Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

Read this article to know the real meaning of volatility and its importance in stock trading. Hedge fund managers and big investors buy put to protect their funds.

Before reading this article I want to clear a confusion:

A lot of traders get confused between Volatility and VIX.

The stock is very volatile means it moves a lot.

The Index VIX is stable means there is not much panic in the markets and if the index is stable. Stable does not mean the Index is not moving. It is moving but not very Volatile.

For high volatile stocks, VIX will be high.

For low volatile stocks, VIX will be low.

For traders volatility is very important.

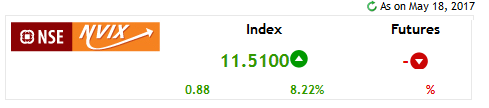

During April-May 2017 India VIX is hovering at historically low levels. 9-11 is considered low VIX.

You can find India VIX here:

https://www.nseindia.com/live_market/dynaContent/live_watch/vix_home_page.htm

See INDIA VIX as on 18-May-2017:

INDIA VIX 18 May 2017

Today Nifty has fallen so VIX has risen:

NSE 18 May 2017

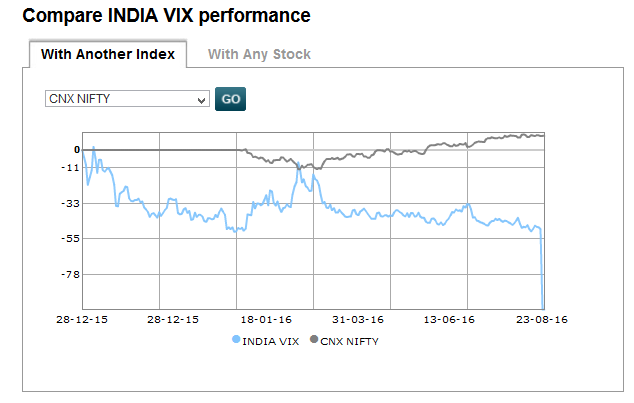

Over the long period stock markets and VIX are inversely proportional. If stock markets fall, there is panic in the markets and VIX increases. And if stock markets rise, there is no panic in the markets and VIX falls. Like since the last 3-4 months Nifty went from 8000 levels to 9400 levels and India VIX from 17-18 levels to 10-11 levels.

See this graph for proof. You can see that when CNX Nifty rose VIX fell and when CNX Nifty fell, VIX rose.

Nifty vs VIX

Source:

http://www.moneycontrol.com/indian-indices/india-vix-36.html

What hedge fund manages do when VIX is low?

This is the time when options are available at cheaper prices to hedge. For them this is a great opportunity. They start buying puts to hedge their positions in stocks against a fall. How many lots they are willing to buy depends on how much money they are managing.

Do not forget that they manage millions, some fund managers manage billions. This is when they use options to do exactly what they were meant for. To Hedge.

Of course this will not come in the media. This is their personal decision on the job, and they will not disclose it in public.

Another time they hedge their positions is when the markets become very volatile. This is to protect from volatility.

Suppose a bad news comes in, the HNI (High Net Worth Individuals) and fund managers start buying puts.

When a lot of Puts is being bought, the markets gets into fear and the VIX goes higher and markets move lower.

In simple worlds it is profit booking by most investors or put buying by fund managers.

Why do you think when markets move higher, it starts to fall from some point? There is no bad news as on 18-May-2017, but Nifty has fallen? Why?

This is pure profit booking, not a fall because of a bad news.

It is a common mistake by most retail investors. Whenever in media they say the markets are volatile, they think that stock markets are falling. This is not true.

Period from when Nifty went from 8000-9400 is also volatile, same as when Nifty went from 8800 to 8000 levels.

Volatile can be going up or going down. Unfortunately volatility is associated with stock markets going down.

Volatile means fast movement, not necessarily the stock or Index going down.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users