Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

Article Written on: Thursday, 08 June 2017

Learn how volume in stock or derivative trading can help traders set up their winning trades.

What Is Volume?

Volume is a count of total trading done at a given period of time.

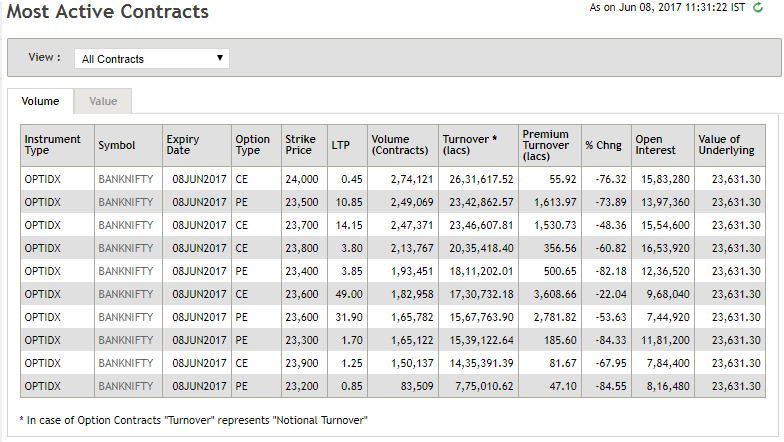

See today’s highest volume in Bank Nifty:

Source: https://www.nseindia.com/live_market/dynaContent/live_analysis/most_active_contracts.htm

You can find historical contract-wise price volume data of NSE here:

https://www1.nseindia.com/products/content/derivatives/equities/historical_fo.htm

As you can see as on June 08, 2017, 11:31:22 Indian Standard Time:

Most volume of trading can be seen in BANK NIFTY of strike 24,000 CE.

Volume: 2,74,121

Turnover in lacs: Rs. 26,31,617.52

Open Interest: 15,83,280

Value of Underlying: 23,631.30

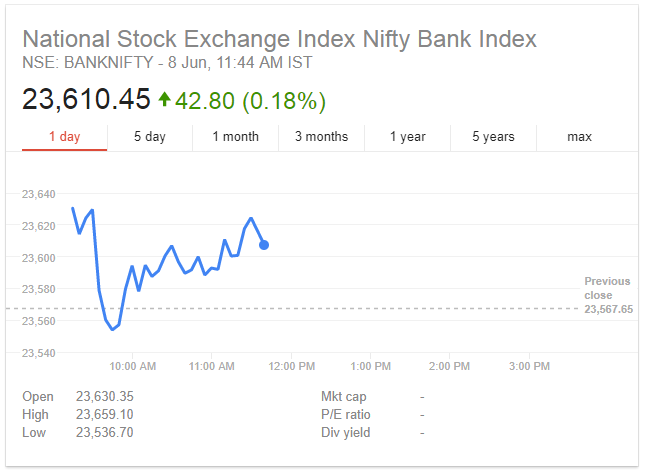

Bank Nifty at the time of writing is currently at 23,610.45:

Source: https://www.google.co.in/search?q=banknifty+share+price

Today – Thursday, 08-06-2017, is Bank Nifty weekly expiry. As you can see since strike CE 24000 is Out of The Money Call Option, a lot of traders are trying to make money here there.

Read The Reality Of Very Far OTM Out Of Money Options, to know why Out of The Money options are highly traded on expiry day.

I that article I had written – They get attracted by low premium and low risk options.

This you can see comes true in every expiry day.

Volume is overlooked because not many trades know how to utilize it.

Volume is created because for every buyer there has to be a seller, and for every seller there has to be a buyer. When in a certain stock or derivative too much volume is created, there is definitely something going on.

In stocks with high volumes the ask and bid prices are very close. In low volume stocks the ask and bid prices are far.

Especially in stock options, the out of the money options have very low volume. Sometimes are volume are so low that there are buyers but no sellers, and the trade cannot take place.

Volumes can be great indicator to trade a stock.

How To Use Volume as an Indicator of Direction?

Before reading I need to add a disclaimer: Volume itself is not the only indicator of the direction of the move. It is just one part of the indicator of the direction.

Most traded stocks, option strikes and futures can be found in many websites. One link I have already given above, but there are many brokers who show the high volume stocks for their clients to take a decision to trade. Here is another link to see the volume, most active stocks traded during the day, last 5 day performance, Gain Percentage, SMA, Deliverables, live when the markets are open:

http://www.moneycontrol.com/stocks/marketstats/nse-mostactive-stocks/nifty-50-9/

As traders it is better to participate in stocks with more volume than stocks with less volumes. This is better for a short term trading not long term investing in stocks.

Long term investing can sometimes produce stellar returns, I offer a course on selecting stocks for long term investing. For long term investing volume is not important.

However for short term trades, volume is a strong indicator of trading though it is not a strong indicator of success of trading.

Indicators to help you take a trading decision

Possibility of success is high if the volume in the above situation is very high. In low volumes it may be a wrong signal as in low volume trading the volume can change any time.

Example:

When a company comes out with great quarterly result, there is a very high chance of high volume and rising stock price of that company. Similarly when a company comes out with bad quarterly result, there is a very high chance of lack of interest, low volume and falling stock price of that company.

What is the problem with the above volume based trading?

Volume has to be constantly monitored. This is a serious drawback as within seconds volumes can change. This is the reason we see a high volume stock suddenly falling, or a high volume stock suddenly rising.

Have a look at Yes Bank trading chart on 09-June-2017:

At 1.41 pm the stock suddenly started moving up from a intraday low of 1475.20. Exactly here the volume must have increased.

This is where is the problem with volume based trading. Seeing the decreasing volume some intraday traders must have shorted the stock at 1.40 pm only to see the stock going up from 1.41 pm and must have exited in loss.

In extraordinary volumes some stocks become very volatile. They move up and down in a rapid way leaving the traders in a frenzy mode. When volume increases it goes up, when volume decreases it goes down. This happens intraday.

It is seen that most intraday traders get caught in the market tops seeing the volume and vice versa.

Is Historic Volume is Of Any Help?

No. Historic volume will produce irrelevant data. If traders need to compare volumes then maximum they can go back to 14 trading days.

Conclusion:

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users