Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

One of the best ways to short stocks, nifty or banknifty is on a bad news. I am a great fan of bad news. See this chart of PNB after the news came out of the Nirav Modi scandal. The Punjab National Bank scam came to light on 14 February 2018, and since then it has been a downhill ride for the Indian Banking community especially PNB – Punjab National Bank.

See the downhill chart of PNB from the news came out:

The downhill continues for months for PNB:

It is almost certain that a stock will fall heavily when bad news hits the company. Resignation of a top manager, employee specific scandal, tax hiding getting caught (like Satyam), any illegal activity – even a small illegal activity will take the stock down by 5%.

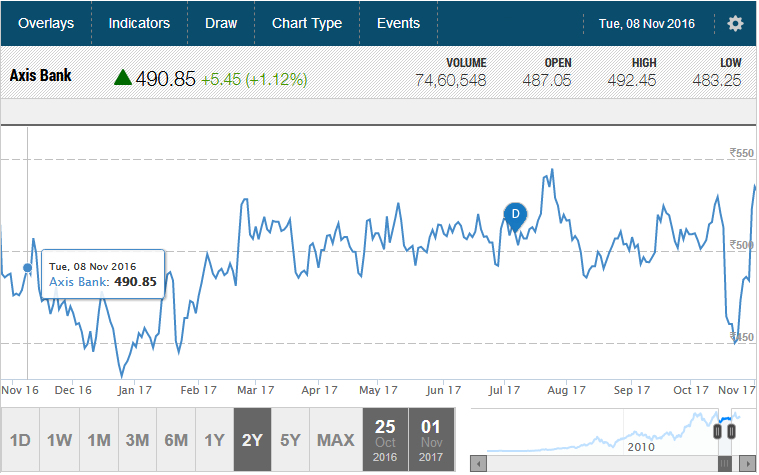

Remember the Axis Bank scandal during demonetization in 2016? See this how Axis Bank fell from 490 to 432 in about a month:

Then it started to go up slowly.

Basically when a bad news is hit it is almost certain that a stock will fall heavily. However when a good news hits, the stock may rise approx 5% only.

Why this happens?

Because fear of losing money spreads very fast and people take out their money as soon as possible without even reading the news properly. But when a good news has come in a company, people start reading the newspapers to verify the news, try to figure out the outcomes, start seeing business channels – by this time the smart investors (HIIs and DIIs) have already bought the stock in huge quantity – they know very well the late comers (retail traders like you) will join the party at the top of the hill – this is the time they start to sell.

Who loses? Retail investors.

However if you track how a stock behaves to bad news vs good news you will see that impact of bad news is much higher than the impact of good news.

The scandal of Punjab National Bank broke out on 14 February 2018, but the stock has not yet come out of the shock of the bad news till now.

So when to sell a stock?

As soon as a bad news hits the company. Read newspapers looking for bad news in any company and see if there is derivative trading allowed there. If yes do not waste time in shorting the stock. Of course this can be risky. If the management comes out with an announcement to counter allegations, then the stock may rebound within seconds of announcement. Therefore it is very important to hedge your traders to make sure that the risk is minimized.

In my Nifty and Bank Nifty course you will find strategies where you can learn hedging and also get strategies to make monthly income consistently without worrying too much about your money and the direction of the stock. Wherever the stock goes you can make a profit.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users