profit and buying a Put has limited loss but unlimited profits.

For example:

Today 11-Jan-2017, at 11.09 am, INDUSIND BANK LIMITED stock is up by 4.54%. It is quite obvious that lot of traders will be trading this stock in Equity, Options and Futures. Depending on their view they may buy or sell.

The current price of INDUSIND BANK LIMITED stock in NSE is Rs. 1212.50. It is quite obvious that option traders will be most active in its At The Money (ATM) Options. Proof is here, both are in the top most active option strikes in NSE website:

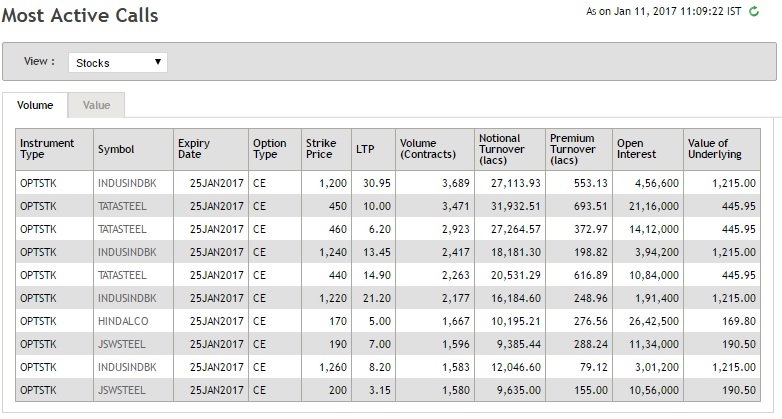

Most Active Calls as on 11-Jan-2017, 11.09 am India time:

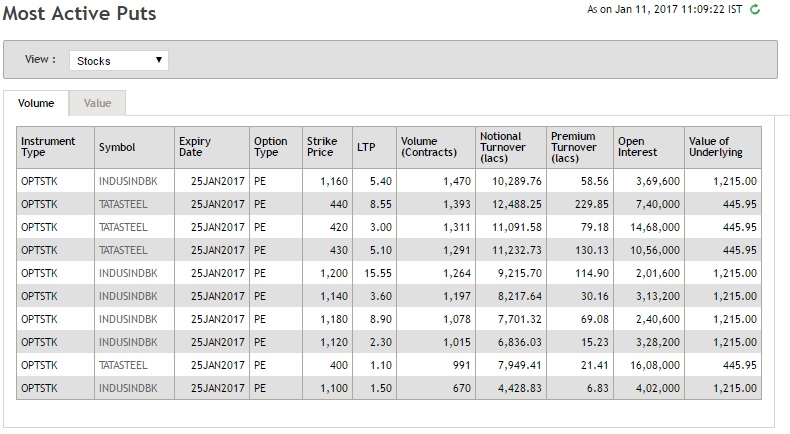

Most Active Puts as on 11-Jan-2017, 11.09 am India time:

From the above here we get the ATM option premiums:

INDUSINDBK Strike 1,200 Call Option expiring on 25-JAN-2017 LTP (Last Trading price): 30.95

INDUSINDBK Strike 1,200 Put Option expiring on 25-JAN-2017 LTP (Last Trading price): 15.55

Lot size of INDUSINDBK is 600.

Trader A feels INDUSIND BANK LIMITED stock will fall as it has already risen almost 5%. He sells or shorts INDUSINDBK Strike 1,200 ONE Call Option expiring on 25-JAN-2017 at: 30.95. His maximum profit if on the expiry day 25-JAN-2017, INDUSIND BANK LIMITED stock cash price closes at Rs.1200 or below.

30.95*600 = Rs. 18,570.00

However on paper a short seller of an option loss in unlimited. Here is the calculation:

Assuming on expiry day INDUSIND BANK LIMITED stock closes at 1250. Loss of Trader A:

(1200-1250) * 600 = Rs.-30,000.00

Assuming on expiry day INDUSIND BANK LIMITED stock closes at 1300. Loss of Trader A:

(1200-1300) * 600 = Rs. -60,000.00

It is clear the more INDUSIND BANK LIMITED stock goes up from 1200 on expiry day, the more losses Trader A will have to take.

How to limit the loss?

