Open ZERO Brokerage FREE Share Trading Account - Buy and Sell Stocks Without Brokerage - Set GTT (Good Till Triggered) Orders on System and Forget

This broker does not charge anything for stock buying and selling. You can set GTT (Good Till Triggered) order after buying a stock - the system will sell the stock automatically at your target price even if you are not monitoring the market. Only 25k is blocked for option selling with hedge. Get a lifetime account in Sensibull.com (virtual trading app & strategy builder) fee ₹800.00+GST per month for FREE. It takes 5 minutes to open an account online. Click Here to Open Free Account with Them Today and Join 1+ Crore Investors & Traders>>In this article you will learn:

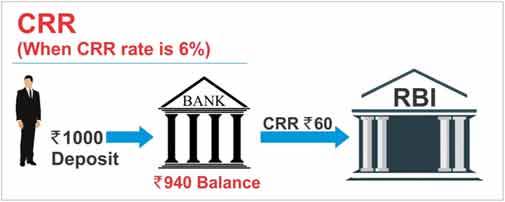

CRR is Cash Reserve Ratio. CRR is the percentage of money the banks have to keep with Reserve Bank of India (RBI).

Let me take an example. See the image below:

What is CRR Cash Reserve Ratio

In the above image, the CRR is 6%. A man deposits Rs. 1000 in his bank. Since CRR is 6% and 6% of 1000 is Rs.60/-, the bank has to keep Rs.60/- with RBI and is left with only 1000-60 = Rs.940/- to be given as loans and make money.

What is the CRR as On 28-Nov-2016?

The CRR is 4% NOT 6% as mentioned in the image. It is just given as an example. So right now if Rs.1000 is deposited banks have to give RBI Rs.40/- as CRR.

Why CRR is Done by RBI?

RBI the head of all banks in India has a job to control the money flow in the system and to keep a check on any wrong doing in the system.

These are its primary job:

1. To control the supply of money in the economy. That is how much money is available for the industry or the economy.

This is the money with which the banks to loan to people and do business. Do not forget that banks are also a business not just banks to keep your money safe and pay you 3.5% on your savings account.

2. The cost of credit. It means the price that the economy has to pay to borrow that money. For example personal loan comes at a certain percentage per year which is more than double of the saving accounts deposits and also more than current inflation. Why? Because that person does not own that money but has borrowed it from the system so he has to pay a price.

Banks charge 1 or 2 percent more than their own costs like infrastructure management, salaries to their employees etc. That 1 or 2 percent extra is their profits. Please note that one or two percent more has to be more than inflation too, else there is no profit.

For example a loan of 1 lakh. Inflation cost = 7%. Cost of the bank like salaries and management = 3%. This is 10%. Now anything extra changed is their profits.

Same is the case with home loans and car loans. Since risk is low in home and car loans the rate also gets lowered but is always above inflation.

Another reason is if all money is allowed to be kept with the banks, they can fall for greed and do a lot of things which can lead to losses.

For example let’s assume a bank get a deposit of Rs. 1000 crore in a month and the management gets a bit greedy. They now give loans to everyone for 1 year at an extra discount without proper check the credit quality of to whom it is given to (like KingFisher).

After one year the bank gets only Rs. 800 crore. Instead of making profits the bank is now in the loss of Rs. 200 crore. Add 10% inflation and expenditures to this. So a total loss of Rs. 220/- crore in one year.

The bank closes after one year. Like this if allowed, all banks in a country can vanish in one year. This neither the government not RBI can allow or want to happen.

Does it Still Happen?

Yes it does. KingFisher example has already been given. That company owns around Rs.2000/- corers to SBI and public sector bank. A through quality check probably was not done and this may have happened.

Since this was big it came under media eyes. But losses like 10 or 20 crores are not reported in media so we do not know. But it does keep coming in newspapers now and then that finance ministry and the RBI governor always keeps telling the banks to keep a quality check on companies and people whom they are giving loans to.

That said as long as receivables are more than the amount given as loans, the bank is in profit. This happens with almost all banks. But I hope you remember sometimes a bank or financial institution closes. The reason is the same – loans that were given never came back – in fact the principal itself does not come back, and the bank got closed or was bought by another bank.

Can you see what greed can do?

It has the power to destroy companies, institutional, businesses and even banks.

It is already destroying wealth of 95% of stock traders in the world. Do not forget that stock trading is a business. Business is written above.

What Will Happen to Banks After RBI Introduced Incremental CRR Of 100 Per Cent

On Saturday 27-Nov-2016 RBI in an attempt to absorb some of the surplus liquidity available in the banking system, asked banks to maintain an incremental cash reserve ratio (CRR) of 100%.

This rule applies to deposits between September 16, 2016 and November 11, 2016 fortnights. This move is estimated to suck out around Rs 3.24 lakh crore excess liquidity from the system.

Why RBI has done this?

RBI data says total deposits rose from Rs 97 lakh crore in the September 16 fortnight to Rs 101.1 lakh crore in the November 11 fortnight. For the rest, central bank said the CRR remains unchanged at 4% of net deposits.

For deposits in the above mentioned dates banks cannot give then as loans as they have to keep 100% of it as CRR with RBI. They cannot do business with this until RBI revises this again.

For this money banks have to pay savings interest rate as promised in their terms and conditions but cannot do business with this money.

So What may happen to banks?

In the short term for at least 2-3 months there is going to be a liquidity crunch, so the loans limit will get reduced. Of course withdrawals limits may not get effected as it is a very small percentage of the money taken out from the banks. But business, home and personal loan limits will defiantly get reduced.

As a result of this, the next quarter results of banks is surely going to be less than the same quarter of the previous year.

Click to Share this website with your friends on WhatsApp

COPYRIGHT INFRINGEMENT: Any act of copying, reproducing or distributing any content in the site or newsletters, whether wholly or in part, for any purpose without my permission is strictly prohibited and shall be deemed to be copyright infringement.

INCOME DISCLAIMER: Any references in this site of income made by the traders are given to me by them either through Email or WhatsApp as a Thank You message. However, every trade depends on the trader and his level of risk-taking capability, knowledge and experience. Moreover, stock market investments and trading are subject to market risks. Therefore there is no guarantee that everyone will achieve the same or similar results. My aim is to make you a better & disciplined trader with the stock trading and investing education and strategies you get from this website.

DISCLAIMER: I am NOT an Investment Adviser (IA). I am an Authorized Person (AP) of a Stock Broker. I do not give tips or advisory services by SMS, Email, WhatsApp or any other forms of social media. I strictly adhere to the laws of my country. I only offer education for free on finance, risk management & investments in stock markets through the articles on this website. You must consult an authorized Investment Adviser (IA) or do thorough research before investing in any stock or derivative using any strategy given on this website. I am not responsible for any investment decision you take after reading an article on this website. Click here to read the disclaimer in full.

Find 200+ testimonials of my course:

What Traders Say About This Course

My student gets the Winner's Certificate of Zerodha 60-day Challenge - Click here and Open Stock Buy and Sell Free Account with Them Today!!!

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

Testimonial by a Technical Analyst an Expert Trader - Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

60% Profit Using Just Strategy 1 In A Financial Year – Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Testimonial by Housewife Trader - Results may vary for users

Hai sir,

Really a didactic one.

Thanks Mr. Rao.

Those who do not understand the meaning of “didactic” here it is: Intended to teach, particularly in having moral instruction as an ulterior motive.

Thanks again.