Sponsored Ad: Click Here to Open a FREE Demat Account Online and Pay ZERO Brokerage to Buy and Sell Shares. Also get services of Sensibull - option strategy builder, Tijori Finance - In-depth data of stocks, Smallcase - get help in making long-term & diversified portfolio, Streak - SystematicTrading platform, and many others worth ₹2500+/- per month for FREE!!!

There is no way to earn lakhs in just few days. Read to know it is a huge myth in stock markets. You can earn a lot of money but it will take time.

Tips for Paid Subscribers: [Hidden from free subscribers and website visitors, if you want to read this enroll for my course.]

Now Free For All Content:

Whenever I go through writers mental block (a situation where a writer does not know what to write next), I get a strange or great email from one of my website visitors who gives me an idea to write and help everyone reading my newsletters or blog.

I do not know how this person reached my site, it could either be by searching on the net or referral though a friend (yes my subscribers do refer their friends to my site. I am really thankful to them for supporting an honest man and not giving support to those greedy people who take money away from people and give loss making tips.)

His question was How Can I Earn Lakhs In Just Few Days From the Stock Markets?

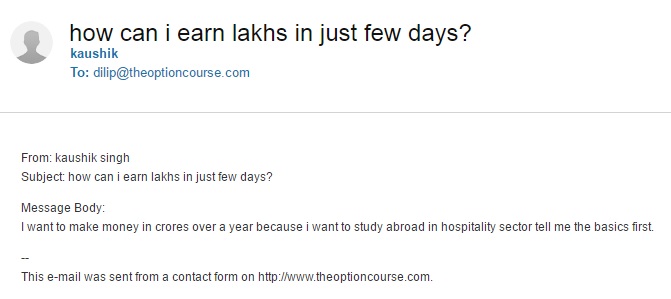

Here is the screenshot of his email I received today morning while going through writers block:

His email was: I want to make money in crores over a year because I want to study abroad in hospitality sector tell me the basics first.

Amazing isn’t it what people think about the stock markets. The perception of the stock markets itself is WRONG. Yes some people do make amazing wealth from the stock markets but only those make who have proper knowledge and understanding of how stock markets work.

As you can guess from his email that he does not even know the basics of stock markets. And if he actually learns how to make crores from the stock markets in one year then why study abroad in hospitality sector to make just a few lakhs in a year? Why not keep making those crores every year from the stock markets?

I do not understand how can an educated person ask a question which does not have a plain logic? Isn’t it really silly to think to first learn how to make crores (not crore, but crores), and then work hard to make just a few lakhs? I find it very strange that educated people think this way. Tips providers look for exactly these kinds of people. And what I will do? After sending this email to you just delete his email.

I do not need money of a greedy person who does not even understand even simple logic of how this world works. You will NEVER achieve success without hard work. If you think hard work is not required to make money from stock markets then I am sorry your basic thinking is wrong.

You only know that Warren Buffett made a lot of money from the stock markets by investing and you become greedy thinking even you can do it. You do not want to know how he made it, this is where is the problem. When I see a kid going to play Cricket, I ask him – what you want to become? He says Sachin Tendulkar. I then ask, do you know how many hours he used to practice when he was of your age? The kid then replies by smiling – I do not know.

This is where the problem is. Average people living an average life only see the ends. They are not interested to know or learn what means were used to reach that ends. All they are interested is in ends. If you do not know Sachin Tendulkar used to get up at 4 am and was there in the field practicing cricket at 5 am almost everyday including Sundays and holidays since childhood. Do you think he was born with these skills? No. He was just born as a normal kid, got interested in Cricket but the way he practiced differed a lot from the way other kids of his age did. The results are in front of you.

Now here is some important information on what made Warren Buffet the best investor in the history of Stock Markets all over the world.

1. He started an insurance business with a partner which did very well.

2. With the money he saved he bought stocks just like anybody else does, like tips from brokers or advice from friends and he lost money just like we do.

3. Quickly he understood that this is NOT the correct way to invest in a stock. The first lesson he learned was to control greed.

4. Whatever was happening he did not lose interest in his insurance business. It kept on growing at a rapid rate.

5. He now started studying about companies that he wanted to invest in. Basically he was interested in the stock of the companies with good economic MOAT.

According to Investopedia:

The term economic moat, coined and popularized by Warren Buffett, refers to a business’ ability to maintain competitive advantages over its competitors in order to protect its long-term profits and market share from competing firms. Remember that a competitive advantage is essentially any factor that allows a company to provide a good or service that is similar to those offered by its competitors and, at the same time, outperform those competitors in profits. A good example of a competitive advantage would be a low-cost advantage, such as cheap access to raw materials. Very successful investors such as Buffett have been very adept at finding companies with solid economic moats but relatively low share prices.

