Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

Date of posting: Saturday, 04-May-2024

Should You Sell In May and Go Away?

The selloff on Friday, 03-May-24 was so broad-based that two of every three stocks on BSE were trading in the red and nearly 247 exchange-listed stocks had hit their respective lower circuits, with investors losing Rs 3.21 lakh crore.

Take a look at the fall. This is the screenshot of EOD – Fri, 03-May-24:

BSE – EOD – Friday, 03-May-24

Interestingly this is the month of May and the saying Sell in May and Go Away is trending for obvious reasons.

Just Google and you will see that market analysts have also started saying this – some for and some against:

https://www.google.com/search?q=sell+in+may+and+go+away

This is the screenshot of the Google search “sell in may and go away” on Saturday, 04-May-24:

Note: The results may differ if you search a few days from 04 May 2024 or in some other month.

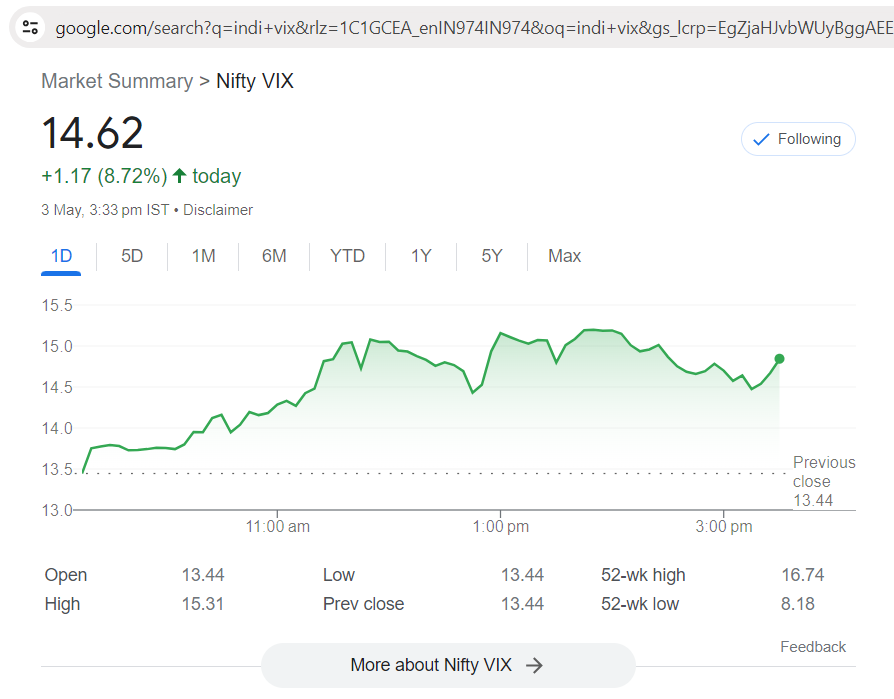

Now, have a look at INDIA VIX EOD – Fri, 03-May-24 – it increased by 8.72%:

INDIA VIX EOD 04-May-24

The increase in INDIA VIX is not because of May but due to the ongoing General Elections. I have already told via my newsletters that whenever some important political event happens the VIX will increase till the event is over. This increase is the effect of the General Elections.

Did you notice that stock markets fell and INDIA VIX increased on the same day? This again proves that Stock Markets and INDIA VIX are inversely proportional.

My View:

I have had enough of so-called market analysts. I used to read their analysis a lot – and then realized that learning from your own experiences is better. They are sometimes correct and sometimes wrong. It is their job to say something on the market and therefore they say. So it is not a good idea to depend on their views and make investment decisions.

My suggestion below is based on how stock markets work (the reality of stock markets) and what investors and traders should do.

What Should You Do?

For investors: Ignore the analysts. If you have bought some stocks for the long term – do not sell. For the time being, think that Warren Buffet is your analyst and just copy him. Of course, if you bought the stocks for the short term then sell them only if they are in at least 10% profit. Yes even for the short term your target should be to take away at least 10% from a risky investment – else why should you invest in the first place?

For traders: On 03-May-2024 India’s VIX increased by 8.72%. This is a signal of an increase in volatility where markets become unpredictable. So reduce the lot size and trade until this political event (General Election 2024) is over.

Note: If you are reading this post after the General Elections 2024, the logic of how the stock markets work will remain the same. If any political event is coming the VIX will increase and you should reduce the lot size and trade. Once the political event is over the VIX will normalize and the markets will also normalize, and you can resume normal trading.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users