Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

These are educational courses, not advisory or tip providing service. Once you complete the course you will not need any tip providers or advisory services. You will be able to trade on your own. You will have a plan to trade and manege it well.

I offer 2 courses:

Course 1: Conservative Options Trading Course:

Who should do this course? Traders who trade options and futures but are losing money. After doing this course you will be able to make an average of 3-5% a month. 45,000 is minimum required since margin rule got reduced for hedged trades in June 2020. Prior to June 20, Rs.1.8 Lac minimum was required to trade these strategies. Its a non-directional strategy. There are five strategies in total and a bonus trade in which my client made 37% return a month by twisting one of the strategies in my course. Your results may vary. You will also get 1 year support on these strategies for free to understand these strategies and become a better option and future trader. Testimonials are here.

Course 1: Testimonials Pages:

What Traders Say About This Course

Testimonials Year 2015

Testimonials Year 2015 Page 2

Testimonials Year 2015 & 2016

Testimonials Year 2016

Testimonials Year 2017

Testimonials Year 2018

Testimonials Year 2019

Testimonials Year 2020

Testimonials Year 2021

What People Say Just After Reading My Course

Emotional Testimonial by a Young Woman Trader and Her Mother

Course 1: Course Content:

Strategy 1) Conservative Non-Directional Strategy: (10 pages)

Min required: 45,000 (Option selling required but due to hedging total margin gets reduced)

This strategy has to be traded every month irrespective of Nifty going up or down because this is direction independent strategy and works either way the market goes.

No one can accurately predict the direction of the markets. I have seen that market neutral strategies always almost perform better in the long run.

This trade should make money if Nifty is range bound. If there is a swift movement too far in one direction, I will tell you how to adjust to make sure losses are less than 1500.

India VIX is an important factor for the strategy.

You will also learn what to look for before taking this trade like any news, India VIX, liquidity of the strikes traded etc.

How much this strategy makes? Approx. 2500-3000 per trade. It’s a positional trade for 10-12 days.

What is the risk? Approx. 1500 – note that this is limited due to hedge.

What is the Risk to Reward ratio? 3:1. Which means you make money three times and lose once.

Is there any huge risk in a Black Swan Event? Not at all. A Black Swan Event comes once in 10 years so that should not be a big concern. However, in a Black Swan Event loss can be 5000.

Strategy 2) Adjustment to Conservative Non-Directional Strategy:

This is traded only when stop loss is hit in strategy 1. This is basically adjustment to strategy 1. Minimum required is same as strategy 1. You will have to close the strategy 1 and then trade this strategy.

Basically for stop loss to be hit in this strategy Nifty will have to travel 1500 points in 30 days’ time which is impossible.

So whatever is lost in strategy 1 is recovered in strategy 2.

Strategy 3) Conservative Stock Option Strategy: (9 pages)

This is a HNI (High Net worth Individual) strategy. Minimum required for this strategy is 5 lakhs. Equity buying is required. I will tell in which stocks this can be traded.

This strategy is great for people who like to hold equities in their demat account. Great for people who want to trade stock options. Great for busy people who cannot watch and trade markets often.

This will make approx. 15000 per month without any risk. The strategy works as a rental income as if you bought a home for 5 lakhs and the tenant living there pays 15k per month without fail. Plus dividends if any will be your extra income.

This strategy makes money from three places:

1. Just one trade is required in this strategy for the entire month and that one trade will make 15k for you in 30 days. That’s one way it makes money.

2. Good companies give dividends anywhere between 2-5% a year. That’s yours to keep. That’s second way this strategy makes money.

3. You can always get collateral against the shareholding on the stock and trade strategy 1 without bringing the entire amount to trade. Strategy 1 will make 3% approx. per month. Note that you are using the same money to make 15k, dividends, and with collateral trading strategy 1 and making 3% a month. This company gives good collateral against stock holdings. That’s third way this strategy makes money.

Sometimes, not always, it may make up to 24% return in 60 days. If you do the course you will understand why.

Strategy 4) Conservative Directional Strategy for Future Buy & Sell: (5 pages)

This strategy is good for traders who trade Stock or Index Futures. Minimum required is 25,000. Note that margin is reduced because the future will be hedged with options.

Risk is 5000(fixed) but reward can be above 10k. Note that this is a future trade and should be traded only when you become an experienced future trader. Some monitoring may be required. Therefore in this strategy first paper trading is recommended.

Risk reward ratio since it’s a future trade is 2:1.

Strategy 5) BONUS – The Great Directional Trade for Reversal Benefit: (4 pages)

This strategy was developed by one of my clients who made 22% in a month by a slight twist in Strategy 4. Basically within 30 days time-frame Nifty makes a reversal. We can take our chances in these 30 days time-frame right? You will learn how to take a limited risk and wait for a reversal in the index or stock to make exceptional profits.

Course 2: Bank Nifty Weekly Option Course:

Who should do this course? Traders who trade Bank Nifty Weekly Options. Bank Nifty & Nifty Weekly Options expire every Thursday. Bank Nifty is very volatile too. So a good strategy can make good profits. This is also a non-directional strategy. There are two strategies. One is option hedged with option and another is future hedged with options.

Course 2: Course Content:

Bank Nifty Strategy 1 is an aggressive strategy where you will learn how to hedge futures with options. Due to its very aggressive nature, this strategy works better in volatile stocks than Bank Nifty itself. Works best during results season.

Bank Nifty Strategy 2 is the only options strategy that can be traded intraday or positional. It is a fully changed and aggressive way to hedge options with options. Minimum required is 70k intraday and 1.2L positional. The success rate is 80%. Risk reward is 3000:1500.

This strategy is based on the fact that one bought option can hedge 2-3 sold options. So one way you are safe on the other hand you make good profit on the margin blocked. This strategy works best on expiry days with 90% success rate. Even if loss the loss will be small and manageable.

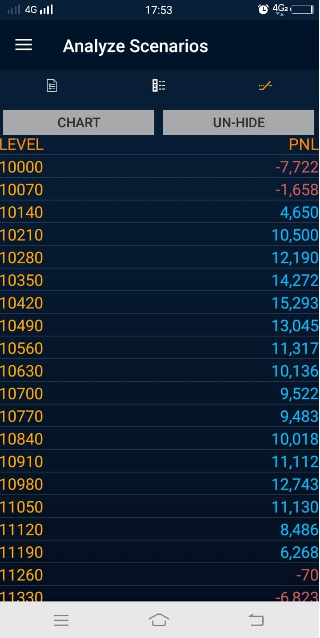

Check this safety net of this strategy in Nifty – there is very little chance that you will lose money:

Course 2: Testimonials:

Bank Nifty Weekly Option Course Detailed Explanation & Testimonials

Bank Nifty Course Testimonials

How the course is conducted:

After payment, I will send 6 PDFs explained like a video with screenshots of Nifty/BN and then the explanation.

And of course, you can ask me questions on WhatsApp, email or phone for one year. Note that PDF you can keep forever, and read even in the office or while traveling. VDOs you can’t see it whenever you want.

Course Fee:

Course 1 is 6000 and Course 2 is 5000. However you can pay 8000 (3000 less) and do both. Check the fees page here. You can pay by credit/debit card or net baking.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users