A great example in India of a company with great economic MOAT is PATANJALI. In 5 years a company which had a turnover of just 1000 crore in a year has now reached 5000 crores in 5 years. Now they are planning to reach 10,000 crores by the end of this financial year. 100% growth in one year.

How many companies can even imagine that.

Here is a short description of Baba Ramdev’s company PATANJALI from The Telegraph:

Ramdev, whose Patanjali brand had more than 800 products ranging from herbal toothpastes to noodles to health drinks, became a household name in several parts of the country through yoga shows on his 24-hour television channel, Aastha. After a brief association with an anti-corruption movement, Ramdev has settled down to develop his herbal medicines and toiletries business, expanding into fast-moving consumer goods.

A mix of prices lower than that of the rivals, a sales pitch based on “Ayurveda, natural and healthy products” and point-of-purchase advertising seems to have clicked with the masses.

His toothpaste brand, Dant Kanti, has snapped up a 5 per cent share of the market, eating into the share of a multinational company.

A controversy over additives to Nestle’s popular Maggi brand of noodles last year, which led to its temporary withdrawal from the market, saw Ramdev picking on the opportunity to launch his own brand of “healthy noodles”. (See how he caught an opportunity and used it to maximum gains.)

Last year, Patanjali reported a turnover of Rs 5,000 crore. Ramdev, who lives in a secluded, high-walled compound on the Patanjali campus, said the turnover was expected to touch Rs 10,000 crore by the end of the current financial year.

Market research firm IIFL said in a report that Patanjali was poised to grow to be a threat to existing market leaders in most categories it has entered.

“Our analysis suggests that by 2020, Patanjali will have high market shares in categories such as Honey (35 per cent), Ayurvedic Medicine (35 per cent) and Ghee (33 per cent),” the research firm’s report predicted.

They are now planning to launch an apparel brand, called Paridhaan. I am sure many multinational companies must be shaking in fear as this company is sure to eat into its share of profits.

This is called great economy moat. Unfortunately Patanjali does not have shares. Else I would have been the first person to buy its shares.

So What Worked for Patanjali?

1. Low cost advertisements.

2. Hence low cost of products so entering into the middle calls and lower earning class makes it easier.

3. Image of Baba Ramdev who is his own companies’ brand ambassador.

4. Showing its factories in advertisements.

5. Dant Kanti recently got an award for the best toothpaste in the country.

So these type of companies with great economy MOAT will keep performing well.

Ok coming back to Warren Buffett.

6. Once a company with great economy MOAT was found, Buffett would fix an appointment with its owners or managers just to get their point of view and know the reality of how the company worked. The management, its factories, infrastructure etc.

7. Since he could not afford to go by plane he used to take a train and have a talk with management. Once a company passed all these exams he would discuss with his business partner and buy its shares for years. Yes NOT intraday, like most of India traders are interested in, or one month – he wanted to keep it for years. I am taking about 10 years at least, until it had no more great economy MOAT. It is obvious that once the great economy MOAT gets vanished from that company the shares would certainly fall. The he used to sell and book profits.

Once in an interview someone asked him – when is the best time to sell a share. His answer was NEVER.

Choosing companies with great economy MOAT made him the best investor of all times in the history of stock markets. For three years in a row he was the richest man in the world.

Did you see that the process is more important than the end results? Those who study the process of success perform well in life. Those who see the results and go and have a beer party keep doing that for life.

So if you really want to make money in stock markets first get your logics clear, kick greed out of your system, learn to be patient, have a proper risk management, get education and then start trading.

If you follow the above, results will follow. Else only losses will follow.

Rest it’s your choice.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Comments on this entry are closed.

Dear Dilip,

I suggest one idea please establish a one company of like minded your friends who

do day trading and options trading you may get one expert group. with some good ideas useful trading

can be done i am day trader but struggling because of my habits

if you do not like my idea then forget

warm regards

mulji

Mulji establishing a one company of like minded people very difficult. And a lot of money is required so not interested. I do not like day trading. I feel they are like day labors whose salary is not justified. I in fact hate day trading. Not a single day trader has made a lot of money in history of stock markets.

Sirji,

Regards…

Thank You very much for such good article…

Tushar

Thanks Tushar for reading.

Nice mail Dilip…!!!

Thanks