Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

Post Date: 26-Sep-2019

One decision to lower corporate tax by Finance Minister Nirmala Sitharaman by a few percentage resulted in huge jump in stock markets.

The News: On Friday, September 20, 2019, Finance Minister Nirmala Sitharaman announced a reduction in the country’s effective corporate tax rate from around 35% to 25%. For companies that do not avail of any other incentive or commission, the effective tax rate would be just 22%.

This will save a lot of money of the companies doing business in India and of course will result in better profits, which in turn will result in business expansion and creation of jobs. Its a very good news for Indian economy.

Of course a news such as this results in a jump in stock markets. From Friday to Thursday, 26-Sep-19 NSE went up from 10700 levels to 11600. This is an increase of 8.5% approx.

Bank Nifty went from 26757 to 30400 levels. This is an increase of more than 13%.

See this one month graph of Bank Nifty:

Source: https://www.moneycontrol.com/indian-indices/nifty-bank-23.html

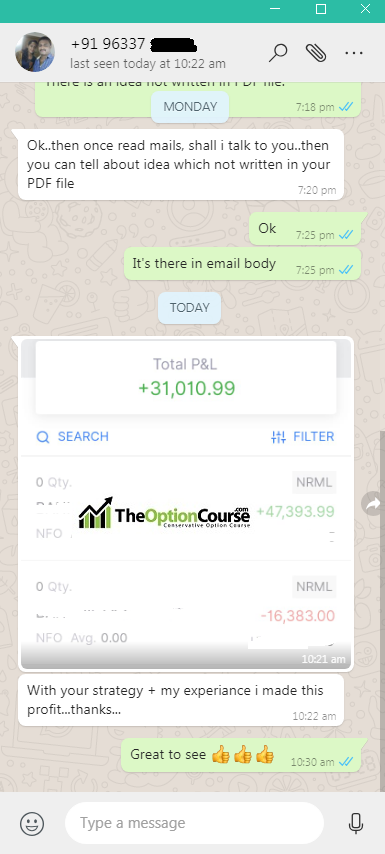

In such a swing and volatile markets such profits are possible in 1 or 2 days in my Bank Nifty Course Strategy:

During these volatile times traders must be very careful. Especially if you are a future traders or an option seller you must maintain your stop loss levels.

There is no better adjustment than taking a STOP LOSS.

Traders keep asking me one question that what is the best adjustment strategy for a future or an option short trade gone wrong. They think that there is an adjustment strategy that can work wonders and bring a losing position to winning position after the adjustment is done.

Let me tell very clearly. The more you try to adjust a losing trade, the more you will go deep in losses.

After seeing an option shorting gone wrong, traders adjust the position by shorting another either the same option or a deep OTM option.

This is a very wrong way to adjust a trade.

The best adjustment in a losing trade is to get out of the trade.

There is nothing better than this.

So be careful when a major news has come out. This is the time to reduce your lot size, take a less risk and trade.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users