Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

These are very kind of emails that I receive almost every day:

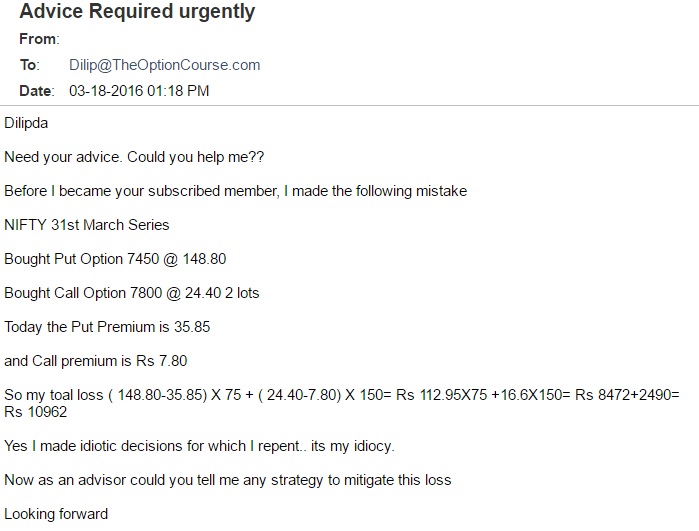

Here is the text of the email:

Dilip,

Need your advice. Could you help me?

Before I became your subscribed member, I made the following mistake:

NIFTY 31st March Series:

Bought Put Option 7450 @ Rs. 148.80.

Bought Call Option 7800 @ Rs. 24.40 2 lots.

Today the Put Premium is Rs. 35.85.

and Call premium is Rs 7.80.

So my total loss ( 148.80-35.85) X 75 + ( 24.40-7.80) X 150= Rs 112.95X75 +16.6X150

= Rs 8,472+2,490

= Rs 10,962Yes I made idiotic decisions for which I repent. it’s my idiocy.

Now as an advisor could you tell me any strategy to mitigate this loss?

Looking forward.

First let’s get into psychology of these kinds of traders why they love to buy calls and puts.

When most of us first learn about options on the Internet or in any book or by our brokers, we are told that “option buying is unlimited profit and option selling is unlimited loss.” As soon as we read it an idea comes into our minds (mostly to do with greed and easiness of trading).

This is the virtual dream that we start dreaming:

“Let me buy any Call and any Put – if Nifty goes down Put will make unlimited profits and if Nifty goes up Call will make unlimited profits. It is so easy. I will become very rich in couple of years.”

And then they press the button of a Call buy and Put buy the next day without using their brains and they feel happy that they have done a great trade. After a few days reality kicks in. Both calls and puts lose money. Then they see their virtual dream breaking and search the Internet in vain for help. They do not get any help and close their position in losses.

Wait the story doesn’t end here. They think they were unlucky so they try another time. And this time to recover the losses they buy 2 lots of both calls and puts. After a few days the story repeats. First loss was around 10,000 this time 10,000 more so total loss stands at 10000+20000 = Rs. 30,000/-.

Unfortunately the story continues for years and now the losses stands at lakhs. Then they either stop trading or start selling options. Unfortunately even after losing money in lakhs they do not understand that hedging your trades is very important. Just like a medical and a term insurance is important for all of us, hedging is like an insurance in option trading so its an important part of option traders life. This time in one or two trades they make a profit then one day a huge movement comes in.

Remember that selling options means losses are unlimited. But somehow they forget that or live in the hope that before expiry Nifty will reverse and they will end up in profits. It does not happen. So now this loss not only takes away their last two profits but they lose even more. Again the story continues. Then one day they realize losses standing at more than 5 lakhs.

Now they understand the reality – they are not good traders and need help. Here tip providers comes in. Welcome more losses. 🙂

Did you notice that most of us want to take the easy route to make money? Nobody wants to learn about stock markets but still think they think they can make money.

How is that possible tell me?

Trading Options and Futures in not an investment it is a business. If you are not willing to get knowledge someone with knowledge will take your money away. Also remember that in any business lazy people who look for making easy money never succeed in making money. So why do you treat stock markets as a different ball game? Stock markets also needs hard work and knowledge to succeed.

