Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

Average True Range (ATR) stop loss method is more popular among the experienced traders. In some countries like India it is also known as Day Moving Average (DMA).

Please note that MA (Moving Averages are different than ATR or DMA). Simply put, Moving Averages are calculated on the closing price of a stock on daily basis. It can go from last 5 trading days up to 200 trading days. Moving Averages are mostly used by stock traders who buy stocks for the short or medium term, not Intraday or day traders.

How Is the ATR / DMA Calculated?

The percentage of the difference between the highest point and the lowest point of daily moving averages of last few days is taken into account.

Day traders usually take last 5 days Average True Range, ATR or Day Moving Average, DMA. Some take last 14 days moving averages. Positional traders usually take last 30 days ATR or DMA.

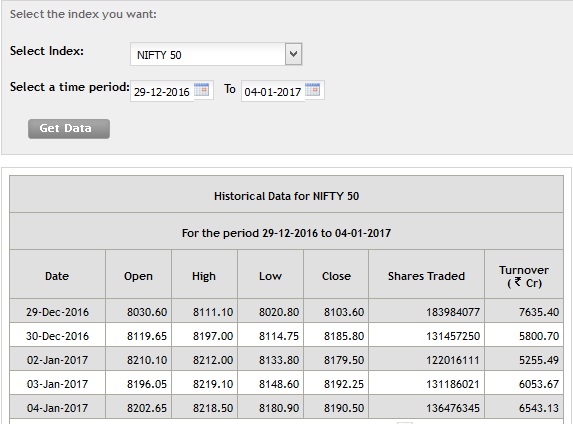

Let us take the last 5 days ATR (Average True Range) of Nifty 50. As on today, the last 5 trading days are 29, 30 Dec 2016, 2, 3 and 4 Jan 2017:

Here is the image of daily high and low of the last 5 days taken from the NSE site:

[table id=4 /]

Calculating the Day Moving:

90.30 + 82.25 + 78.20 + 70.50 + 37.60 = 358.85 / 5 = 71.77

71.77 is 0.87% of 8256.00 the current spot Nifty price.

Therefore if a day trader has bought Nifty Future to trade Intraday when Nifty spot is at 8256.00 his Stop loss will be at 8256-72 = 8184.00, and sell target, profit will be at 8256+72 = 8328.00. If at the end of the day the trade is in small profit or loss the day trader will exit as the trade was initiated for Intraday day trading and not positional trade.

To Conclude:

The three types of stop loss methods of Intraday or Day Trading:

[ninja_form id=10]

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Comments on this entry are closed.

Average ATR stop loss method was new for me, Thanks for explaining that topic Dilip sir!!

Welcome

Hi sir,

How to match 71.77 with 8256 spot nifty price.

Chandrakant I could not understand your question properly. I request you to ask again clearly or read the article agian I have explained in simple terms.