1. Hedge the call option sold. You can learn proper hedging strategies here.

2. Trade with a plan and exit when stop loss is hit. Most traders do this but hedging is much better way to limit losses than trading naked options especially if the trade is a positional trade.

Explaining Option Buy – On paper buying an Option has Limited risk but Unlimited Profits.

Trader B had the same view that Indusind Bank shares my fall therefore he chose to buy its ATM (At The Money) one lot Put at 15.55. They both did the trade at the same time and got the rate prevailing at that time.

Lot size of INDUSIND BANK is 600. Total money invested by Trader B is 15.55*600 = Rs. 9330.00

Trader B maximum profit is on paper is unlimited and the loss is limited to the amount he paid to buy the Put i.e. Rs. 9330.00. If on the expiry day if Indusind Bank stock closes anywhere above 1220 then this put will expire worthless and Trader B will lose 100% of the amount he paid to buy the put.

Warning: This is where most traders go wrong. Predicting direction is a very though job for any trader. At the time of initiating the trade all traders feel that their view is right and they dream of making a lot of money within a few minutes, but they end up losing their money when the trade goes wrong. Stock markets can humble even highly educated and well experienced traders, but you have to learn something from your losses. Trading losses are your biggest stock market teachers. It is unfortunate that even after huge losses traders only buy Options looking to make that gold run one day, which never comes ever. After a few years of trading some option traders become bankrupts and leave trading forever. This is why you must trade with a plan, if not you will keep losing money forever.

On paper buying a put option has huge potential for profits but limited loss. Loss we have calculated earlier. Trader B maximum loss in this trade will be Rs. 9330.00.

Now let’s look at profits in the same situations almost exactly opposite of the above.

Assuming on expiry day INDUSIND BANK LIMITED stock closes at 1150. Profit of Trader B:

(1200-1150) * 600 = Rs.30,000.00

Assuming on expiry day INDUSIND BANK LIMITED stock closes at 1100. Profit of Trader B:

(1200-1100) * 600 = Rs. 60,000.00

Assuming on expiry day INDUSIND BANK LIMITED stock closes at 1100. Profit of Trader B:

(1200-1100) * 600 = Rs. 60,000.00

Assuming on expiry day INDUSIND BANK LIMITED stock closes at 1000. Profit of Trader B:

(1200-1000) * 600 = Rs. 120,000.00

A stock rarely closes at ZERO, but just to calculate maximum profit of buying a put, assuming that INDUSIND BANK LIMITED stock closes at 0 on expiry day. Profits of Trader B:

(1200-0) * 600 = Rs. 720,000.00 (Maximum Profit)

Hope it is clear the more INDUSIND BANK LIMITED stock closes down from 1200 on expiry day, the more profits Trader B will make.

Short Selling and Buying Puts can be used for hedging as well:

A lot of traders use short selling of calls to hedge their stocks against a fall. This is known as covered call strategy. Basically if a trader owns a stock and he feels that the stock may fall they can sell a call option to get some money if the stock falls. You can click here to read the covered call strategy.

Some traders do a slightly different trade. Instead of selling a call, they buy a put to protect the losses if the stock they hold they feel is going to fall. To protect their profits they buy (mostly ATM) put option. Some buy OTM puts. This is known as the married put strategy. You can click here to read about the married put strategy.

Another difference between shorting a call and buying a put is the margin requirement. Since on paper shorting an option is unlimited loss brokers block a lot of margin when a trader shorts an option to keep the money to give back to market makers in case the trade losses money. In case the losses nears the blocked margin, either the trader is asked to deposit more money in their account or the trade is squared off as a risk management procedure. With most brokers this process is automated, they do not call the trader instead just close the trade as soon as 95% of blocked margin is the loss.

However since the option buyer maximum loss is the money they paid to buy the options no more money is blocked than the money required to buy the option. However with buying options risk is the limited time. Every derivative has an expiry date, therefore an option buyer has to be correct before the expiry date to make a profit else they lose all the money paid to buy the option and its given to the seller of that option.

What Should Traders Do?

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Comments on this entry are closed.

THANKS FOR SHARING YOUR KNOWLEDGE.

Thank you for your advise.

Highly helpful….Thanks for wonderful guidance..