Do you think Warren Buffett made money easily in the stock markets? No. He used to visit the offices and factories of the companies he wanted to invest in. He used to even talk to managers of the companies he wanted to invest in. He used to calculate MOAT of the stocks to know the real valuations of the companies he wanted to to invest in. Only after some conditions were met he invested in only those companies those passed his test. How many of you do research on the companies that you invest in? Most of you invest out of pure speculations no research. Because research involves hard work and we do not want to work hard.

You may have heard and read it a thousand times but I will repeat it again.

To achieve Success there is NO substitute to Hard Work. Do not take short cut you will destroy your wealth.

If buying options and making money was very easy then imagine what kind of world we will be living in. No one will go to school. Because our fathers will be buying options calls and puts and making huge money and they will teach us the same when we turn 18 and give us 1 lakh, open a trading account and tell us the easiest way to make money. The whole world will collapse. No one will open a factory, no one will start a business, no one will become a scientist. So there won’t be any offices or jobs. The only work in the world will be buying options. So all will be option buyers. There won’t be any farmers too. So there won’t be any food to eat too. Even though we will be earning a lot we all will die of hunger. Do you think there can be a world where the only job people do is to buy options? And one more thing – if option buying only makes money then no one will sell options. If no one will sell options then trading will also stop. The whole world will collapse. God knows this and therefore makes sure that greedy and lazy traders lose money so that they get back to work.

People do not use their brains and think what I have written above, but just press the buy button because they only think about unlimited profits. No one thinks of the possibilities of losses. Only when they start losing they realize the fact that option buying cannot make money.

They also forget that options premiums are decided by five factors: Delta, Gamma, Theta, Vega & Rho and when they buy they are fighting against Theta (Time). Tell me in the history of this world who has won against time? No one so why and how do you think you will?

Ok some of you may have made money by buying options sometimes but how many of you got unlimited profits? Remember that unlimited profits are only in books. In reality you press the sell button much before unlimited profits kicks in. Because of the fear that the profits may again go away and turn into losses. So in real world buying options is only limited profit trade.

So unlimited profits is only in the books, not in real world. Long back I had written why option buyers lose money. Please read it for more information.

Once they realize that knowledge is important to make money trading options they enroll for my course. But unfortunately by that time lakhs are already lost and when they tell me their story I feel sorry.

By the way. I was also in the same shoes once upon a time. I did a lot of mistakes and lost about 7 lakhs in my first 3 trading years. 700000/36 = Rs. 19,445 lost on average every month for continuously 36 months. My salary at that time was just 25,000 per month. So basically I lost all my savings of years. I realized my mistake that I wanted to make easy money without gaining any knowledge so I lost. To this day I regret the losses but those losses changed my thinking.

I am today not only a very conservative trader but very conservative with my spending as well. I can easily live a more luxuries life, but to save money I am sacrificing them. To give you an example I can right now walk in a car dealers shop and buy a car worth 12 lakhs without taking a loan but I still use a car that’s less than 5 lakhs and 5 years old. So I save 12 lakhs. You know what whether a car is worth 12 lakhs or 4 lakhs, its only job is to take me from one place to another – so why should I spend more? Hope you get the point I now tell myself the real way the world works and do not dream a virtual world. Do you think if I buy a car worth 12 lakhs my business or life will improve? A BIG NO. So basically I will just waste 12 lakhs on NOTHING. Luckily I have a great and supporting wife too. She was and still is a very conservative shopper. We always see the newspapers for offers and discounts and never leave such shopping opportunities. I think because of this in one year we save thousands on shopping itself.

Obviously money saved is money made. We will teach our children the same. Believe me showing off your wealth to others is very costly and no one cares. Over the long run you only lose money showing off. Live a lifestyle below what you earn and I bet within years you would have saved a lot and it will make you very happy.

One more thing – after my accident I realized the importance of health. I realized that health is more important than wealth. What shit a life will be if you have crores in banks but you spend nights in hospitals. All that money will only be lying in the banks. So now I have decided to start exercising and eat very healthy food to remain healthy. Good health will allow me to work harder and create more wealth for my family.

If you are reading this and are still losing money trading options I highly recommend my course. Apart from the strategies it offers a lot of knowledge. You can even apply this knowledge in your own strategies as well or make your own strategies. You can pay for the course here. Remember that you can do this course from your home. It’s done through email only. I will support you for one year to become a better trader. Who in the world offers support for one year for less than 100 dollars? So do it now.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Comments on this entry are closed.

