Sponsored Ad: Click Here to Open a Share Trading Account Online for FREE and Pay ZERO Brokerage to Buy and Sell Shares!!!

Before I say anything please see this:

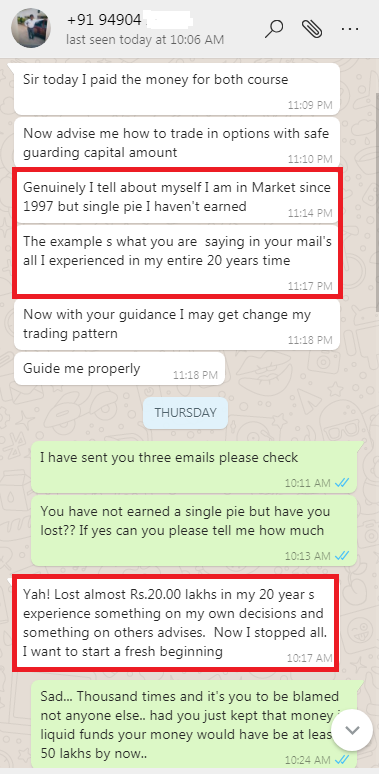

Here is the chat in text:

Trader: Sir today I paid the money for both course. Now advise me how to trade in options with safe guarding capital amount. Genuinely I tell about myself I am in Market since 1997 but single pie I haven’t earned anything. The examples what you are saying in your mail’s all I experienced in my entire 20 years time.

Now with your guidance I may get change my trading pattern. Guide me properly.

Me: I have sent you three emails please check.

You have not earned a single pie but have you lost? If yes can you please tell me how much?

Trader: Yah! Lost almost Rs.20.00 lakhs in my 20 years experience something on my own decisions and something on others advises. Now I stopped all. I want to start a fresh beginning.

Me: Sad… Thousand times and it’s you to be blamed not anyone else. Had you just kept that money in liquid funds your money would have be at least 50 lakhs by now.

Trader: Yes Sir I agree.

Me: Anyway now start reading the course.

=======================

Though he did not tell in details what mistakes he did, neither I wanted to ask because its not that 20 lakhs that matters – what matters is 20 years that has gone down the drain. 🙁

If you do some math 20 lakhs in 20 years is loss of Rs.8333.33 per month. 20 years back it was 1997-1998. In those days Rs.8333.33 per month was considered a high salary. This person lost that in stock markets.

If you read the mistakes I did and the common mistakes of stock market investors you will know some of the mistakes he may have done. Fact is if you are reading this you also may be doing some of the mistakes now.

If you stop doing these mistakes at least you will stop losing huge amount of money.

The problem with the above kind of investors is that they are not wiling to learn. They think its a waste of time learning online, reading books, or doing a course. Agreed doing a course will cost a small fees but it can help you make better trading and investing decisions. This small investment in learning to trade is better than losing lakhs in your entire trading career.

If you are not willing to learn at least trade with very small amount. This will keep you in the game for long. I have seen investors trading with huge capital as soon as they win a small amount in any one trade – the next trade they want to hit a sixer (make a huge profit) with a huge amount. Unfortunately that one big trade ends up cleaned bowled (in a big loss).

Then they do another mistake – pay the tip providers. If a tip provider is good they will not employ marketing people to call you and ask you to pay for their services. In fact it will be other way round. With word of mouth they will get many clients a month. They know that a client will be their client for two months only – so they keep doing their marketing.

Do not do the mistakes written in the pages I have linked above, start small, research well and stick to a strategy that works well for you. Do not try to experiment something new with a huge amount unless you are successful 70% of times and have taken at least 10 trades.

Even if you want to increase your capital in trading, increase gradually. Like one lot each month. Do not put all your money in one trade. Hedge properly and keep an eye once at least in 2 hours in the trade.

Hope you become a good trader if you keep the above in mind.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users