Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

There are times when you read a bad news about a stock but are not fully confident of buying its put options as this is an uncertain market you never know what may happen in a few days. In cases such as these what may a trader do?

One idea is short futures with stop loss – but we know how risky it is so its not recommended. Main problem is with gap up and down opening the next day against your trade. In one trade more than 25000 can be lost. Take the recent upside of SBI – it opened gap up on 25-Oct-2017. See this image:

SBI Gap UP Opening on 25-Oct-2017

Imagine if someone was short in SBI on 24-Oct-2017. He will repent his losses for hid entire life. This is the reason I keep telling LEARN HEDGING.

Those who hedge are free from such stress of gap up or gap down opening. Hedge has the ability to protect huge losses by a huge percentage depending on the quality of the hedge. In my course the the directional strategy is made in such a way that even if you are wrong in direction of the future you can make money. Yes you read it right – even if wrong you and making money.

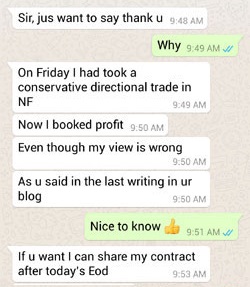

Trader was WRONG in direction of future yet his trade was profitable

Of course as mentioned you can buy a PUT to keep the loss limited. But due to time loss the premiums can get evaporated in air pretty fast – premiums getting reduced with time means your money also going up in the air. Sad but true. This is major problem with Option Buyers.

Another way is to Short a Call. But then shorting a call also has unlimited risk on the upside.

If you feel a stock may go up you can always buy in cash, but you cannot short in cash. Only way is to trade derivatives to take benefit of a stock falling.

There are a lot of ways to hedge a future or option but hedging also has to be smartly done else hedge will be of not much use.

You can do my course and learn hedging, learn the strategies and trade in a better way rather speculate and lose huge.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users