Exactly Dilip…what you have written is hundred percent true. Hope we will try to be a conservative trader.

You are an old reader of my site. You are still hoping to become a conservative trader?

:-))

very good message to all fellow traders

yes u r right sir ” HEALTH IS WEALTH ” so i always give 1st preference to health rather than wealth.

Good decision.

Hi Dilip,

Thank you so much for the email. I hope and pray for your speedy recovery man. You talk so much from your heart that I become so emotional and can’t but consider myself lucky to be reading your emails. “No one would be farming everyone will be buying options”, this sentence made me laugh like hell, hahahahahaha you are superb, that’s exactly what every trader dreams hahahahaha.

I bought 8000 Nifty May(1 lot) and 8300 Nifty May(2 lots) for 51 and 37.5 respectively. Both went into single digits 🙁 . So yes as you said buying never works, and also selling also never works if you think that is profitable. Options is sometimes crazy gambling I guess.

Take care,

Bye,

Chandra

Well said Chandra. Most option buyers dream of making free and easy money buying options. Fact is they lose what they earn from their business or jobs. When losses runs into lakhs they realize their mistake.

Hi Mr. Dilip,

Its really good to read your mail which shares your view on stock market and your real life advice on how to look opportunity on saving and making money.

Thanks.

Regards,

Nimesh

Thanks Nimesh. Nice to know that you people are reading it. 🙂

Dilipda,

I made investment in coal extraction business since 2015 till date incurring huge losses due to market – rate of coal at its lowest in 12 yrs hence out of frustration I was just browsing Indian stock markets and by shear luck I happened to open your site and read all articles abut conservative option trading to my liking – then I registered for 5 days course – have invested good time in reading all lessons sent by mail-today being the 5th day.

I’m really convinced by your 5 days course that is businesses apart from coal. My problem is I am quite new to stock market as such I do not have demat a/c etc. for trading. Do I have to go for demat/trading registration first and then the option course or simultaneously i.e, join option course and in the meantime apply for demat? Thanking you , Barry, Kohima.

Abemo,

Any business including the stock markets needs knowledge to succeed. That’s the reason why most people lose money in stock markets because they think they have a demat account and money and are smart so will make a lot of money. So they speculate and trade and people with knowledge take their money away. It is strange that people still do not realize even after losing lakhs. They keep losing money for 10-15 years and still cannot control their greed and still keep losing. Believe me most people who call me to do my course fall in this category. Its good that you have first decided to learn, get knowledge and trade.

You can do my course and simultaneously apply for a trading account. It just takes 2-3 days to open an account so do not worry. I can help you open account with a low cost broker. Just let me know your name, email and mobile number I will help.

Thanks.

Respected Dilip Sir,

Thank You very much for giving us chance to have You in “5 DAY FREE NEWS LETTER”.

I would like to appreciate your thoughts on PHILOSOPHY OF LIFE……

Once again thank you very much…

Hope, I will join you later but for now good bye…

Tushar nice to know that my articles help you.

Your thoughts are very good, I am impressed with them. Very soon I will subscribe your service.

Thanks Appaso.

Very nice article sir

Thank You Vrinda.

Want to the flaw in this thinking. If I buy 2000 shares of sbi today, it will cost me about 3.7 lakhs. sbi call option with strike price of 190 closed above 8 rs. What happens if I buy one lot of SBI shares and sell a call option at 8. Best case scenario is the spot price on expiry lies between 185 and 190 (todays spot and strike price). My capital will be intact or appreciated a little and I will keep 16000 for myself (slightly more than 4%). I can repeat the cycle once again. Even if the spot price goes to 300 and the option premium to 110 (300-190) on expiry, I do not lose money. If the price moves beyond strike price plus premium then i will sell the shares. In this case, I will get 26000 profit ( 2000*5+8000 premium). The worst case is if the price falls substantially, say to 125 in which case, I will have to wait for some time before it picks up. Ultimately, if there is a market for banking sector, then SBI will be in the first few if not the first and it has to rise in the very near future. This can be done with any big company like reliance also. Is there something that I am missing?

This thinking is correct but how many people trade like this? This post says something else that people think buying calls and puts is like buying a free lottery and they will make a lot of money without hard work – this proves fatal over the long run. That is what is all I meant – though your trade is option sell not buy and it makes sense but most people do not trade like this.